Question: CHAPTER 15 WORKING-CAPITAL MANAGEMENT END-OF-CHAPTER STUDY PROBLEMS (PART 2/2) 15-4. Note: For ease of computation, a 360-day year is used for the interest rate calculations

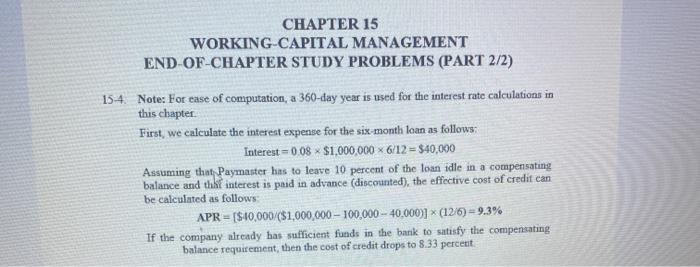

CHAPTER 15 WORKING-CAPITAL MANAGEMENT END-OF-CHAPTER STUDY PROBLEMS (PART 2/2) 15-4. Note: For ease of computation, a 360-day year is used for the interest rate calculations in this chapter First, we calculate the interest expense for the six-month loan as follows: Interest=008 * $1,000,000 * 6/12 = $40,000 Assuming that Paymaster has to leave 10 percent of the loan idle in a compensating balance and that interest is paid in advance (discounted), the effective cost of credit can be calculated as follows: APR = [$40,000/($1,000,000 - 100.000 - 40,000)] * (126) = 9.3% If the company already has sufficient funds in the bank to satisfy the compensating balance requirement, then the cost of credit drops to 8.33 percent CHAPTER 15 WORKING-CAPITAL MANAGEMENT END-OF-CHAPTER STUDY PROBLEMS (PART 2/2) 15-4. Note: For ease of computation, a 360-day year is used for the interest rate calculations in this chapter First, we calculate the interest expense for the six-month loan as follows: Interest=008 * $1,000,000 * 6/12 = $40,000 Assuming that Paymaster has to leave 10 percent of the loan idle in a compensating balance and that interest is paid in advance (discounted), the effective cost of credit can be calculated as follows: APR = [$40,000/($1,000,000 - 100.000 - 40,000)] * (126) = 9.3% If the company already has sufficient funds in the bank to satisfy the compensating balance requirement, then the cost of credit drops to 8.33 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts