Question: Chapter 14: Aplia Homework 4. IPO trading Based on your understanding of the involvement of investment banks in an IPO, complete the following sentences. If

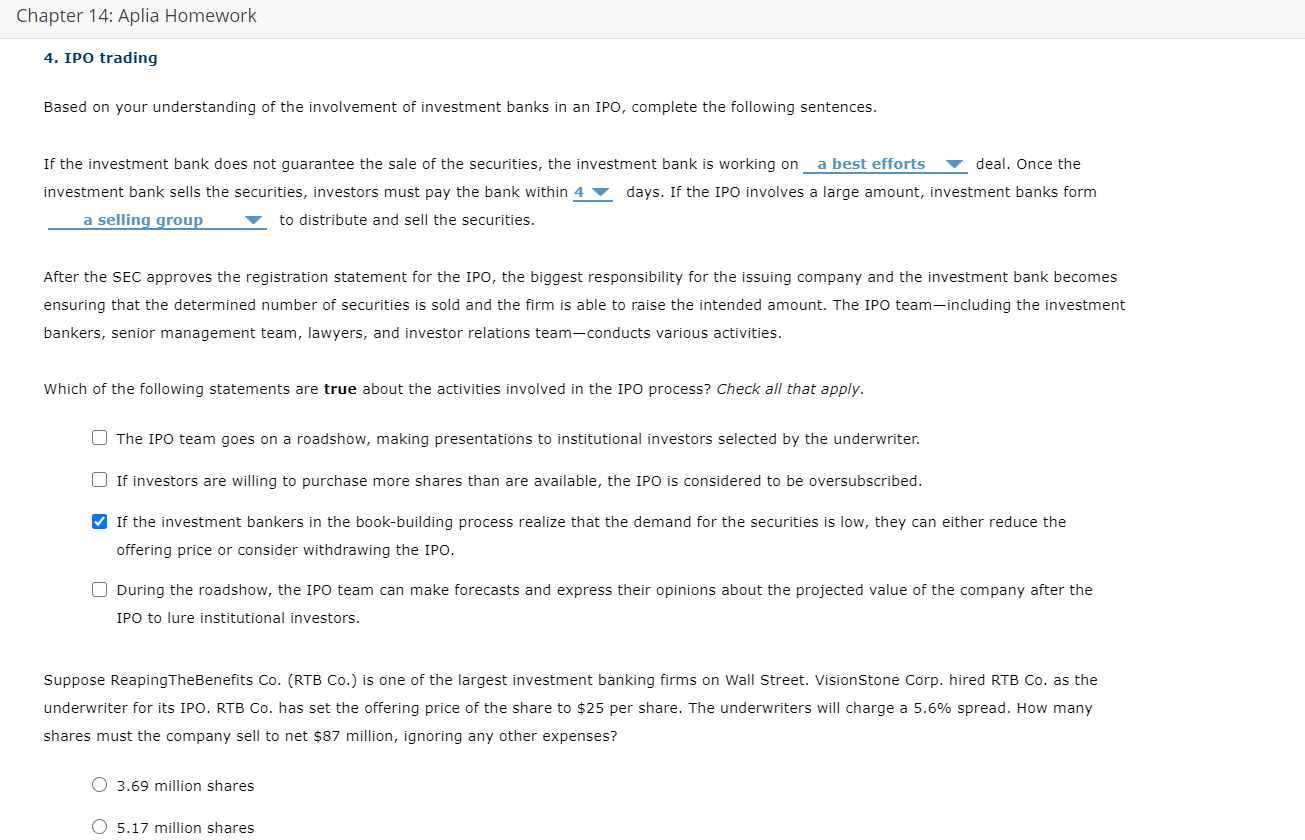

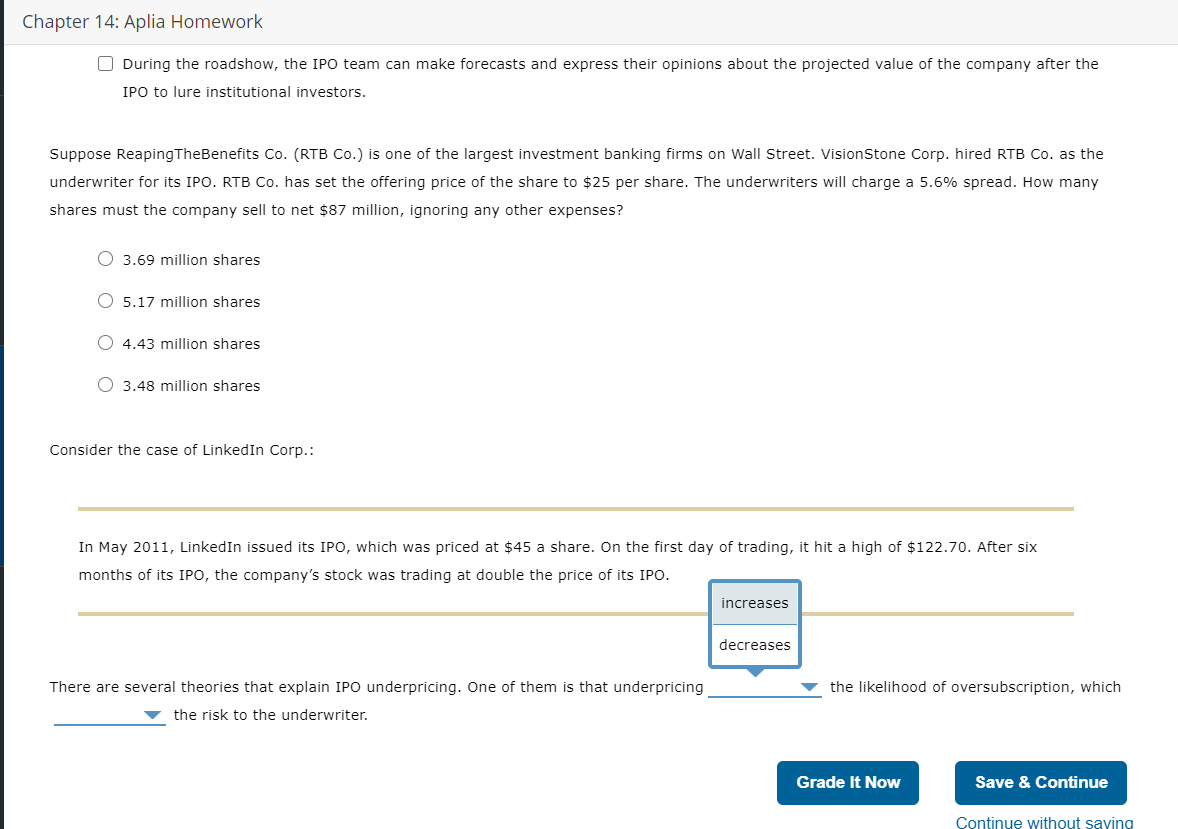

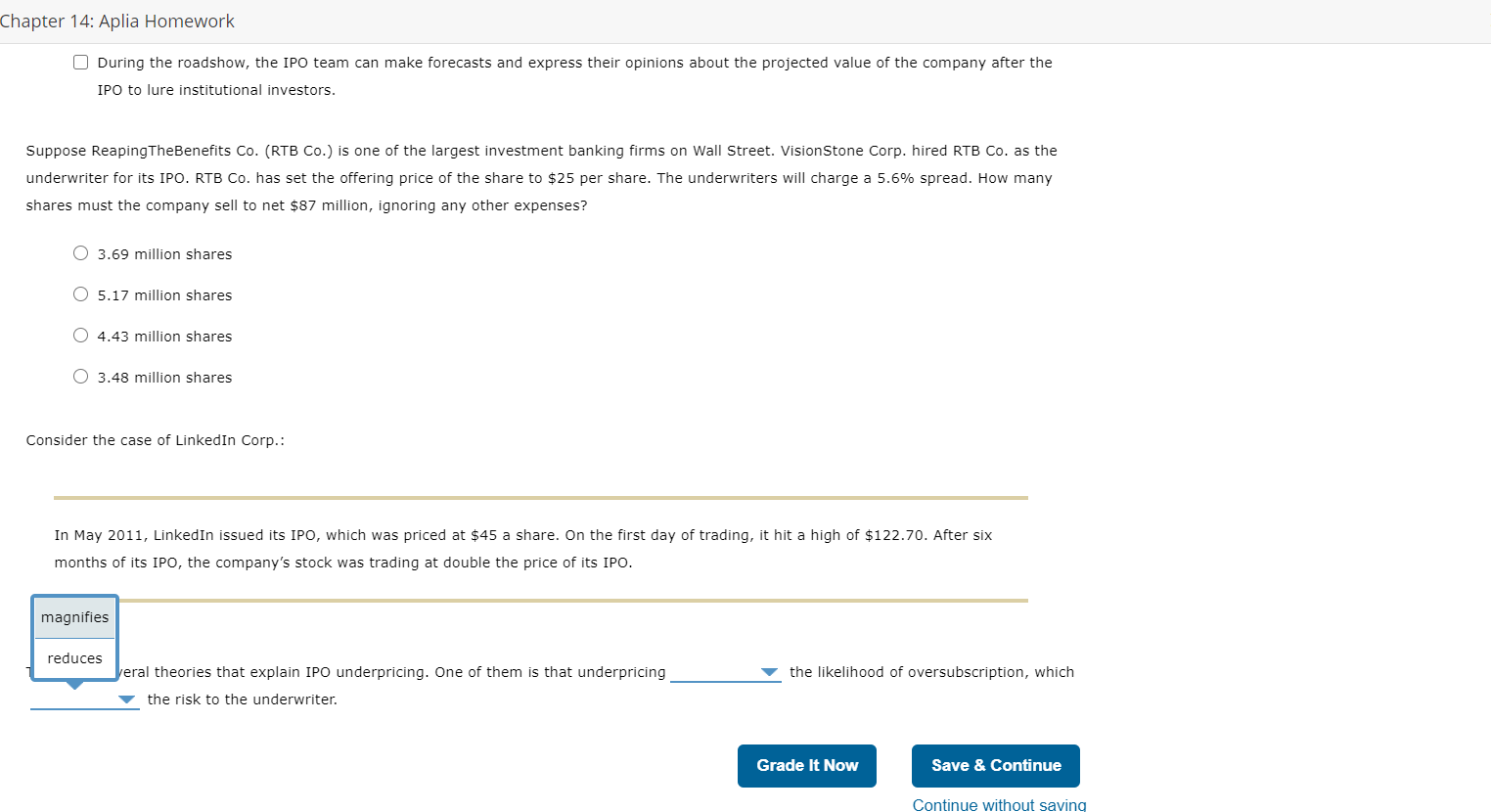

Chapter 14: Aplia Homework 4. IPO trading Based on your understanding of the involvement of investment banks in an IPO, complete the following sentences. If the investment bank does not guarantee the sale of the securities, the investment bank is working on a best efforts deal. Once the investment bank sells the securities, investors must pay the bank within 4 days. If the IPO involves a large amount, investment banks form a selling group to distribute and sell the securities. After the SEC approves the registration statement for the IPO, the biggest responsibility for the issuing company and the investment bank becomes ensuring that the determined number of securities is sold and the firm is able to raise the intended amount. The IPO team-including the investment bankers, senior management team, lawyers, and investor relations team-conducts various activities. Which of the following statements are true about the activities involved in the IPO process? Check all that apply. The IPO team goes on a roadshow, making presentations to institutional investors selected by the underwriter. If investors are willing to purchase more shares than are available, the IPO is considered to be oversubscribed. If the investment bankers in the book-building process realize that the demand for the securities is low, they can either reduce the offering price or consider withdrawing the IPO. During the roadshow, the IPO team can make forecasts and express their opinions about the projected value of the company after the IPO to lure institutional investors. Suppose ReapingTheBenefits Co. (RTB Co.) is one of the largest investment banking firms on Wall Street. Vision Stone Corp. hired RTB Co. as the underwriter for its IPO. RTB Co. has set the offering price of the share to $25 per share. The underwriters will charge a 5.6% spread. How many shares must the company sell to net $87 million, ignoring any other expenses? O 3.69 million shares O 5.17 million shares Chapter 14: Aplia Homework During the roadshow, the IPO team can make forecasts and express their opinions about the projected value of the company after the IPO to lure institutional investors. Suppose ReapingTheBenefits Co. (RTB Co.) is one of the largest investment banking firms on Wall Street. Vision Stone Corp. hired RTB Co. as the underwriter for its IPO. RTB Co. has set the offering price of the share to $25 per share. The underwriters will charge a 5.6% spread. How many shares must the company sell to net $87 million, ignoring any other expenses? O 3.69 million shares 5.17 million shares 0 4.43 million shares O 3.48 million shares Consider the case of Linkedin Corp.: In May 2011, LinkedIn issued its IPO, which was priced at $45 a share. On the first day of trading, it hit a high of $122.70. After six months of its IPO, the company's stock was trading at double the price of its IPO. increases decreases the likelihood of oversubscription, which There are several theories that explain IPO underpricing. One of them is that underpricing the risk to the underwriter. Grade It Now Save & Continue Continue without saying Chapter 14: Aplia Homework During the roadshow, the IPO team can make forecasts and express their opinions about the projected value of the company after the IPO to lure institutional investors. Suppose ReapingTheBenefits Co. (RTB Co.) is one of the largest investment banking firms on Wall Street. Vision Stone Corp. hired RTB Co. as the underwriter for its IPO. RTB Co. has set the offering price of the share to $25 per share. The underwriters will charge a 5.6% spread. How many shares must the company sell to net $87 million, ignoring any other expenses? O 3.69 million shares 05.17 million shares 0 4.43 million shares 0 3.48 million shares Consider the case of LinkedIn Corp.: In May 2011, LinkedIn issued its IPO, which was priced at $45 a share. On the first day of trading, it hit a high of $122.70. After six months of its IPO, the company's stock was trading at double the price of its IPO. magnifies reduces the likelihood of oversubscription, which Veral theories that explain IPO underpricing. One of them is that underpricing the risk to the underwriter. Grade It Now Save & Continue Continue without saving Chapter 14: Aplia Homework 4. IPO trading Based on your understanding of the involvement of investment banks in an IPO, complete the following sentences. If the investment bank does not guarantee the sale of the securities, the investment bank is working on a best efforts deal. Once the investment bank sells the securities, investors must pay the bank within 4 days. If the IPO involves a large amount, investment banks form a selling group to distribute and sell the securities. After the SEC approves the registration statement for the IPO, the biggest responsibility for the issuing company and the investment bank becomes ensuring that the determined number of securities is sold and the firm is able to raise the intended amount. The IPO team-including the investment bankers, senior management team, lawyers, and investor relations team-conducts various activities. Which of the following statements are true about the activities involved in the IPO process? Check all that apply. The IPO team goes on a roadshow, making presentations to institutional investors selected by the underwriter. If investors are willing to purchase more shares than are available, the IPO is considered to be oversubscribed. If the investment bankers in the book-building process realize that the demand for the securities is low, they can either reduce the offering price or consider withdrawing the IPO. During the roadshow, the IPO team can make forecasts and express their opinions about the projected value of the company after the IPO to lure institutional investors. Suppose ReapingTheBenefits Co. (RTB Co.) is one of the largest investment banking firms on Wall Street. Vision Stone Corp. hired RTB Co. as the underwriter for its IPO. RTB Co. has set the offering price of the share to $25 per share. The underwriters will charge a 5.6% spread. How many shares must the company sell to net $87 million, ignoring any other expenses? O 3.69 million shares O 5.17 million shares Chapter 14: Aplia Homework During the roadshow, the IPO team can make forecasts and express their opinions about the projected value of the company after the IPO to lure institutional investors. Suppose ReapingTheBenefits Co. (RTB Co.) is one of the largest investment banking firms on Wall Street. Vision Stone Corp. hired RTB Co. as the underwriter for its IPO. RTB Co. has set the offering price of the share to $25 per share. The underwriters will charge a 5.6% spread. How many shares must the company sell to net $87 million, ignoring any other expenses? O 3.69 million shares 5.17 million shares 0 4.43 million shares O 3.48 million shares Consider the case of Linkedin Corp.: In May 2011, LinkedIn issued its IPO, which was priced at $45 a share. On the first day of trading, it hit a high of $122.70. After six months of its IPO, the company's stock was trading at double the price of its IPO. increases decreases the likelihood of oversubscription, which There are several theories that explain IPO underpricing. One of them is that underpricing the risk to the underwriter. Grade It Now Save & Continue Continue without saying Chapter 14: Aplia Homework During the roadshow, the IPO team can make forecasts and express their opinions about the projected value of the company after the IPO to lure institutional investors. Suppose ReapingTheBenefits Co. (RTB Co.) is one of the largest investment banking firms on Wall Street. Vision Stone Corp. hired RTB Co. as the underwriter for its IPO. RTB Co. has set the offering price of the share to $25 per share. The underwriters will charge a 5.6% spread. How many shares must the company sell to net $87 million, ignoring any other expenses? O 3.69 million shares 05.17 million shares 0 4.43 million shares 0 3.48 million shares Consider the case of LinkedIn Corp.: In May 2011, LinkedIn issued its IPO, which was priced at $45 a share. On the first day of trading, it hit a high of $122.70. After six months of its IPO, the company's stock was trading at double the price of its IPO. magnifies reduces the likelihood of oversubscription, which Veral theories that explain IPO underpricing. One of them is that underpricing the risk to the underwriter. Grade It Now Save & Continue Continue without saving

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts