Question: Chapter 14: Dividend and Chapter 16: Working Capital Management 4. Exeningstar Worldwide forecasts a capital budget of $650,000, and its initial capital structure of 40%

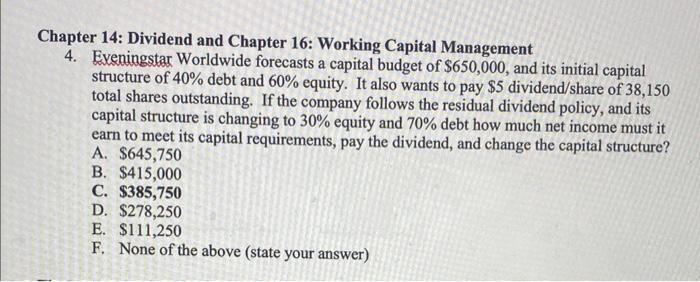

Chapter 14: Dividend and Chapter 16: Working Capital Management 4. Exeningstar Worldwide forecasts a capital budget of $650,000, and its initial capital structure of 40% debt and 60% equity. It also wants to pay $5 dividend/share of 38,150 total shares outstanding. If the company follows the residual dividend policy, and its capital structure is changing to 30% equity and 70% debt how much net income must it earn to meet its capital requirements, pay the dividend, and change the capital structure? A. $645,750 B. $415,000 C. $385,750 D. $278,250 E. $111,250 F. None of the above (state your answer)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts