Question: CHAPTER 17 Analyzing Financial Statements Problem 17-2B Calculating ratios and percentages LO2, 3, 4 eXcel The condensed statements of Organic Grocery Corporation follow. Organic Grocery

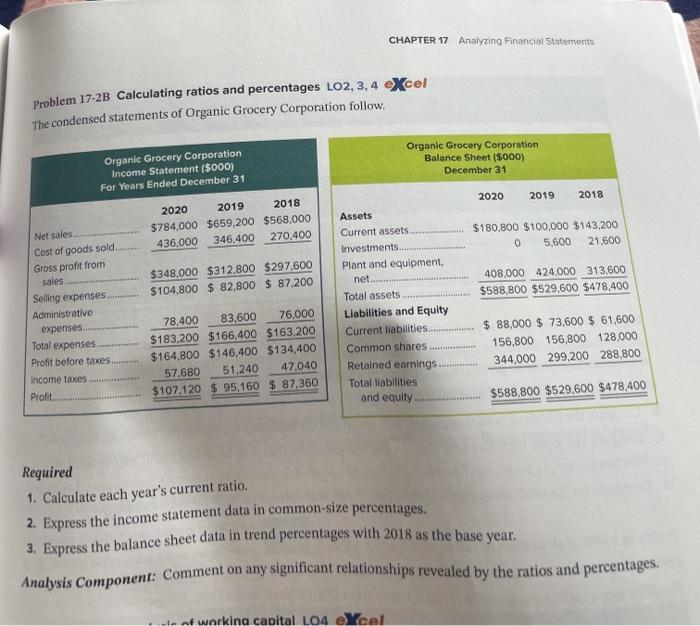

CHAPTER 17 Analyzing Financial Statements Problem 17-2B Calculating ratios and percentages LO2, 3, 4 eXcel The condensed statements of Organic Grocery Corporation follow. Organic Grocery Corporation Income Statement ($000) For Years Ended December 31 Organic Grocery Corporation Balance Sheet($000) December 31 2020 2019 2018 $784,000 $659,200 $568,000 436,000 346,400 270,400 $348,000 $312.800 $297.600 $104,800 $ 82,800 $ 87,200 Net sales Cost of goods sold Gross profit from sales Selling expenses.......... Administrative expenses... Total expenses Profit before taxes Income taxes.... 2020 2019 2018 Assets Current assets $180,800 $100,000 $143,200 Investments 0 5,600 21.600 Plant and equipment, net... 408,000 424 000 313.600 Total assets $588,800 $529,600 $478.400 Liabilities and Equity Current liabilities......... $ 88,000 $ 73,600 $ 61,600 Common shares 156,800 156,800 128.000 Retained earnings........ 344,000 299,200 288.800 Total liabilities and equity $588,800 $529,600 $478.400 78.400 83,600 76,000 $183,200 $166,400 $163.200 $164,800 $146,400 $134,400 57 680 51,240 47.040 $107.120 $ 95,160 $ 87,360 Profit Required 1. Calculate each year's current ratio. 2. Express the income statement data in common-size percentages. 3. Express the balance sheet data in trend percentages with 2018 as the base year. Analysis Component: Comment on any significant relationships revealed by the ratios and percentages. te of working capital LO4 eXce

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts