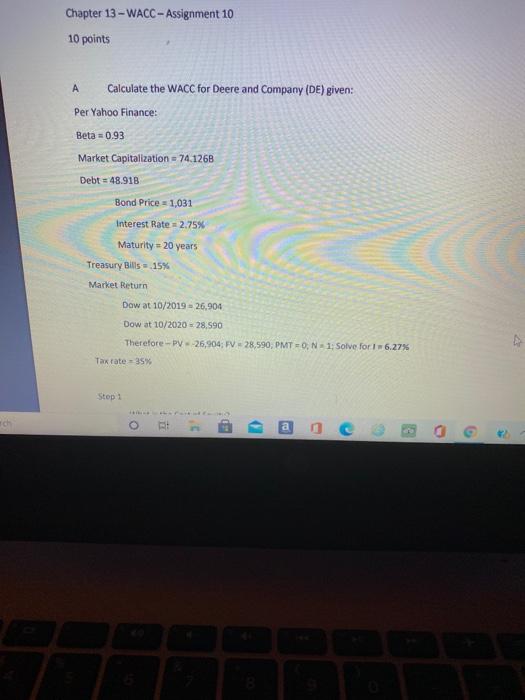

Question: Chapter 13 - WACC - Assignment 10 10 points A Calculate the WACC for Deere and Company (DE) given: Per Yahoo Finance: Beta=0.93 Market Capitalization

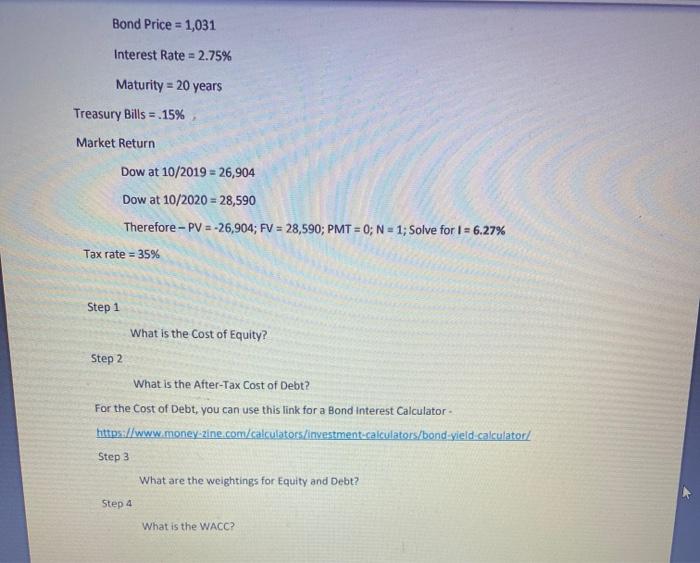

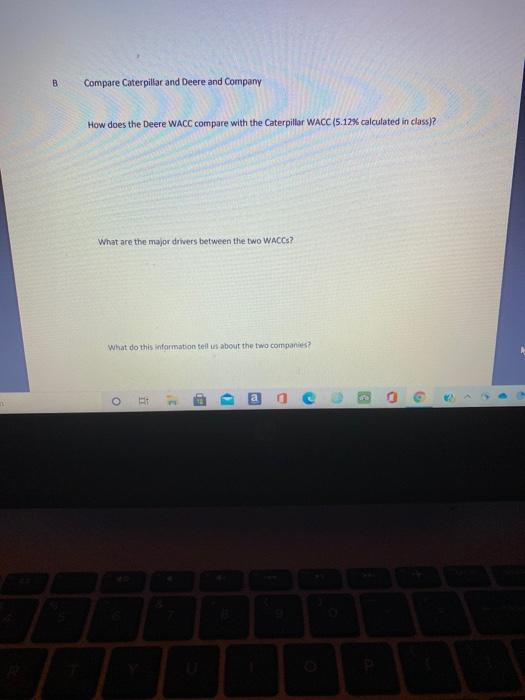

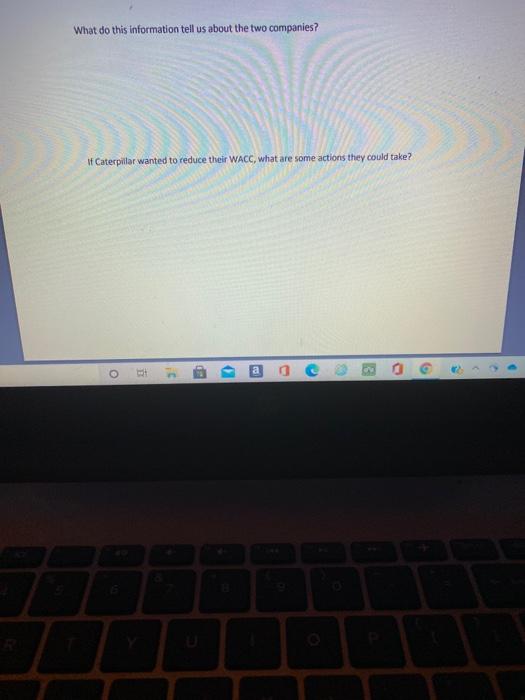

Chapter 13 - WACC - Assignment 10 10 points A Calculate the WACC for Deere and Company (DE) given: Per Yahoo Finance: Beta=0.93 Market Capitalization - 74.1268 Debt = 48.91B Bond Price = 1,031 Interest Rate 2.75% Maturity = 20 years Treasury Bills - 15% Market Return Daw at 10/2019 - 26,904 Dow at 10/2020 = 28.590 Therefore-PV-26,904: FV 28,590, PMT=0, N1: Solve for 6.27% Taxtate = 35% Stop 1 3D 3 Bond Price = 1,031 Interest Rate = 2.75% Maturity = 20 years Treasury Bills = 15% Market Return Dow at 10/2019 - 26,904 Dow at 10/2020 = 28,590 Therefore - PV = -26,904; FV = 28,590; PMT = 0; N = 1; Solve for I = 6.27% Tax rate = 35% Step 1 What is the cost of Equity? Step 2 What is the After-Tax Cost of Debt? For the cost of Debt, you can use this link for a Bond Interest Calculator https://www.money-zine.com/calculators/investment-calculators/bond-yield calculator/ Step 3 What are the weightings for Equity and Debt? Step 4 What is the WACC? B Compare Caterpillar and Deere and Company How does the Deere WACC compare with the Caterpillar WACC (5.12% calculated in class)2 What are the major drivers between the two WACCS? What do this information tell us about the two companies? 0 a O G 1 What do this information tell us about the two companies? If Caterpillar wanted to reduce their WACC, what are some actions they could take? - a Chapter 13 - WACC - Assignment 10 10 points A Calculate the WACC for Deere and Company (DE) given: Per Yahoo Finance: Beta=0.93 Market Capitalization - 74.1268 Debt = 48.91B Bond Price = 1,031 Interest Rate 2.75% Maturity = 20 years Treasury Bills - 15% Market Return Daw at 10/2019 - 26,904 Dow at 10/2020 = 28.590 Therefore-PV-26,904: FV 28,590, PMT=0, N1: Solve for 6.27% Taxtate = 35% Stop 1 3D 3 Bond Price = 1,031 Interest Rate = 2.75% Maturity = 20 years Treasury Bills = 15% Market Return Dow at 10/2019 - 26,904 Dow at 10/2020 = 28,590 Therefore - PV = -26,904; FV = 28,590; PMT = 0; N = 1; Solve for I = 6.27% Tax rate = 35% Step 1 What is the cost of Equity? Step 2 What is the After-Tax Cost of Debt? For the cost of Debt, you can use this link for a Bond Interest Calculator https://www.money-zine.com/calculators/investment-calculators/bond-yield calculator/ Step 3 What are the weightings for Equity and Debt? Step 4 What is the WACC? B Compare Caterpillar and Deere and Company How does the Deere WACC compare with the Caterpillar WACC (5.12% calculated in class)2 What are the major drivers between the two WACCS? What do this information tell us about the two companies? 0 a O G 1 What do this information tell us about the two companies? If Caterpillar wanted to reduce their WACC, what are some actions they could take? - a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts