Question: Chapter 14 UYJ (Using Your Judgement): Procter & Gamble (P&G) for the year ended 6/30/20 (see the note above). Note this modification of part b

Chapter 14 UYJ (Using Your Judgement): Procter & Gamble (P&G) for the year ended 6/30/20 (see the note above). Note this modification of part b of the question: Prepare an assessment of its liquidity, solvency, and financial flexibility using ratio analysis.

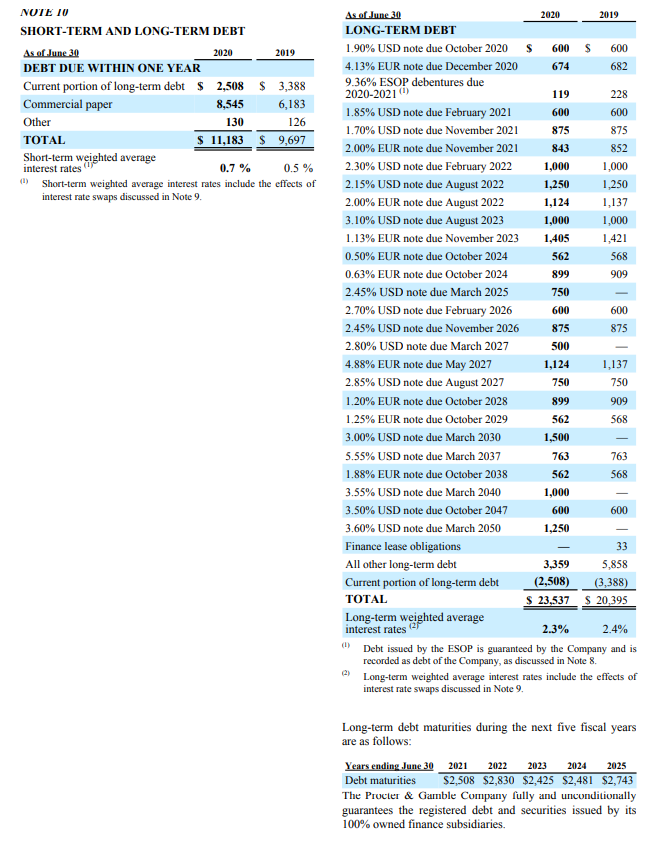

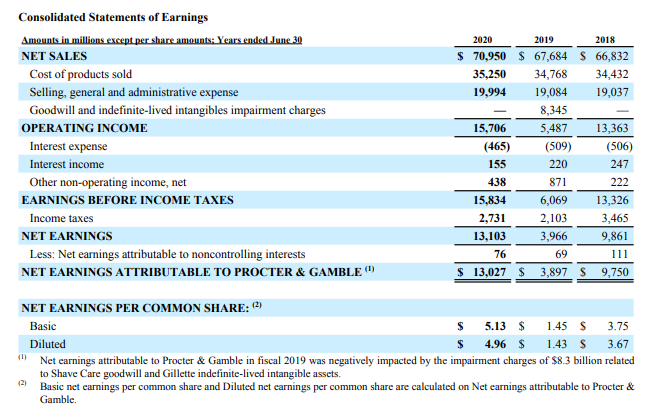

2020 2019 NOTE IV SHORT-TERM AND LONG-TERM DEBT As of June 30 2020 2019 DEBT DUE WITHIN ONE YEAR Current portion of long-term debt $ 2,508 $ 3,388 Commercial paper 8,545 6,183 Other 130 126 TOTAL $ 11,183 $ 9,697 Short-term weighted average interest rates 0.7% 0.5% ) Short-term weighted average interest rates include the effects of interest rate swaps discussed in Note 9. 600 As of June 30 LONG-TERM DEBT 1.90% USD note due October 2020 $ 600 s 600 4.13% EUR note due December 2020 674 682 9.36% ESOP debentures due 2020-2021) 119 228 1.85% USD note due February 2021 600 600 1.70% USD note due November 2021 875 875 2.00% EUR note due November 2021 843 852 2.30% USD note due February 2022 1,000 1,000 2.15% USD note due August 2022 1,250 1,250 2.00% EUR note due August 2022 1,124 1,137 3.10% USD note due August 2023 1,000 1,000 1.13% EUR note due November 2023 1,405 1,421 0.50% EUR note due October 2024 562 568 0.63% EUR note due October 2024 899 909 2.45% USD note due March 2025 750 2.70% USD note due February 2026 600 2.45% USD note due November 2026 875 875 2.80% USD note due March 2027 500 4.88% EUR note due May 2027 1,124 1,137 2.85% USD note due August 2027 750 750 1.20% EUR note due October 2028 899 909 1.25% EUR note due October 2029 562 568 3.00% USD note due March 2030 1,500 5.55% USD note due March 2037 763 763 1.88% EUR note due October 2038 562 568 3.55% USD note due March 2040 1,000 3.50% USD note due October 2047 600 600 3.60% USD note due March 2050 1,250 Finance lease obligations 33 All other long-term debt 3,359 5,858 Current portion of long-term debt (2,508) (3,388) TOTAL $ 23,537 $ 20,395 Long-term weighted average interest rates 28 2.3% 2.4% Debt issued by the ESOP is guaranteed by the Company and is recorded as debt of the Company, as discussed in Note 8. Long-term weighted average interest rates include the effects of interest rate swaps discussed in Note 9. 2024 Long-term debt maturities during the next five fiscal years are as follows: Years ending June 30 2021 2022 2023 2025 Debt maturities $2,508 $2,830 $2,425 $2,481 $2,743 The Procter & Gamble Company fully and unconditionally guarantees the registered debt and securities issued by its 100% owned finance subsidiaries. Consolidated Statements of Earnings Amounts in millions except per share amounts: Years ended June 30 NET SALES Cost of products sold Selling, general and administrative expense Goodwill and indefinite-lived intangibles impairment charges OPERATING INCOME Interest expense Interest income Other non-operating income, net EARNINGS BEFORE INCOME TAXES Income taxes NET EARNINGS Less: Net earnings attributable to noncontrolling interests NET EARNINGS ATTRIBUTABLE TO PROCTER & GAMBLE) 2020 2019 2018 $ 70,950 $ 67,684 $ 66,832 35,250 34,768 34,432 19,994 19,084 19,037 8,345 15,706 5,487 13,363 (465) (509) (506) 155 220 247 438 871 222 15,834 6,069 13,326 2,731 2,103 3,465 13,103 3,966 9,861 76 69 111 $ 13,027 $ 3,897 S 9,750 NET EARNINGS PER COMMON SHARE: (2) Basic $ 5.13 $ 1.45 $ 3.75 Diluted $ 4.96 $ 1.43 $ 3.67 Net earnings attributable to Procter & Gamble in fiscal 2019 was negatively impacted by the impairment charges of $8.3 billion related to Shave Care goodwill and Gillette indefinite-lived intangible assets. Basic net earnings per common share and Diluted net earnings per common share are calculated on Net earnings attributable to Procter & Gamble. (1) (21) 2020 2019 NOTE IV SHORT-TERM AND LONG-TERM DEBT As of June 30 2020 2019 DEBT DUE WITHIN ONE YEAR Current portion of long-term debt $ 2,508 $ 3,388 Commercial paper 8,545 6,183 Other 130 126 TOTAL $ 11,183 $ 9,697 Short-term weighted average interest rates 0.7% 0.5% ) Short-term weighted average interest rates include the effects of interest rate swaps discussed in Note 9. 600 As of June 30 LONG-TERM DEBT 1.90% USD note due October 2020 $ 600 s 600 4.13% EUR note due December 2020 674 682 9.36% ESOP debentures due 2020-2021) 119 228 1.85% USD note due February 2021 600 600 1.70% USD note due November 2021 875 875 2.00% EUR note due November 2021 843 852 2.30% USD note due February 2022 1,000 1,000 2.15% USD note due August 2022 1,250 1,250 2.00% EUR note due August 2022 1,124 1,137 3.10% USD note due August 2023 1,000 1,000 1.13% EUR note due November 2023 1,405 1,421 0.50% EUR note due October 2024 562 568 0.63% EUR note due October 2024 899 909 2.45% USD note due March 2025 750 2.70% USD note due February 2026 600 2.45% USD note due November 2026 875 875 2.80% USD note due March 2027 500 4.88% EUR note due May 2027 1,124 1,137 2.85% USD note due August 2027 750 750 1.20% EUR note due October 2028 899 909 1.25% EUR note due October 2029 562 568 3.00% USD note due March 2030 1,500 5.55% USD note due March 2037 763 763 1.88% EUR note due October 2038 562 568 3.55% USD note due March 2040 1,000 3.50% USD note due October 2047 600 600 3.60% USD note due March 2050 1,250 Finance lease obligations 33 All other long-term debt 3,359 5,858 Current portion of long-term debt (2,508) (3,388) TOTAL $ 23,537 $ 20,395 Long-term weighted average interest rates 28 2.3% 2.4% Debt issued by the ESOP is guaranteed by the Company and is recorded as debt of the Company, as discussed in Note 8. Long-term weighted average interest rates include the effects of interest rate swaps discussed in Note 9. 2024 Long-term debt maturities during the next five fiscal years are as follows: Years ending June 30 2021 2022 2023 2025 Debt maturities $2,508 $2,830 $2,425 $2,481 $2,743 The Procter & Gamble Company fully and unconditionally guarantees the registered debt and securities issued by its 100% owned finance subsidiaries. Consolidated Statements of Earnings Amounts in millions except per share amounts: Years ended June 30 NET SALES Cost of products sold Selling, general and administrative expense Goodwill and indefinite-lived intangibles impairment charges OPERATING INCOME Interest expense Interest income Other non-operating income, net EARNINGS BEFORE INCOME TAXES Income taxes NET EARNINGS Less: Net earnings attributable to noncontrolling interests NET EARNINGS ATTRIBUTABLE TO PROCTER & GAMBLE) 2020 2019 2018 $ 70,950 $ 67,684 $ 66,832 35,250 34,768 34,432 19,994 19,084 19,037 8,345 15,706 5,487 13,363 (465) (509) (506) 155 220 247 438 871 222 15,834 6,069 13,326 2,731 2,103 3,465 13,103 3,966 9,861 76 69 111 $ 13,027 $ 3,897 S 9,750 NET EARNINGS PER COMMON SHARE: (2) Basic $ 5.13 $ 1.45 $ 3.75 Diluted $ 4.96 $ 1.43 $ 3.67 Net earnings attributable to Procter & Gamble in fiscal 2019 was negatively impacted by the impairment charges of $8.3 billion related to Shave Care goodwill and Gillette indefinite-lived intangible assets. Basic net earnings per common share and Diluted net earnings per common share are calculated on Net earnings attributable to Procter & Gamble. (1) (21)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts