Question: Chapter 16 Homework Saved Help Save & Exit Submit Check my work 4 10 points Assume that on January 1, year 1, ABC Inc. issued

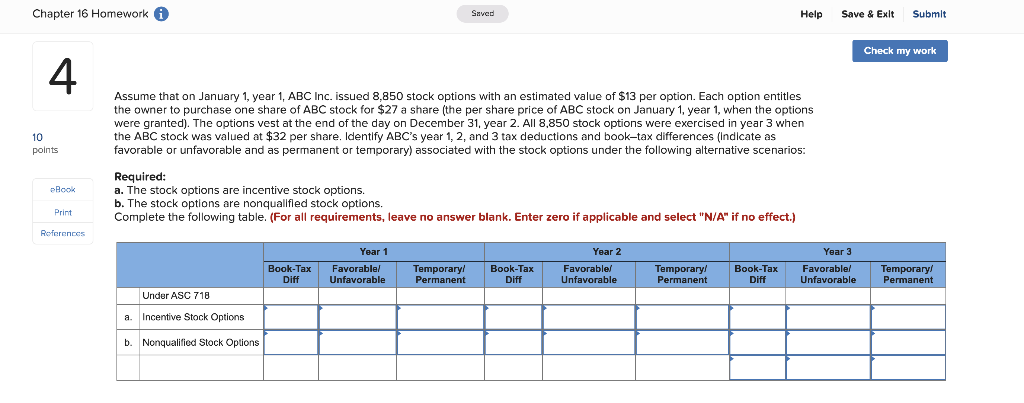

Chapter 16 Homework Saved Help Save & Exit Submit Check my work 4 10 points Assume that on January 1, year 1, ABC Inc. issued 8,850 stock options with an estimated value of $13 per option. Each option entitles the owner to purchase one share of ABC stock for $27 a share (the per share price of ABC stock on January 1, year 1, when the options were granted). The options vest at the end of the day on December 31, year 2. All 8,850 stock options were exercised in year 3 when the ABC stock was valued at $32 per share. Identify ABC's year 1, 2, and 3 tax deductions and book-tax differences (Indicate as favorable or unfavorable and as permanent or temporary) associated with the stock options under the following alternative scenarios: Required: a. The stock options are incentive stock options. b. The stock options are nonqualified stock options. Complete the following table. (For all requirements, leave no answer blank. Enter zero if applicable and select "N/A" if no effect.) eBook Print References Book-Tax Diff Year 1 Favorable! Unfavorable Temporary! Permanent Book-Tax Diff Year 2 Favorable/ Unfavorable Temporary Permanent Book-Tax Diff Year 3 Favorable! Unfavorable Temporary Permanent Under ASC 718 a. Incentive Stock Options b. Nonqualified Stock Options

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts