Question: Chapter 16 Problem 7 Problem 7 ITA 54, 8(2, 840) 54.1), 8015 Ms. Bast owns all the common shares of Ballerup Lad., a Canadian controlled

Chapter 16 Problem 7

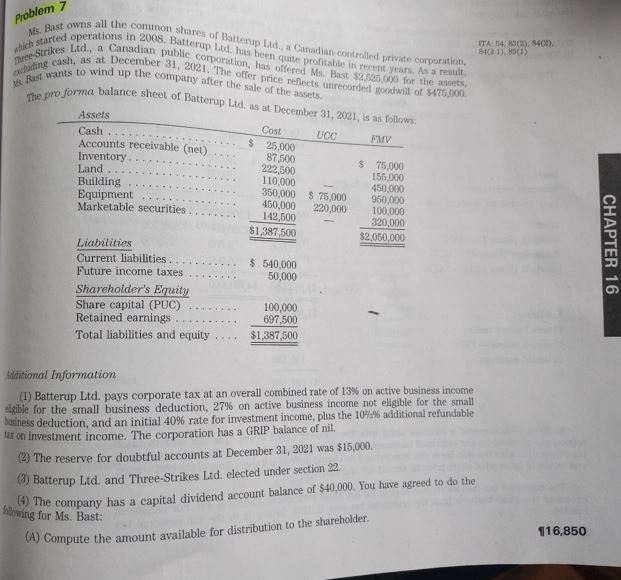

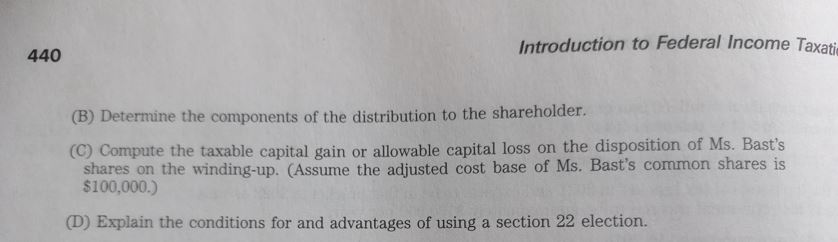

Problem 7 ITA 54, 8(2, 840) 54.1), 8015 Ms. Bast owns all the common shares of Ballerup Lad., a Canadian controlled private corporation, which started operations in 2008. Batterup udlvas been quite profitable recent years. As a result, excluding cash, as at December 31, 2021. The offer price reflects unrecorded goodwill of $475.000 Three Strikes Ltd., a Canadian publie corporation, has offered Ms. Bast $2.125.000 for the sets, Rast wants to wind up the company after the sale of the assets The pro forma balance sheet of Batterup Ud as at December 31, 2021, is as follows: Assets Cost UCC Cash. IMV $ 25,000 Accounts receivable (net) 87,500 Inventory $ 75,000 222,500 Land 156,000 110,000 Building 450,000 350,000 $ 75,000 960,000 Equipment 450,000 220,000 100,000 Marketable securities 142,500 320,000 $1,387,500 $2,050,000 Liabilities Current liabilities $ 540,000 Future income taxes 50,000 Shareholder's Equity Share capital (PUC) 100,000 Retained earnings 697,500 Total liabilities and equity $1,387,500 CHAPTER 16 Additional Information (1) Batterup Ltd. pays corporate tax at an overall combined rate of 13% on active business income sigible for the small business deduction, 27% on active business income not eligible for the small business deduction, and an initial 40% rate for investment income, plus the 10% additional refundable lar on investment income. The corporation has a GRIP balance of nil. (2) The reserve for doubtful accounts at December 31, 2021 was $15,000. (3) Batterup Ltd. and Three-Strikes Lad. elected under section 22. The company has a capital dividend account balance of $40,000. You have agreed to do the Swing for Ms. Bast: 116,850 (A) Compute the amount available for distribution to the shareholder Introduction to Federal Income Taxati 440 (B) Determine the components of the distribution to the shareholder. (C) Compute the taxable capital gain or allowable capital loss on the disposition of Ms. Bast's shares on the winding-up. (Assume the adjusted cost base of Ms. Bast's common shares is $100,000.) (1) Explain the conditions for and advantages of using a section 22 election. Problem 7 ITA 54, 8(2, 840) 54.1), 8015 Ms. Bast owns all the common shares of Ballerup Lad., a Canadian controlled private corporation, which started operations in 2008. Batterup udlvas been quite profitable recent years. As a result, excluding cash, as at December 31, 2021. The offer price reflects unrecorded goodwill of $475.000 Three Strikes Ltd., a Canadian publie corporation, has offered Ms. Bast $2.125.000 for the sets, Rast wants to wind up the company after the sale of the assets The pro forma balance sheet of Batterup Ud as at December 31, 2021, is as follows: Assets Cost UCC Cash. IMV $ 25,000 Accounts receivable (net) 87,500 Inventory $ 75,000 222,500 Land 156,000 110,000 Building 450,000 350,000 $ 75,000 960,000 Equipment 450,000 220,000 100,000 Marketable securities 142,500 320,000 $1,387,500 $2,050,000 Liabilities Current liabilities $ 540,000 Future income taxes 50,000 Shareholder's Equity Share capital (PUC) 100,000 Retained earnings 697,500 Total liabilities and equity $1,387,500 CHAPTER 16 Additional Information (1) Batterup Ltd. pays corporate tax at an overall combined rate of 13% on active business income sigible for the small business deduction, 27% on active business income not eligible for the small business deduction, and an initial 40% rate for investment income, plus the 10% additional refundable lar on investment income. The corporation has a GRIP balance of nil. (2) The reserve for doubtful accounts at December 31, 2021 was $15,000. (3) Batterup Ltd. and Three-Strikes Lad. elected under section 22. The company has a capital dividend account balance of $40,000. You have agreed to do the Swing for Ms. Bast: 116,850 (A) Compute the amount available for distribution to the shareholder Introduction to Federal Income Taxati 440 (B) Determine the components of the distribution to the shareholder. (C) Compute the taxable capital gain or allowable capital loss on the disposition of Ms. Bast's shares on the winding-up. (Assume the adjusted cost base of Ms. Bast's common shares is $100,000.) (1) Explain the conditions for and advantages of using a section 22 election

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts