Question: Chapter 13 Supplementary Self Study (SSS) Problems SSS Problem Thirteen 3 Volume 2 Page 74 SSS Problem Thirteen -3 (Part I And Part IV Refundable

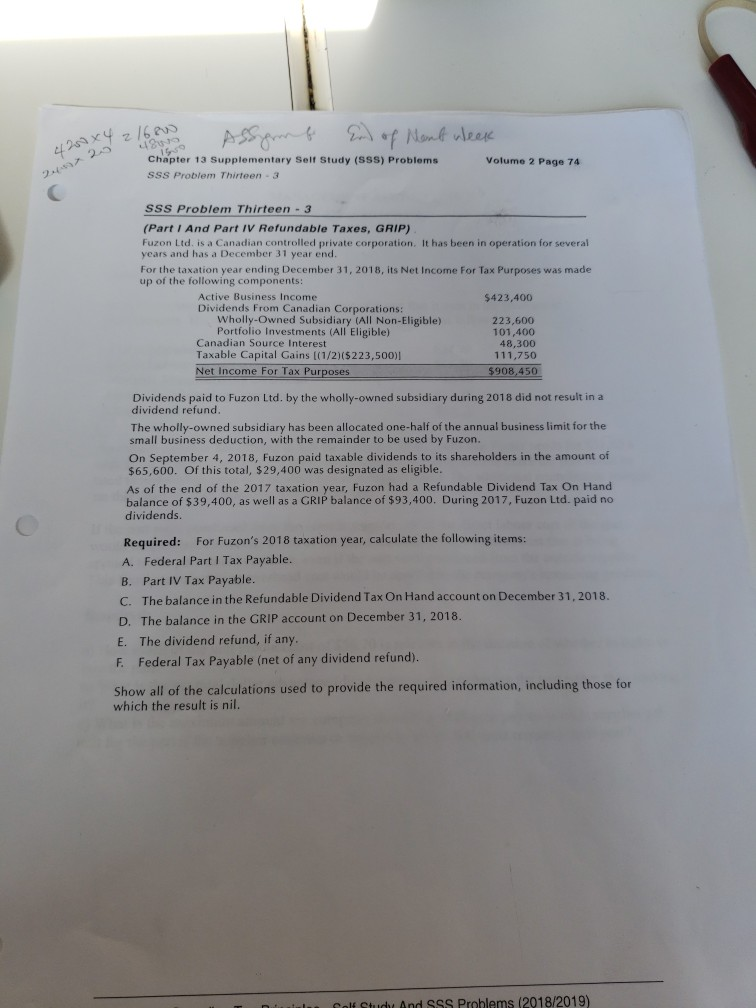

Chapter 13 Supplementary Self Study (SSS) Problems SSS Problem Thirteen 3 Volume 2 Page 74 SSS Problem Thirteen -3 (Part I And Part IV Refundable Taxes, GRIP) Fuzon Ltd. is a Canadian controlled private corporation. It has been in operation for several years and has a December 31 year end For the taxation year ending December 31, 2018, its Net Income For Tax Purposes was made up of the following components: Active Business Income Dividends From Canadian Corporations: $423,400 Wholly-Owned Subsidiary (All Non-Eligible) 223,600 101,400 48,300 111,750 5908,450 Portfolio Investments (All Eligible) Canadian Source Interest Taxable Capital Gains [(1/2)(5223,500)I Net Income For Tax Purposes Dividends paid to Fuzon Ltd. by the wholly-owned subsidiary during 2018 did not result in a dividend refund. The wholly-owned subsidiary has been allocated one-half of the annual business limit for the small business deduction, with the remainder to be used by Fuzon. On September 4, 2018, Fuzon paid taxable dividends to its shareholders in the amount of $65,600. Of this total, $29,400 was designated as eligible As of the end of the 2017 taxation year, Fuzon had a Refundable Dividend Tax On Hand balance of $39,400, as well as a GRIP balance of $93,400. During 2017, Fuzon Ltd. paid no dividends Required: For Fuzon's 2018 taxation year, calculate the following items: A. Federal Part I Tax Payable. B. Part IV Tax Payable. C. The balance in the Refundable Dividend Tax On Hand account on December 31,2018 D. The balance in the GRIP account on December 31, 2018 E. The dividend refund, if any F. Federal Tax Payable (net of any dividend refund). Show all of the calculations used to provide the required information, including those for which the result is nil Solt Ctudy And SSs Problems (2018/2019) Chapter 13 Supplementary Self Study (SSS) Problems SSS Problem Thirteen 3 Volume 2 Page 74 SSS Problem Thirteen -3 (Part I And Part IV Refundable Taxes, GRIP) Fuzon Ltd. is a Canadian controlled private corporation. It has been in operation for several years and has a December 31 year end For the taxation year ending December 31, 2018, its Net Income For Tax Purposes was made up of the following components: Active Business Income Dividends From Canadian Corporations: $423,400 Wholly-Owned Subsidiary (All Non-Eligible) 223,600 101,400 48,300 111,750 5908,450 Portfolio Investments (All Eligible) Canadian Source Interest Taxable Capital Gains [(1/2)(5223,500)I Net Income For Tax Purposes Dividends paid to Fuzon Ltd. by the wholly-owned subsidiary during 2018 did not result in a dividend refund. The wholly-owned subsidiary has been allocated one-half of the annual business limit for the small business deduction, with the remainder to be used by Fuzon. On September 4, 2018, Fuzon paid taxable dividends to its shareholders in the amount of $65,600. Of this total, $29,400 was designated as eligible As of the end of the 2017 taxation year, Fuzon had a Refundable Dividend Tax On Hand balance of $39,400, as well as a GRIP balance of $93,400. During 2017, Fuzon Ltd. paid no dividends Required: For Fuzon's 2018 taxation year, calculate the following items: A. Federal Part I Tax Payable. B. Part IV Tax Payable. C. The balance in the Refundable Dividend Tax On Hand account on December 31,2018 D. The balance in the GRIP account on December 31, 2018 E. The dividend refund, if any F. Federal Tax Payable (net of any dividend refund). Show all of the calculations used to provide the required information, including those for which the result is nil Solt Ctudy And SSs Problems (2018/2019)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts