Question: CHAPTER 16 Learning Objective 2 S-F:16-9 Computing the change in cash; identifying non-cash transactions Jennifer's Wedding Shops earned net income of $27,000, which included

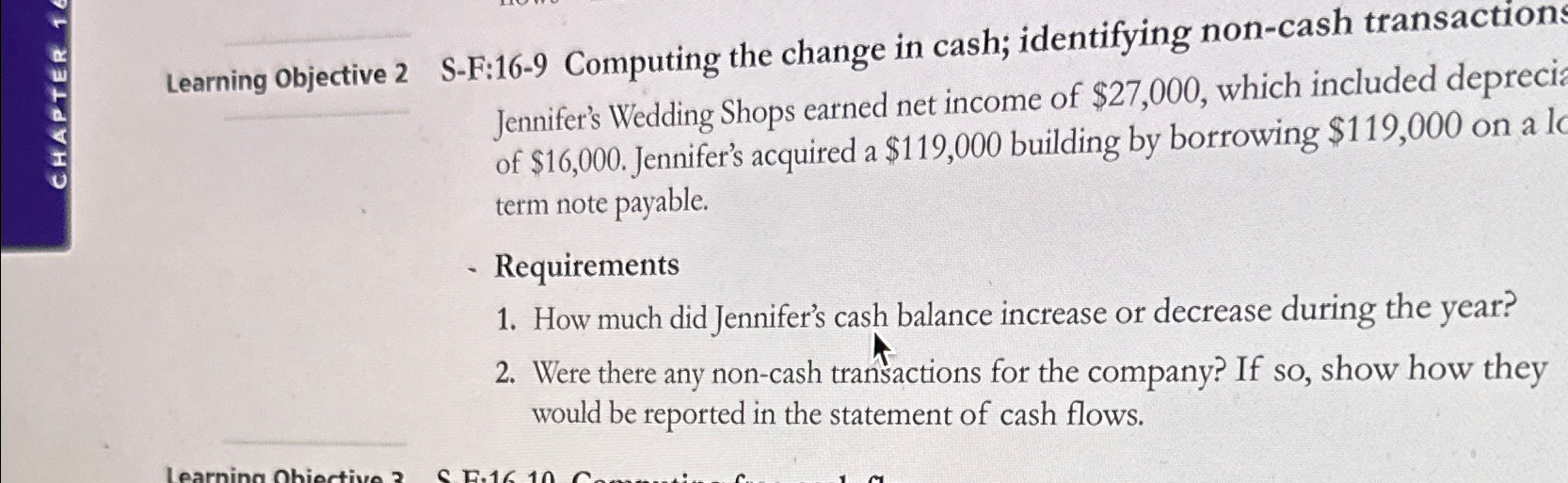

CHAPTER 16 Learning Objective 2 S-F:16-9 Computing the change in cash; identifying non-cash transactions Jennifer's Wedding Shops earned net income of $27,000, which included deprecia of $16,000. Jennifer's acquired a $119,000 building by borrowing $119,000 on a lo term note payable. Requirements 1. How much did Jennifer's cash balance increase or decrease during the year? 2. Were there any non-cash transactions for the company? If so, show how they would be reported in the statement of cash flows. Learning Obiective 3 SF.16.10 Com

Step by Step Solution

There are 3 Steps involved in it

Answer 1 To determine how Jennifers cash balance changed during the year we need to consider the net ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

663d6123411b1_967569.pdf

180 KBs PDF File

663d6123411b1_967569.docx

120 KBs Word File