Question: Chapter 14: Raising Equity Capital 1. You have started a company and are in luck-a venture capitalist (VC) has offered to invest. You own

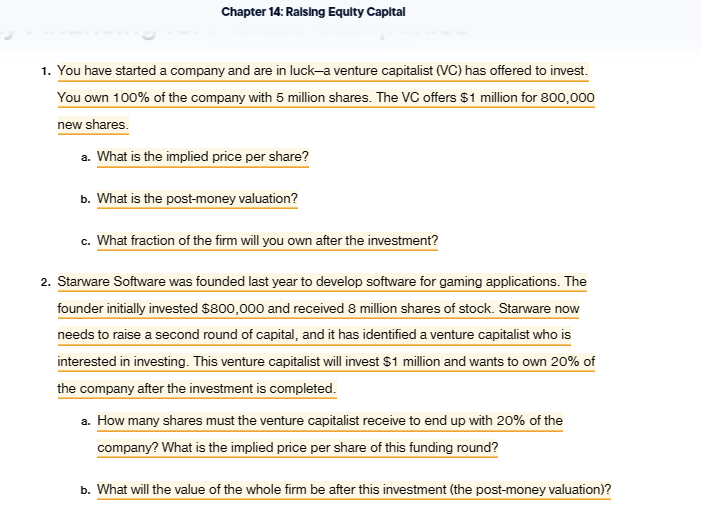

Chapter 14: Raising Equity Capital 1. You have started a company and are in luck-a venture capitalist (VC) has offered to invest. You own 100% of the company with 5 million shares. The VC offers $1 million for 800,000 new shares. a. What is the implied price per share? b. What is the post-money valuation? c. What fraction of the firm will you own after the investment? 2. Starware Software was founded last year to develop software for gaming applications. The founder initially invested $800,000 and received 8 million shares of stock. Starware now needs to raise a second round of capital, and it has identified a venture capitalist who is interested in investing. This venture capitalist will invest $1 million and wants to own 20% of the company after the investment is completed. a. How many shares must the venture capitalist receive to end up with 20% of the company? What is the implied price per share of this funding round? b. What will the value of the whole firm be after this investment (the post-money valuation)?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts