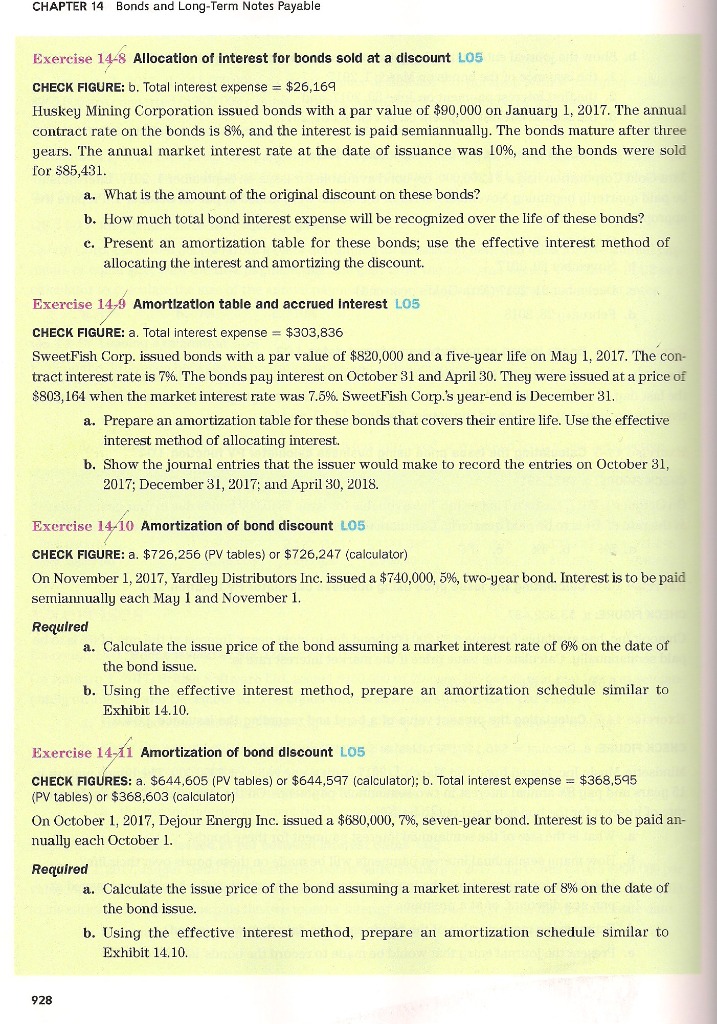

Question: CHAPTER 14 Bonds and Long-Term Notes Payable discount L05 Exercise 14-8 Allocation of interest for bonds sold at CHECK FIGURE: b. Total interest expense $26,169

CHAPTER 14 Bonds and Long-Term Notes Payable discount L05 Exercise 14-8 Allocation of interest for bonds sold at CHECK FIGURE: b. Total interest expense $26,169 Huskey Mining Corporation issued bonds with a par value of $90,000 on January 1, 2017. The annual contract rate on the bonds is 8% , and the interest is paid semiannually. The bonds mature after three years. The annual market interest rate at the date of issuance was 10% , and the bonds were sold for $85,431 a. What is the amount of the original discount on these bonds? b. How much total bond interest expense will be recognized over the life of these bonds? c. Present an amortization table for these bonds; use the effective interest method of allocating the interest and amortizing the discount. Exercise 14-9 Amortlzatlon table and accrued interest LO5 CHECK FIGURE: a. Total interest expense $303,836 SweetFish Corp. issued bonds with a par value of $820,000 and a five-year life on May 1, 2017. The con- tract interest rate is 7%. The bonds pay interest on October 31 and April 30. They were issued at a price of $803,164 when the market interest rate was 7.5%. SweetFish Corp.'s year-end is December 31. a. Prepare an amortization table for these bonds that covers their entire life. Use the effective interest method of allocating interest. b. Show the journal entries that the issuer would make to record the entries on October 31, 2017; December 31, 2017; and April 30, 2018. Exercise 14-0 Amortization of bond discount LO5 $726,247 (calculator) CHECK FIGURE: a. $726,256 (PV tables) On November 1, 2017, Yardley Distributors Inc. issued a $740,000, 5 % , two-year bond. Interest is to be paid semiannually each May 1 and November 1 Required a. Calculate the issue price of the bond asssuming a market interest rate of 6% on the date of the bond issue. b. Using the effective interest method, prepare an amortization schedule similar to Exhibit 14.10. Exercise 14-1 Amortization of bond discount LO5 CHECK FIGURES: a. $644,605 (PV tables) or $644,597 (calculator); b. Total interest expense $368,595 (PV tables) or $368,603 (calculator) On October 1, 2017, Dejour Energy Inc. issueda $680,000, 7% , seven-year bond. Interest is to be paid an- nually each October 1 Required a. Calculate the issue price of the bond assuming a market interest rate of 8% on the date of the bond issue. b. Using the effective interest method, prepare an amortization schedule similar to Exhibit 14.10 928

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts