Question: Chapter 17 - Dropbox 4.4 Problem 3: Share Repurchase In the previous problem (completed and attached), suppose Ferguson has announced it is instead going to

|

Chapter 17 - Dropbox 4.4 | |||||||||

| Problem 3: Share Repurchase | |||||||||

| In the previous problem (completed and attached), suppose Ferguson has announced it is instead going to repurchase $15,600 of stock. | |||||||||

| a) What effect will this have on the equity of the firm? How much will equity change? b) How many shares will remain outstanding after the purchase? c) What will the price be per share after the repurchase? d) Show how the repurchase is effectively the same as a cash dividend. | |||||||||

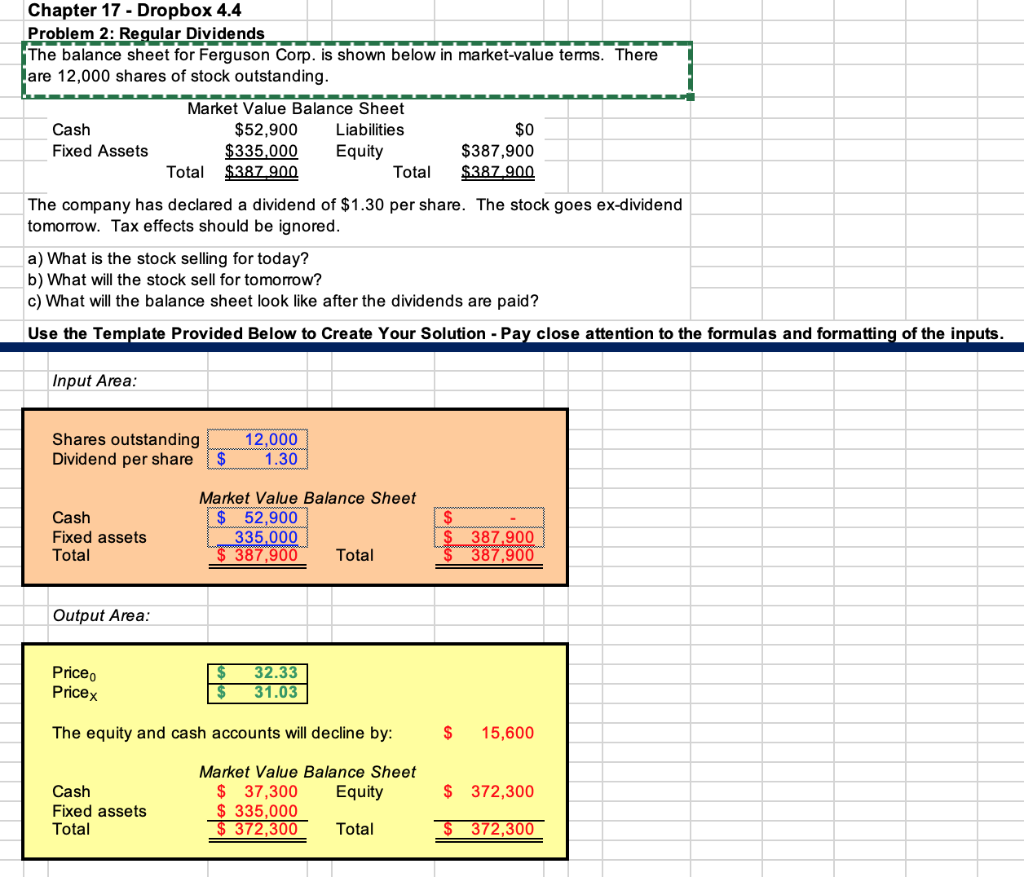

! Chapter 17 - Dropbox 4.4 Problem 2: Regular Dividends The balance sheet for Ferguson Corp. is shown below in market value terms. There Lare 12,000 shares of stock outstanding. Market Value Balance Sheet Cash $52,900 Liabilities $0 Fixed Assets $335,000 Equity $387,900 Total $387.900 Total $387.900 The company has declared a dividend of $1.30 per share. The stock goes ex-dividend tomorrow. Tax effects should be ignored. a) What is the stock selling for today? b) What will the stock sell for tomorrow? c) What will the balance sheet look like after the dividends are paid? Use the Template Provided Below to Create Your Solution - Pay close attention to the formulas and formatting of the inputs. Input Area: Shares outstanding Dividend per share 12,000 1.30 $ Cash Fixed assets Total Market Value Balance Sheet $ 52,900 335,000 $ 387,900 Total $ $ 387,900 387,900 Output Area: Price Pricex The equity and cash accounts will decline by: $ 15,600 Market Value Balance Sheet $ 37,300 Equity $ 335,000 $ 372,300 Total $ Cash Fixed assets Total 372,300 $ 372,300

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts