Question: Chapter 16 - Review Problems (Grad... i Saved Help Save & Exit Submit Check my work Problem 16-15 MM and Taxes 20 points Cede &

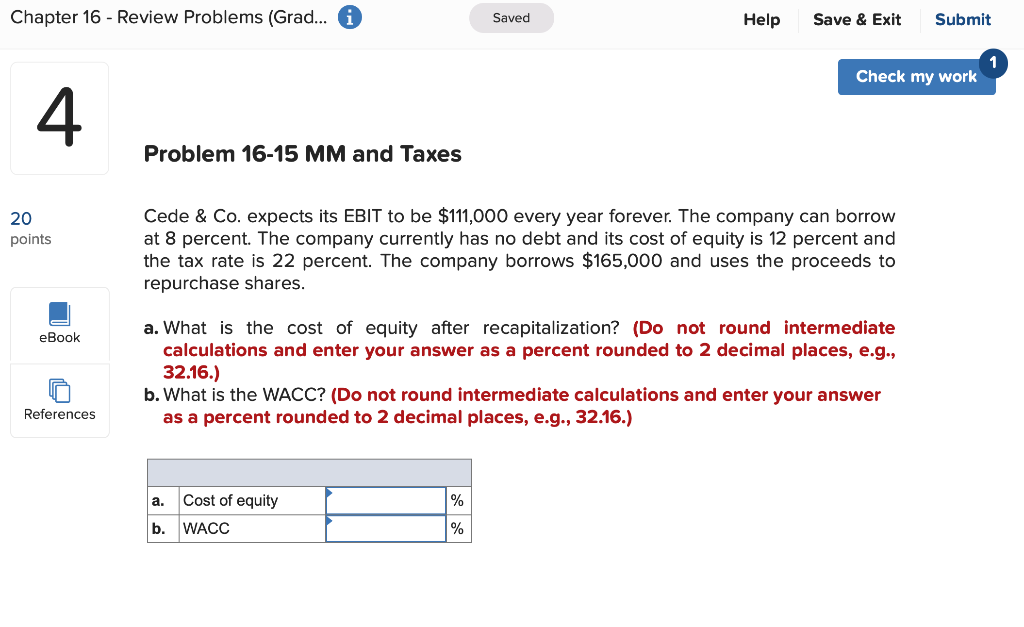

Chapter 16 - Review Problems (Grad... i Saved Help Save & Exit Submit Check my work Problem 16-15 MM and Taxes 20 points Cede & Co. expects its EBIT to be $111,000 every year forever. The company can borrow at 8 percent. The company currently has no debt and its cost of equity is 12 percent and the tax rate is 22 percent. The company borrows $165,000 and uses the proceeds to repurchase shares eBook a. What is the cost of equity after recapitalization? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the WACC? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) References a. Cost of equity b. WACC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts