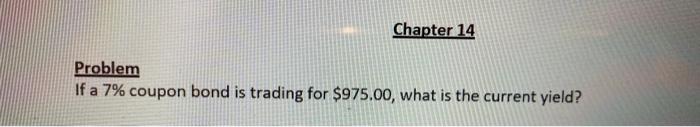

Question: Chapter 14 Problem If a 7% coupon bond is trading for $975.00, what is the current yield? Problem A coupon bond that pays interest annually

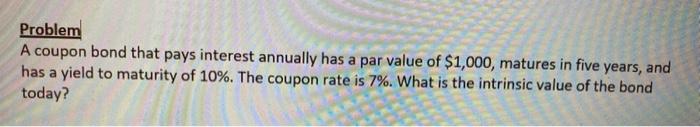

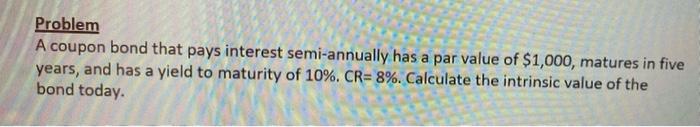

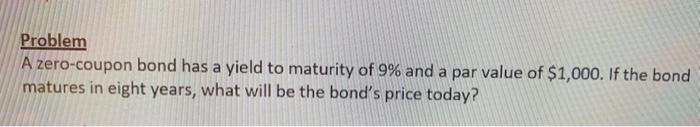

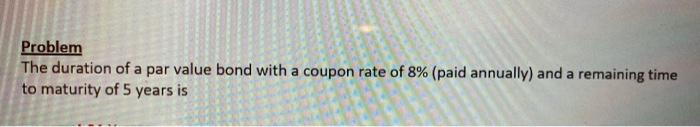

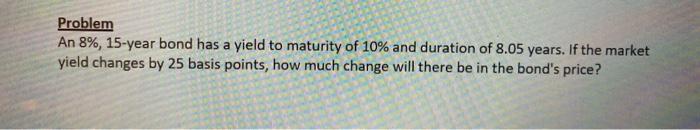

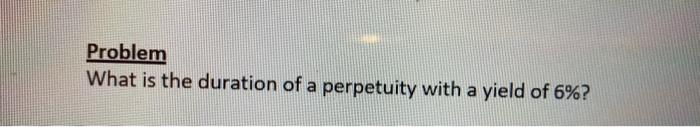

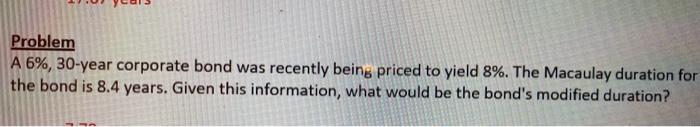

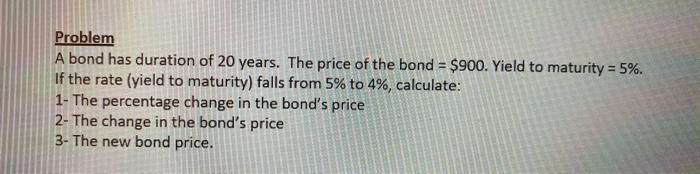

Chapter 14 Problem If a 7% coupon bond is trading for $975.00, what is the current yield? Problem A coupon bond that pays interest annually has a par value of $1,000, matures in five years, and has a yield to maturity of 10%. The coupon rate is 7%. What is the intrinsic value of the bond today? Problem A coupon bond that pays interest semi-annually has a par value of $1,000, matures in five years, and has a yield to maturity of 10%. CR= 8%. Calculate the intrinsic value of the bond today. Problem A zero-coupon bond has a yield to maturity of 9% and a par value of $1,000. If the bond matures in eight years, what will be the bond's price today? Problem The duration of a par value bond with a coupon rate of 8% (paid annually) and a remaining time to maturity of 5 years is Problem An 8%, 15-year bond has a yield to maturity of 10% and duration of 8.05 years. If the market yield changes by 25 basis points, how much change will there be in the bond's price? Problem What is the duration of a perpetuity with a yield of 6%? Problem A 6%, 30-year corporate bond was recently being priced to yield 8%. The Macaulay duration for the bond is 8.4 years. Given this information, what would be the bond's modified duration? Problem A bond has duration of 20 years. The price of the bond = $900. Yield to maturity = 5%. If the rate (yield to maturity) falls from 5% to 4%, calculate: 1- The percentage change in the bond's price 2- The change in the bond's price 3- The new bond price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts