Question: Chapter 14 Financial Planning Exercise 5 Average Social Security benefits and taxes Use Exhibit 14.3 to estimate the average Social Security benefits for a retired

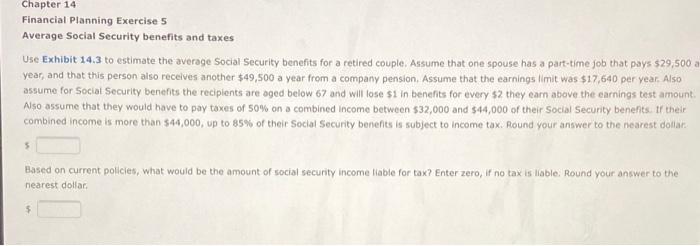

Chapter 14 Financial Planning Exercise 5 Average Social Security benefits and taxes Use Exhibit 14.3 to estimate the average Social Security benefits for a retired couple. Assume that one spouse has a part-time job that pays $29,500 a year, and that this person also receives another $49,500 a year from a company pension. Assume that the earnings mit was $17,640 per year. Also assume for Social Security benefits the recipients are aged below 67 and will lose $1 in benefits for every s2 they earn above the earnings test amount Also assume that they would have to pay taxes of 50% on a combined Income between $32,000 and $44,000 of their Social Security benents. Ir their combined income is more than $44,000, up to 85% of their Social Security benefits is subject to income tax. Round your answer to the nearest dollar 5 Based on current policies, what would be the amount of social security income liable for tax? Enter zero, if no tax is able Round your answer to the nearest dollar 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts