Question: Chapter 15 Assignment Saved Help Save & Exit Submit Check my work Williams Industries has decided to borrow money by issuing perpetual bonds with a

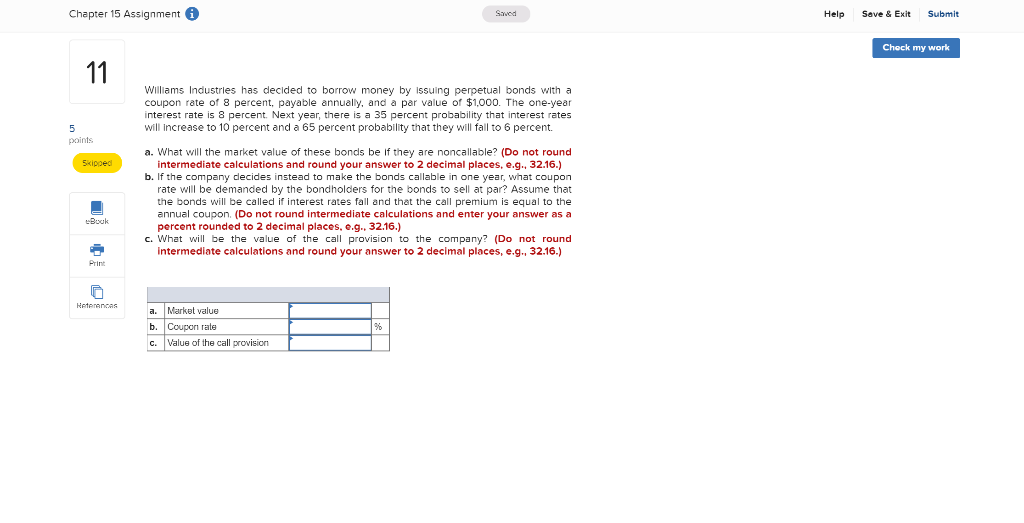

Chapter 15 Assignment Saved Help Save & Exit Submit Check my work Williams Industries has decided to borrow money by issuing perpetual bonds with a coupon rate of 8 percent, payable annually, and a par value of $1,000. The one-year interest rate is 8 percent. Next year, there is a 35 percent probability that interest rates will increase to 10 percent and a 65 percent probability that they will fall to 6 percent. points 5xipded a. What will the market value of these bonds be if they are noncallable? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. If the company decides instead to make the bonds callable in one year, what coupon rate will be demanded by the bondholders for the bonds to sell at par? Assume that the bonds will be called if interest rates fall and that the call premium is equal to the annual coupon. (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g. 32.16.) c. What will be the value of the call provision to the company? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Book Print Heterancas a. Market value b. Coupon rate C. Value of the call provision Chapter 15 Assignment Saved Help Save & Exit Submit Check my work Williams Industries has decided to borrow money by issuing perpetual bonds with a coupon rate of 8 percent, payable annually, and a par value of $1,000. The one-year interest rate is 8 percent. Next year, there is a 35 percent probability that interest rates will increase to 10 percent and a 65 percent probability that they will fall to 6 percent. points 5xipded a. What will the market value of these bonds be if they are noncallable? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. If the company decides instead to make the bonds callable in one year, what coupon rate will be demanded by the bondholders for the bonds to sell at par? Assume that the bonds will be called if interest rates fall and that the call premium is equal to the annual coupon. (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g. 32.16.) c. What will be the value of the call provision to the company? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Book Print Heterancas a. Market value b. Coupon rate C. Value of the call provision

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts