Question: Chapter 16: Statement of Cash Flows Using the most recent annual report of the corporation that youve been researching, examine the Statement of Cash Flows

Chapter 16: Statement of Cash Flows

Using the most recent annual report of the corporation that youve been researching, examine the Statement of Cash Flows and accompanying notes of your company. Answer the following questions:

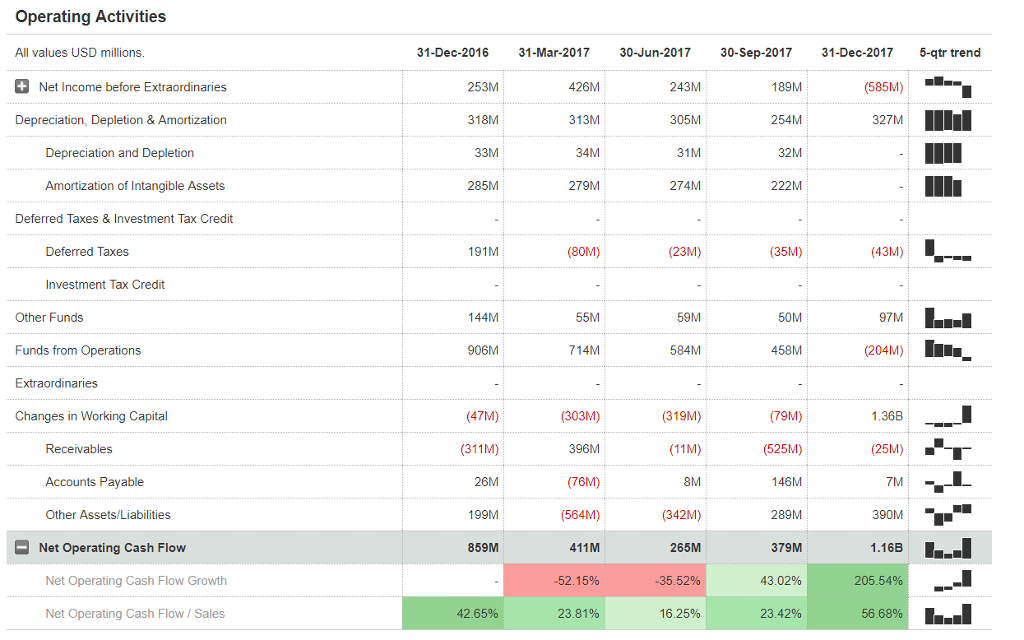

1. Does the company use the direct or indirect method for computing cash flows from operating activities? What effect does depreciation have on cash flows? Have receivables, inventories, and payables had positive or negative effects on cash flows from operating activities?

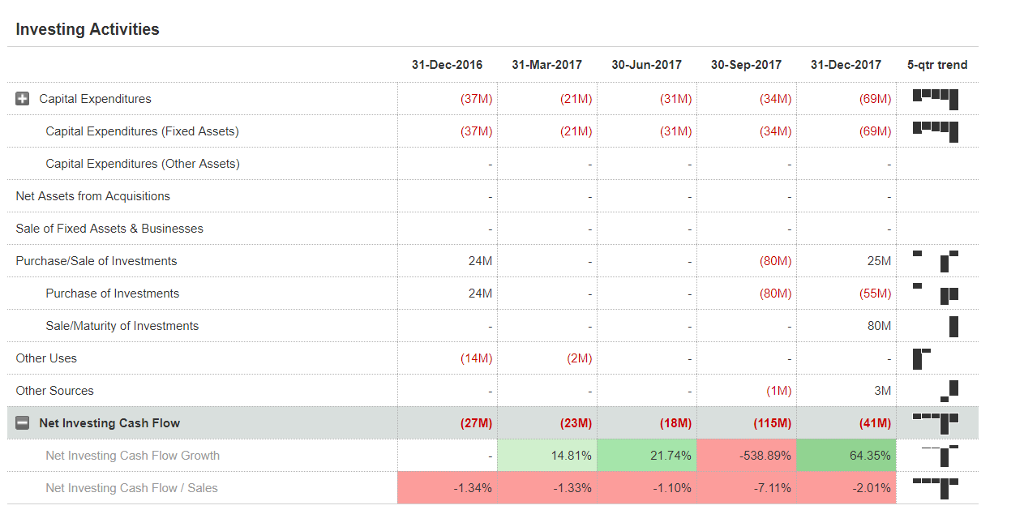

2. What are the most important investing activities for the company in the most recent year?

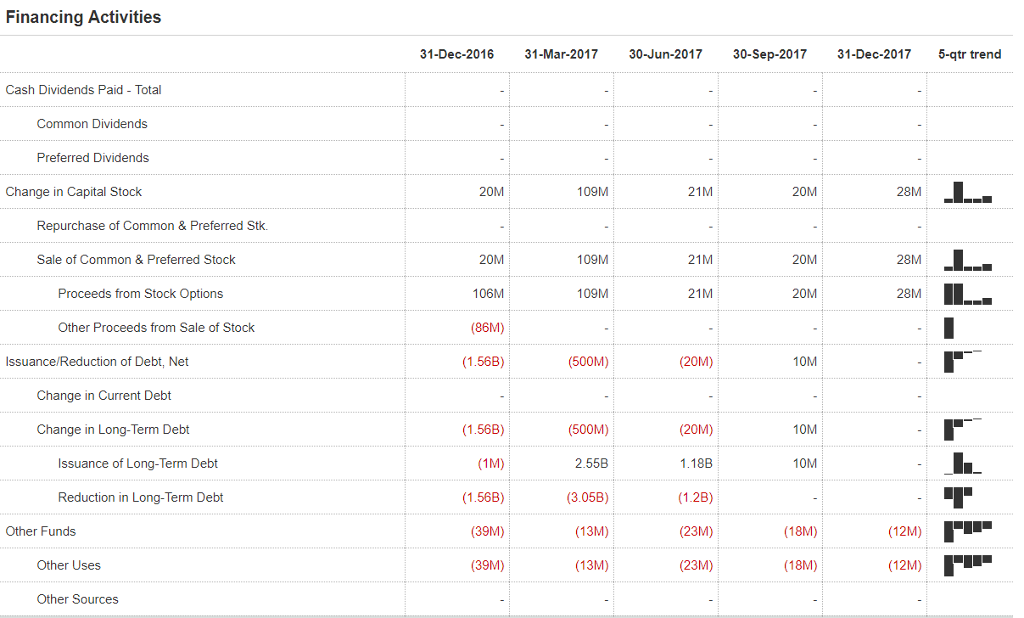

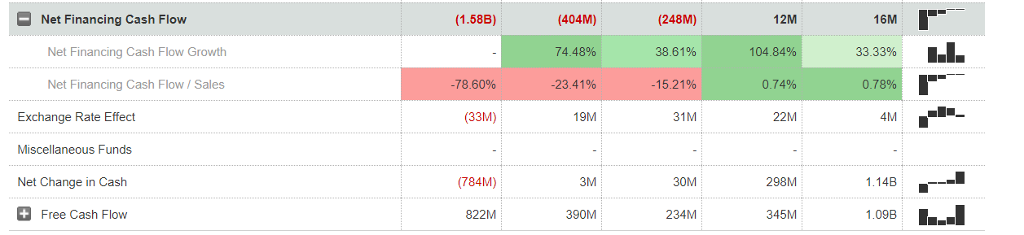

3. What are the most important financing activities for the company in the most recent year?

Please answer all the parts.

Operating Activities All values USD millions. 31-Dec-2016 31-Mar-2017 30-Jun-2017 30-Sep-2017 31-Dec-2017 5-qtr trend m@-- 253M 318M 33M 285M 426M 313M 34M 279M 243M 305M 31M 274M 189M 254M 32M 222M Net Income before Extraordinaries (585M) Depreciation, Depletion & Amortization 327M Depreciation and Depletion Amortization of Intangible Assets Deferred Taxes & Investment Tax Credit Deferred Taxes 191M (80M) (23M) (35M) (43M) Investment Tax Credit 144M 55M 50M 97M Other Funds Funds from Operations Extraordinaries Changes in Working Capital 59M 906M 714M 584M 458M (47M) (311M) 26M 199M (303M) 396M (76M) (564M) 411M (319M) (11M) 8M (342M) 265M -35.52% (79M) (525M) 146M 289M 379M 43.02% 1.36B (25M) Receivables Accounts Payable Other Assets/Liabilities Net Operating Cash Flow 859M 1.16B Net Operating Cash Flow Growth -52.1 5% 205.54% Net Operating Cash Flow/Sales 42.65% 23.81% 16.25% 23.42% 56.68%L

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts