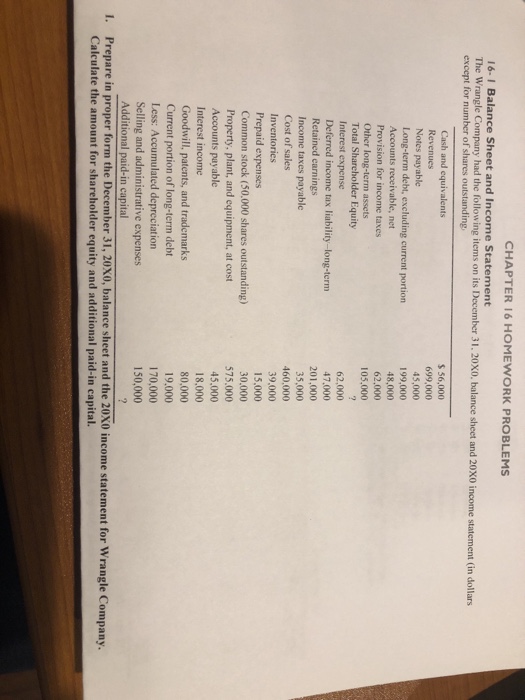

Question: CHAPTER 16 HOMEWORK PROBLEMS 16-1 Balance Sheet and Income Statement The Wrangle Company had the following items on its December 31. 20X0, balance sheet and

CHAPTER 16 HOMEWORK PROBLEMS 16-1 Balance Sheet and Income Statement The Wrangle Company had the following items on its December 31. 20X0, balance sheet and 20X0 income statement (in dollars except for number of shares outstanding Cash and equivalents $ 56,000 699,000 45,000 199,000 18,000 62.000 105,000 Revenues Notes payable Long-term debt, excluding current portion Accounts receivable, net Provision for income taxes Other long-term assets Total Sharcholder Equity 62,000 47.000 201,000 35.000 Interest expense Deferred income tax liability-long-term Retained earnings Income taxes payable Cost of sales Inventories Prepaid expenses Common stock (50,000 shares outstanding) Property, plant, and equipment, at cost Accounts payable Interest income Goodwill, patents, and trademarks Current portion of long-term debt 39,000 15,000 575,000 15,000 18,000 80,000 19.000 170,000 Less: Accumulated depreciation Selling and administrative expenses Additional paid-in capital 150,000 1. Prepare in proper form the December 31, 20X0, balance sheet and the 20X0 income statement for Wrangle Company. Calculate the amount for shareholder equity and additional paid-in capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts