Question: Chapter 14 1. Chapter 14, Question 13 Capital Budgeting Example Brower, Inc., just constructed a manufacturing plant in Ghana. The construction cost 9 billion Ghanaian

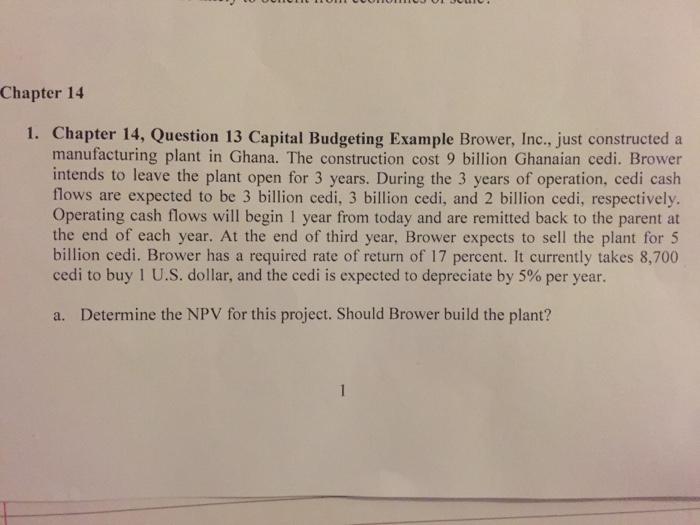

Chapter 14 1. Chapter 14, Question 13 Capital Budgeting Example Brower, Inc., just constructed a manufacturing plant in Ghana. The construction cost 9 billion Ghanaian cedi. Brower intends to leave the plant open for 3 years. During the 3 years of operation, cedi cash flows are expected to be 3 billion cedi, 3 billion cedi, and 2 billion cedi, respectively. Operating cash flows will begin 1 year from today and are remitted back to the parent at the end of each year. At the end of third year. Brower expects to sell the plant for 5 billion cedi. Brower has a required rate of return of 17 percent. It currently takes 8,700 cedi to buy 1 U.S. dollar, and the cedi is expected to depreciate by 5% per year. a. Determine the NPV for this project. Should Brower build the plant

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts