Question: (Chapter 14) Please answer all questions with a red X next to them. Thank you! Estimating Share Value Using the ROPl Mode Assume following are

(Chapter 14) Please answer all questions with a red X next to them. Thank you!

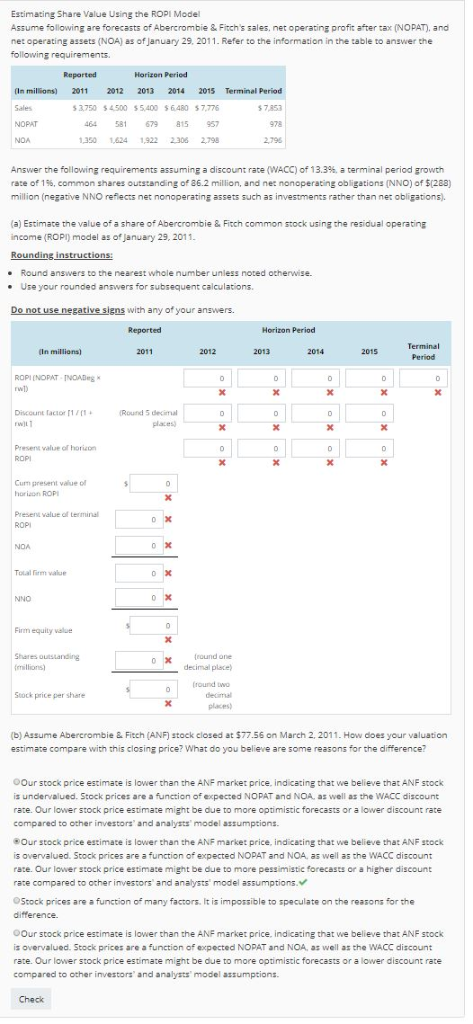

Estimating Share Value Using the ROPl Mode Assume following are forecasts of Abercrombie & Fitch's sales, net operating profit after tax (NOPAT), and net operating assets (NOA) as of January 29, 2011. Refer to the information in the table to answer the following requirements. Horizon Peried (In millioms) 2011 2012 2013 2014 2015 Terminal Period 7.853 978 $3.750 %4500 %5400 %6480 $7,776 464 581 679 815 957 330 1,624 1922 2306 2,798 NOPAT NOA Answer the following requirements assuming a discount rate (WACC) of 13.3%, a terminal period growth rate of 1%, common shares outstanding of 86.2 million, and net nonoperating obligations (NNO) of $(288) million (negative NNO reflects net nonoperating assets such as investments rather than net obligations. (a) Estimate the value of a share of Abercrombie & Fitch common stock using the residual operating income (ROPI) model as of January 29, 2011 - Round answers to the nearest whole number unless noted otherwise. . Use your rounded answers for subsequent calculations. Do not use negative signs with any of your answers. Horizon Period (In millions) 2012 2013 2015 ROPI(NOPAT INDADg rwl) Discount lacior 1 rwlL Round 5 decimal Presens value of horin Cun presenit value of horizon ROP Present value of terminal NOA o x Total m value NNO Firm equity value hares ouistanding round one decal place) round two Stock price per share (b) Assume Abercrombie & Fitch (ANF) stock closed at $77.56 on March 2, 2011. How does your valuation estimate compare with this closing price? What do you believe are some reasons for che difference? Our stock price estimate is lower than the ANF market price, indicating that we believe that ANF stock is undervalued. Stock prices are a function of expected NOPAT and NOA, as well as the WACC discount rate. Our lower stock price estimate might be due to more optimistic forecasts or a lower discount rate compared to other investors and analysts model assumptions Our stock price estimate is lower than the ANF market price, indicating that we believe that ANF stock is overvalued. Stock prices are a function of expected NOPAT and NOA, as well as the WACC discount rate. Our lower stock price estimaze might be due to more pessimistic forecasts or a higher discount rate compared to other investors and analysts model assumptions. Stock prices are a function of many factors. It is impossible to speculate on the reasons for the Our stock price estimate is lower than the ANF market price. indicating that we believe that ANF stock is overvalued. Stock prices are a function of expected NOPAT and NOA, as well as the WACC discount rate. Our lower stock price estimate might be due to more optimistic forecasts or a lower discount rate compared to other investors and analysts model assumptions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts