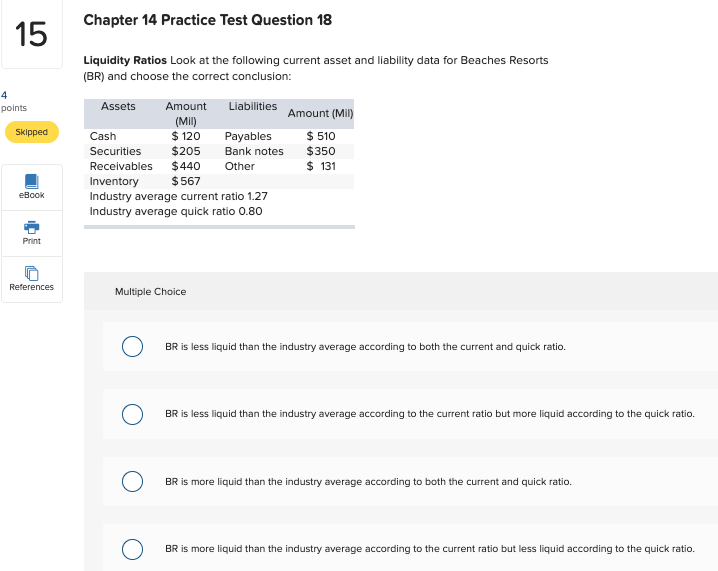

Question: Chapter 14 Practice Test Question 18 15 Liquidity Ratios Look at the following current asset and liability data for Beaches Resorts (BR) and choose the

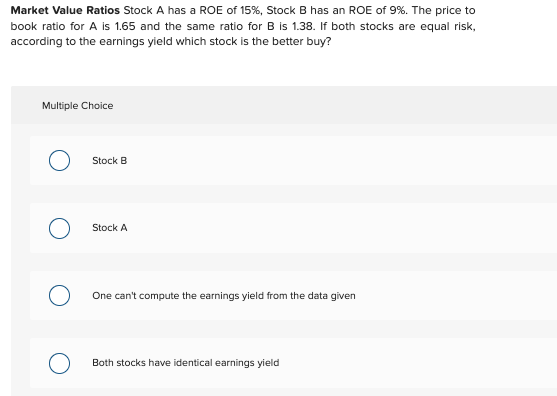

Chapter 14 Practice Test Question 18 15 Liquidity Ratios Look at the following current asset and liability data for Beaches Resorts (BR) and choose the correct conclusion: 4 Assets Amount Liabilities points Amount (Mil) (il) 120 $205 $440 $567 Skipped Cash $510 $350 131 Payables Securities Bank notes Receivables Other Inventory Industry average current ratio 1.27 Industry average quick ratio 0.80 ok Print References Multiple Choice BR is less liquid than the industry average according to both the current and quick ratio. BR is less liquid than the industry average according to the current ratio but more liquid according to the quick ratio BR is more liquid than the industry average according to both the current and quick ratio. BR is more liquid than the industry average according to the current ratio but less liquid according to the quick ratio LO Market Value Ratios Stock A has a ROE of 15%, Stock B has an ROE of 9%. The price to book ratio for A is 1.65 and the same ratio for B is 1.38. If both stocks are equal risk, according to the earnings yield which stock is the better buy? Multiple Choice Stock B Stock A One can't compute the earningss yield from the data given Both stocks have identical earnings yield

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts