Question: Chapter 15 Capital Structure Decisions 647 TEST PROBLEM S Solutions Shown in Appendix A ST-1) The Rogers Company is currently in this situation: (1) EBIT

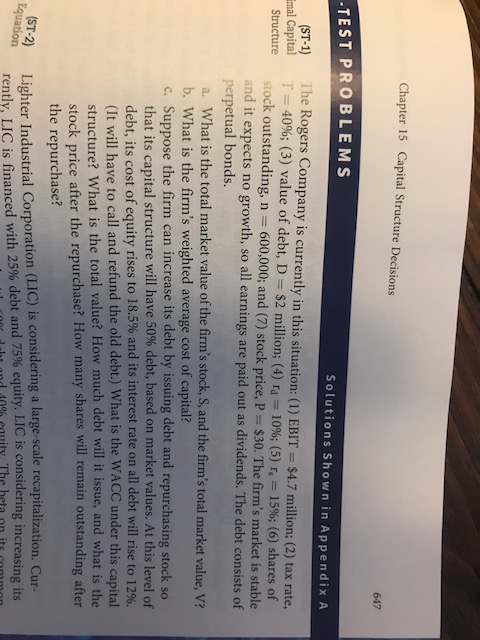

Chapter 15 Capital Structure Decisions 647 TEST PROBLEM S Solutions Shown in Appendix A ST-1) The Rogers Company is currently in this situation: (1) EBIT $4.7 million; (2) tax rate, nal Capital r-4096 (3) value of debt, D . S2 million; (4) rd 10%; (5) rs 15%; (6) shares of Structure stock outstanding, n 600,000; and (7) stock price, P s30. The firm's market is stable and it expects no growth, so all earnings are paid out as dividends. The debt consists of perpetual bonds. What is the total market value of the firm's stock, S, and the firm's total market value, v? a. b. What is the firm's weighted average cost of capital? c. Suppose the firm can increase its debt by issuing debt and repurchasing stock so that its capital structure will have 50% debt, based on market values. At this level of debt, its cost of equity rises to 18.5% and its interest rate on all debt will rise to 12%. (It will have to call and refund the old debt.) What is the WACC under this capital structure? What is the total value? How much debt will it issue, and what is the stock price after the repurchase? How many shares will remain outstanding after the repurchase? USra Lighter Industrial Corporation (LIC) is considering a large scale recapitalization (ST LIC is considering increasing its rently, LIC is financed with 25% debt and 75% equity. ltt and 4006 equity The Chapter 15 Capital Structure Decisions 647 TEST PROBLEM S Solutions Shown in Appendix A ST-1) The Rogers Company is currently in this situation: (1) EBIT $4.7 million; (2) tax rate, nal Capital r-4096 (3) value of debt, D . S2 million; (4) rd 10%; (5) rs 15%; (6) shares of Structure stock outstanding, n 600,000; and (7) stock price, P s30. The firm's market is stable and it expects no growth, so all earnings are paid out as dividends. The debt consists of perpetual bonds. What is the total market value of the firm's stock, S, and the firm's total market value, v? a. b. What is the firm's weighted average cost of capital? c. Suppose the firm can increase its debt by issuing debt and repurchasing stock so that its capital structure will have 50% debt, based on market values. At this level of debt, its cost of equity rises to 18.5% and its interest rate on all debt will rise to 12%. (It will have to call and refund the old debt.) What is the WACC under this capital structure? What is the total value? How much debt will it issue, and what is the stock price after the repurchase? How many shares will remain outstanding after the repurchase? USra Lighter Industrial Corporation (LIC) is considering a large scale recapitalization (ST LIC is considering increasing its rently, LIC is financed with 25% debt and 75% equity. ltt and 4006 equity The

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts