Question: Chapter 15 - Risk Mitigation Lab12 - Quantitative Risk Assessment - Part 1 - Smartphone insurance Scenario Supercar Corporation issues smartphones to some employees. The

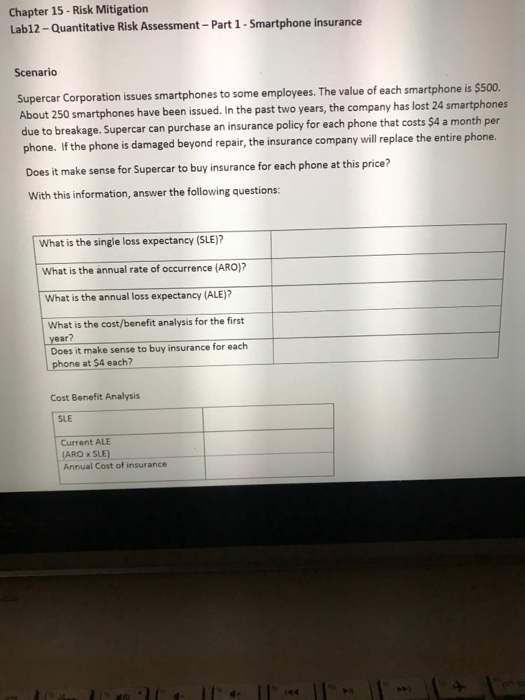

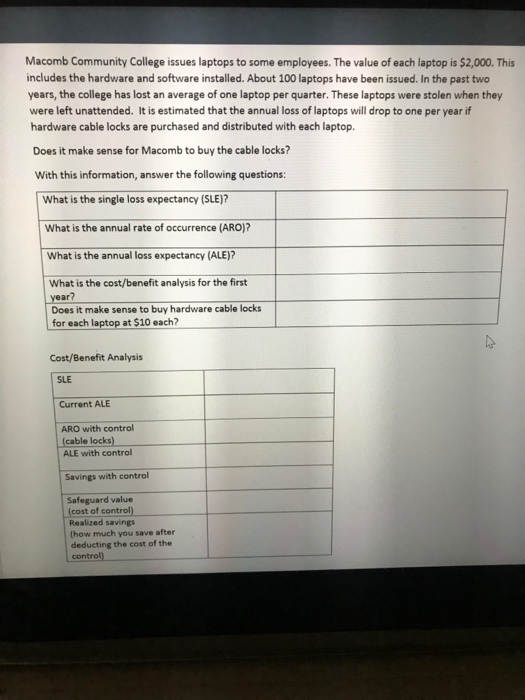

Chapter 15 - Risk Mitigation Lab12 - Quantitative Risk Assessment - Part 1 - Smartphone insurance Scenario Supercar Corporation issues smartphones to some employees. The value of each smartphone is $500. About 250 smartphones have been issued. In the past two years, the company has lost 24 smartphones due to breakage. Supercar can purchase an insurance policy for each phone that costs $4 a month per phone. If the phone is damaged beyond repair, the insurance company will replace the entire phone. Does it make sense for Supercar to buy insurance for each phone at this price? With this information, answer the following questions: What is the single loss expectancy (SLE)? What is the annual rate of occurrence (ARO)? What is the annual loss expectancy (ALE)? What is the cost/benefit analysis for the first year? Does it make sense to buy insurance for each phone at $4 each? Cost Benefit Analysis SLE Current ALE (ARO X SLE) Annual Cost of insurance LITT Macomb Community College issues laptops to some employees. The value of each laptop is $2,000. This includes the hardware and software installed. About 100 laptops have been issued. In the past two years, the college has lost an average of one laptop per quarter. These laptops were stolen when they were left unattended. It is estimated that the annual loss of laptops will drop to one per year if hardware cable locks are purchased and distributed with each laptop Does it make sense for Macomb to buy the cable locks? With this information, answer the following questions: What is the single loss expectancy (SLE)? What is the annual rate of occurrence (ARO)? What is the annual loss expectancy (ALE)? What is the cost/benefit analysis for the first year? Does it make sense to buy hardware cable locks for each laptop at $10 each? Cost/Benefit Analysis SLE Current ALE ARO with control (cable locks) ALE with control Savings with control Safeguard value (cost of control) Realized savings (how much you save after deducting the cost of the control)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts