Question: Chapter 16 Assignment O Sed Help Save & Exit Submit Press F11 Lexit full screen Check my work 4 15 Shannon Polymers uses straight-line depreciation

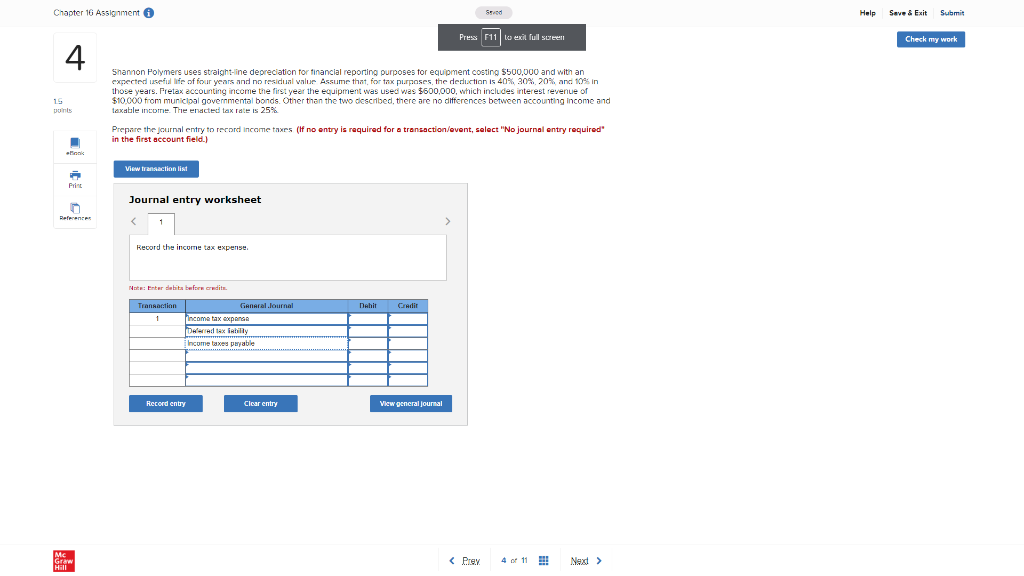

Chapter 16 Assignment O Sed Help Save & Exit Submit Press F11 Lexit full screen Check my work 4 15 Shannon Polymers uses straight-line depreciation for financial reporting purposes for equipment costing $500,000 and with an expected serial life of four years and no residual value Assume that for tax purposes the deduction is 40% 30% 20% and 10% in those years. Fretax accounting income the first year the equipment was used was $600,000, which includes interest revenue of $10.000 from municipal governmental bonds. Other than the two described, there are no differences between accounting income and taxable income. The enacted tax rate is 25% Prepare the journal entry to record income taxes (If no entry is required for a transaction/event, select "No journal entry required in the first account field.) ini View transaction list . Print Journal entry worksheet References 1 > Record the income tax expense Note: Enter diabits before credits Transaction Dahit Credit 1 General.lournal Income tax expand Derdlex lily Income taxes payable Record entry Clear entry View general Journal Mc Graw Hill

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts