Question: (CHAPTER 16) (For this problem, assume that all Miller-Modigliani assumptions hold.) Apples & Oranges is currently an all-equity firm. Its management expects its Earnings

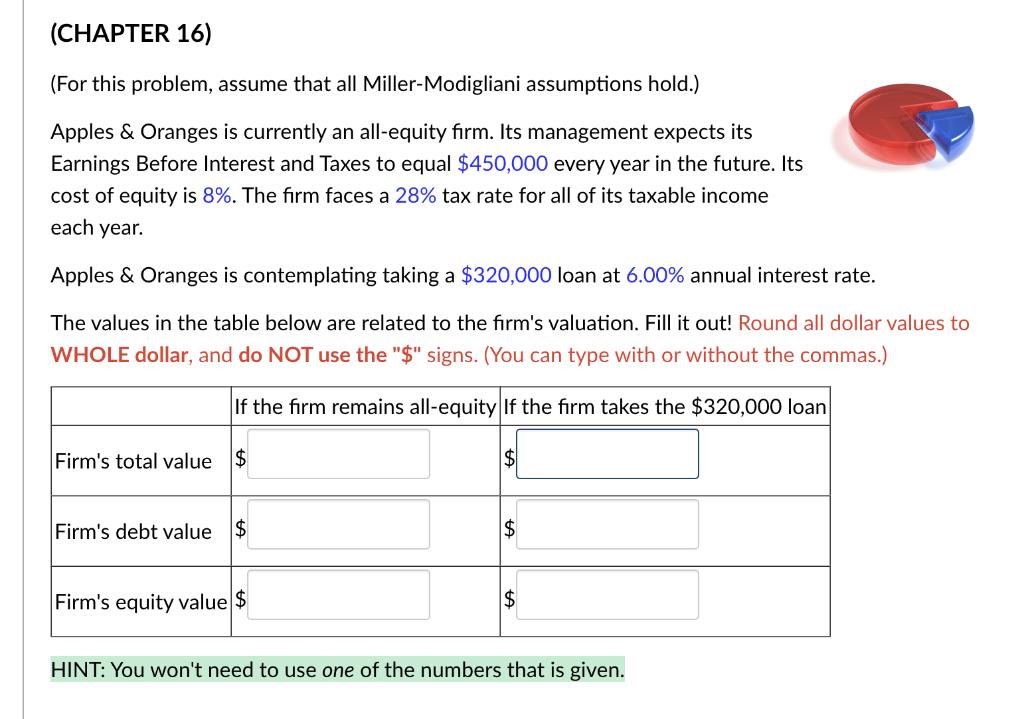

(CHAPTER 16) (For this problem, assume that all Miller-Modigliani assumptions hold.) Apples & Oranges is currently an all-equity firm. Its management expects its Earnings Before Interest and Taxes to equal $450,000 every year in the future. Its cost of equity is 8%. The firm faces a 28% tax rate for all of its taxable income each year. Apples & Oranges is contemplating taking a $320,000 loan at 6.00% annual interest rate. The values in the table below are related to the firm's valuation. Fill it out! Round all dollar values to WHOLE dollar, and do NOT use the "$" signs. (You can type with or without the commas.) If the firm remains all-equity If the firm takes the $320,000 loan Firm's total value $ Firm's debt value $ Firm's equity value $ $ $ $ HINT: You won't need to use one of the numbers that is given.

Step by Step Solution

3.39 Rating (161 Votes )

There are 3 Steps involved in it

Solution Value of Unlearesied Firm Value EBIT 1Ton Equity Fiams debt value ... View full answer

Get step-by-step solutions from verified subject matter experts