Question: Chapter 16, Problem 3, page 529 Bond yields (LO16-2) Harold Reese must choose between two bonds: Bond X pays $95 annual interest and has a

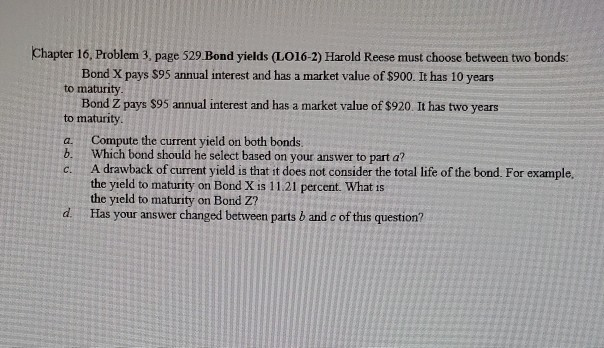

Chapter 16, Problem 3, page 529 Bond yields (LO16-2) Harold Reese must choose between two bonds: Bond X pays $95 annual interest and has a market value of $900. It has 10 years to maturity. Bond Z pays $95 annual interest and has a market value of $920 It has two years to maturity. Compute the current yield on both bonds. b. Which bond should he select based on your answer to part a? A drawback of current yield is that it does not consider the total life of the bond. For example, the yield to maturity on Bond X is 11.21 percent. What is the yield to maturity on Bond Z? d. Has your answer changed between parts b and of this question? a. C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts