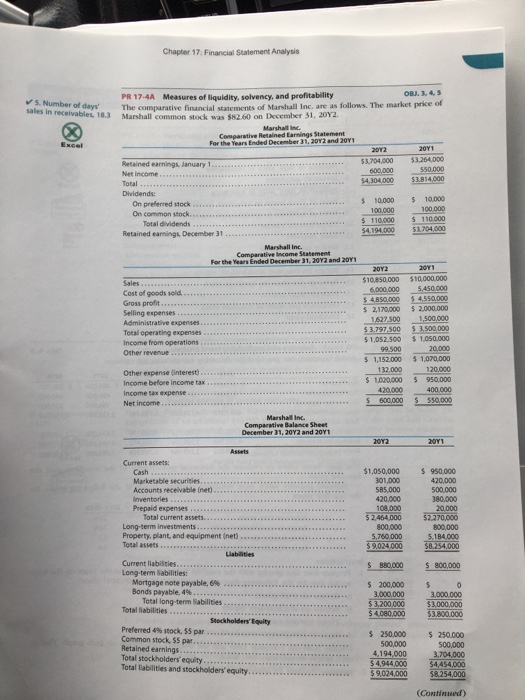

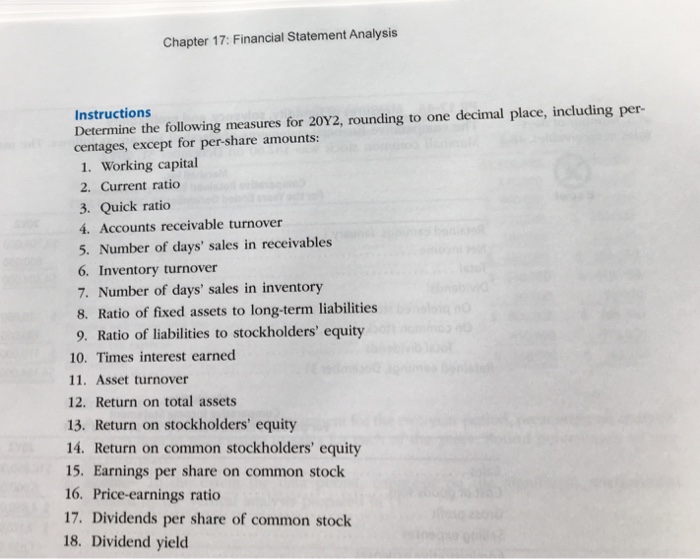

Question: Chapter 17: Financial Statement Analysis OBJ. 3, 4, PR 17-4A Measures of liquidity, solvency, and profitability The comparative financial statements of Marshall Inc. are as

Chapter 17: Financial Statement Analysis OBJ. 3, 4, PR 17-4A Measures of liquidity, solvency, and profitability The comparative financial statements of Marshall Inc. are as follows. The market price 5. Number of days' h receivables, 18.3 Marshall common stock was $82.60 on December 31, 20Y2 Marshall Ine Comparative Retained Earnings Statement the Years Ended December 31, 20Y2 and 20Y $3704,000 3264,000 54304,000 $3.814.000 10,000 10.000 110.000 110.000 Retained earnings, January 1 Total On preferred stock...e.. On common stock.. Total dividends 54,194,000 $3,704,000 Retained earnings, December 31. For the Years Ended December 31, 20Y2 and 201 10.850,000 $10,000.000 6.000.0005450.000 Selling expenses Administrative expenses Total operating expenses Income from operations 2,170000 $ 2000,000 16275001500,000 3.797.500 5 3500000 $ 1,052,500 $1,050,000 99.500 20,000 $ 1,152,000 % 1,070,000 182000 120.000 1020000 950,.000 Other expense (interest) Income before income tax E Income tax expens Net income S 600000 550.000 Marshall Inc. Comparative Balance Sheet December 31, 20Y2 and 20Y1 Current assets $1,050,000 950.000 01,000 585,000 Marketable securities 420,000 420,000 500000 380,000 Inventories Prepaid expenses 2.464,000 $270000 800,000 Total current assets. 800,000 Total assers $9,024.000 $8.254.000 Current liabilities Long-term Sabilities: S 880000 800,000 Mortgage note payable, 6% . . . . Bonds payable, 4% Total liabilities Preferred 4% stock, SS par Common stock, par 3,000,000 3,000.000 $3,200,000 000,000 4080,000$3.800,000 Total long-term liabilities 250,000 250000 500,000 3.704,000 4,944,000 4,44,000 .. Retained earnings Total stockholders equity 500,000 4,194,000 $9,024,000 8254 Continued) Chapter 17: Financial Statement Analysis OBJ. 3, 4, PR 17-4A Measures of liquidity, solvency, and profitability The comparative financial statements of Marshall Inc. are as follows. The market price 5. Number of days' h receivables, 18.3 Marshall common stock was $82.60 on December 31, 20Y2 Marshall Ine Comparative Retained Earnings Statement the Years Ended December 31, 20Y2 and 20Y $3704,000 3264,000 54304,000 $3.814.000 10,000 10.000 110.000 110.000 Retained earnings, January 1 Total On preferred stock...e.. On common stock.. Total dividends 54,194,000 $3,704,000 Retained earnings, December 31. For the Years Ended December 31, 20Y2 and 201 10.850,000 $10,000.000 6.000.0005450.000 Selling expenses Administrative expenses Total operating expenses Income from operations 2,170000 $ 2000,000 16275001500,000 3.797.500 5 3500000 $ 1,052,500 $1,050,000 99.500 20,000 $ 1,152,000 % 1,070,000 182000 120.000 1020000 950,.000 Other expense (interest) Income before income tax E Income tax expens Net income S 600000 550.000 Marshall Inc. Comparative Balance Sheet December 31, 20Y2 and 20Y1 Current assets $1,050,000 950.000 01,000 585,000 Marketable securities 420,000 420,000 500000 380,000 Inventories Prepaid expenses 2.464,000 $270000 800,000 Total current assets. 800,000 Total assers $9,024.000 $8.254.000 Current liabilities Long-term Sabilities: S 880000 800,000 Mortgage note payable, 6% . . . . Bonds payable, 4% Total liabilities Preferred 4% stock, SS par Common stock, par 3,000,000 3,000.000 $3,200,000 000,000 4080,000$3.800,000 Total long-term liabilities 250,000 250000 500,000 3.704,000 4,944,000 4,44,000 .. Retained earnings Total stockholders equity 500,000 4,194,000 $9,024,000 8254 Continued)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts