Question: Chapter 16 Problem 2 A) Assess B) Identify C) Analyze D) Advise dwill which will also be sold. You have been asked to determine the

Chapter 16 Problem 2

A) Assess

B) Identify

C) Analyze

D) Advise

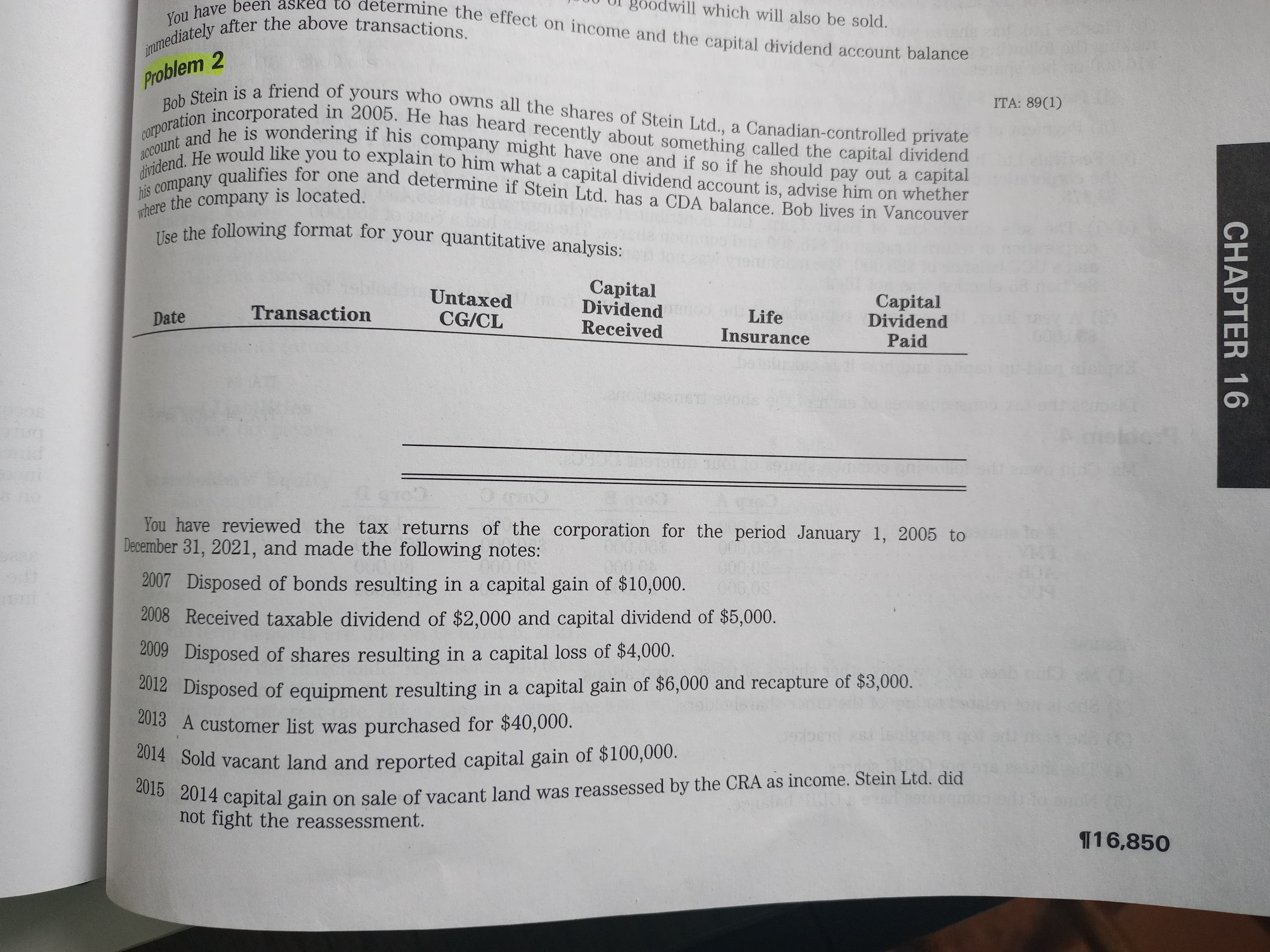

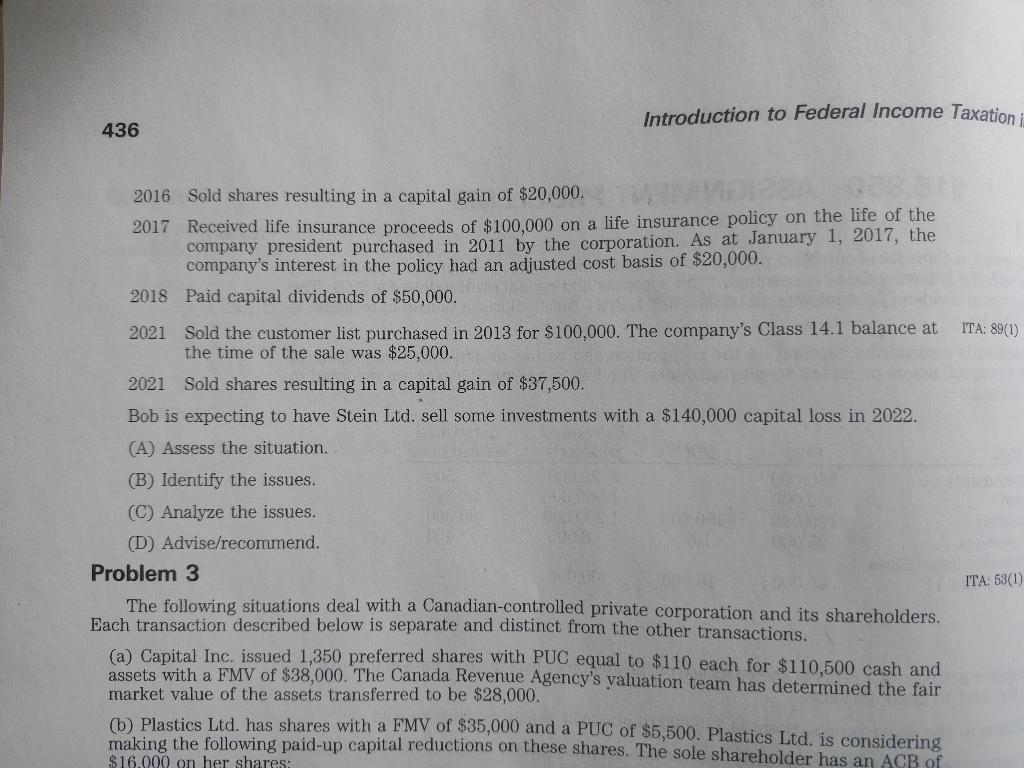

dwill which will also be sold. You have been asked to determine the effect on income and the capital dividend account balance immediately after the above transactions. Problem 2 ITA: 89(1) corporation incorporated in 2005. He has heard recently about something called the capital dividend Bob Stein is a friend of yours who owns all the shares of Stein Ltd., a Canadian-controlled private dividend. He would like you to explain to him what a capital dividend account is, advise him on whether account and he is wondering if his company might have one and if so if he should pay out a capital his company qualifies for one and determine if Stein Ltd. has a CDA balance. Bob lives in Vancouver where the company is located. Use the following format for your quantitative analysis: Untaxed CG/CL Transaction Capital Dividend Received Date Life Insurance Capital Dividend Paid CHAPTER 16 You have reviewed the tax returns of the corporation for the period January 1, 2005 to December 31, 2021, and made the following notes: 2007 Disposed of bonds resulting in a capital gain of $10,000. 2008 Received taxable dividend of $2,000 and capital dividend of $5,000. 2009 Disposed of shares resulting in a capital loss of $4,000. 2012 Disposed of equipment resulting in a capital gain of $6,000 and recapture of $3,000. 2013 A customer list was purchased for $40,000. 2014 Sold vacant land and reported capital gain of $100,000. 2015 2014 capital gain on sale of vacant land was reassessed by the CRA as income. Stein Ltd, did not fight the reassessment. 116,850 Introduction to Federal Income Taxation i 436 ITA: 89(1) 2016 Sold shares resulting in a capital gain of $20,000. 2017 Received life insurance proceeds of $100,000 on a life insurance policy on the life of the company president purchased in 2011 by the corporation. As at January 1, 2017, the company's interest in the policy had an adjusted cost basis of $20,000. 2018 Paid capital dividends of $50,000. 2021 Sold the customer list purchased in 2013 for $100,000. The company's Class 14.1 balance at the time of the sale was $25,000. 2021 Sold shares resulting in a capital gain of $37,500. Bob is expecting to have Stein Ltd. sell some investments with a $140,000 capital loss in 2022. (A) Assess the situation. (B) Identify the issues. (C) Analyze the issues. (D) Advise/recommend. Problem 3 ITA: 53(1) The following situations deal with a Canadian-controlled private corporation and its shareholders. Each transaction described below is separate and distinct from the other transactions. (a) Capital Inc. issued 1,350 preferred shares with PUC equal to $110 each for $110,500 cash and assets with a FMV of $38,000. The Canada Revenue Agency's valuation team has determined the fair market value of the assets transferred to be $28,000. (6) Plastics Ltd. has shares with a FMV of $35,000 and a PUC of $5,500. Plastics Ltd. is considering making the following paid-up capital reductions on these shares. The sole shareholder has an ACB of $16.000 on her shares

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts