Question: Chapter 18 0 Saved Help Save & Exit Submit Check my work Calculate the intrinsic value of GE in each of the following scenarios by

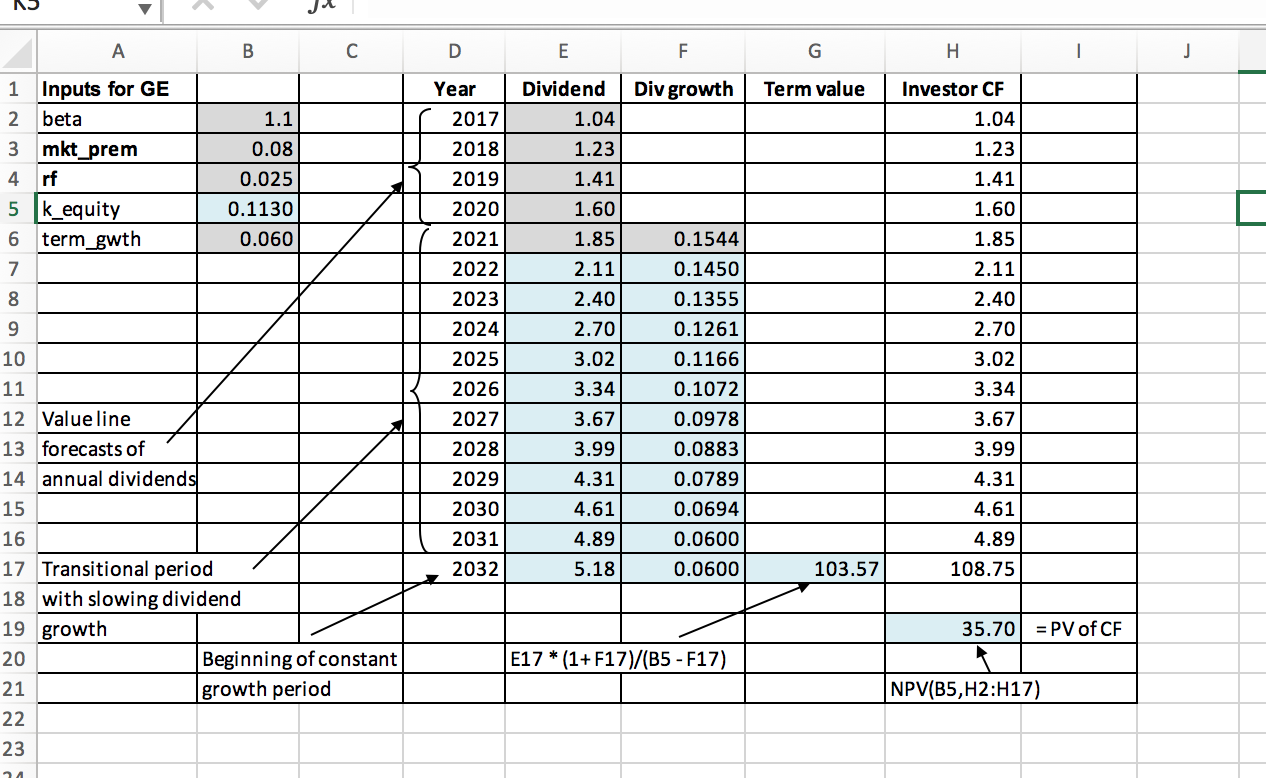

Chapter 18 0 Saved Help Save & Exit Submit Check my work Calculate the intrinsic value of GE in each of the following scenarios by using the three-stage growth model of Spreadsheet 18.1. Treat each scenario independently. a. The terminal growth rate will be 9.30%. (Round your answer to 2 decimal places.) points Intrinsic value eBook Print References b. GE's actual beta is 1.04. (Round your answer to 2 decimal places.) Intrinsic value c. The market risk premium is 9.40%. (Round your answer to 2 decimal places.) Intrinsic value NS H Div growth Term value 1 Inputs for GE 2 beta 3 mkt_prem 4 rf 5 k_equity 6 term_gwth 1.1 0.08 0.025 0.1130 0.060 D Year 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 E Dividend 1.04 1.23 1.41 1.60 1.85 2.11 2.40 2.70 3.02 3.34 3.67 3.99 4.31 4.61 4.89 5.18 Investor CF 1.04 1.23 1.41 1.60 1.85 2.11 2.40 2.70 3.02 3.34 3.67 3.99 4.31 4.61 4.89 108.75 10 0.1544 0.1450 0.1355 0.1261 0.1166 0.1072 0.0978 0.0883 0.0789 0.0694 0.0600 0.0600 11 12 Value line 13 forecasts of 1 14 annual dividends 15 16 103.57 17 Transitional period 18 with slowing dividend 19 growth Beginning of constant growth period 35.70 = PV of CF 20 E17 *(1+F17)/(B5 - F17) NPV(B5, H2:H17) 21 22 23 Chapter 18 0 Saved Help Save & Exit Submit Check my work Calculate the intrinsic value of GE in each of the following scenarios by using the three-stage growth model of Spreadsheet 18.1. Treat each scenario independently. a. The terminal growth rate will be 9.30%. (Round your answer to 2 decimal places.) points Intrinsic value eBook Print References b. GE's actual beta is 1.04. (Round your answer to 2 decimal places.) Intrinsic value c. The market risk premium is 9.40%. (Round your answer to 2 decimal places.) Intrinsic value NS H Div growth Term value 1 Inputs for GE 2 beta 3 mkt_prem 4 rf 5 k_equity 6 term_gwth 1.1 0.08 0.025 0.1130 0.060 D Year 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 E Dividend 1.04 1.23 1.41 1.60 1.85 2.11 2.40 2.70 3.02 3.34 3.67 3.99 4.31 4.61 4.89 5.18 Investor CF 1.04 1.23 1.41 1.60 1.85 2.11 2.40 2.70 3.02 3.34 3.67 3.99 4.31 4.61 4.89 108.75 10 0.1544 0.1450 0.1355 0.1261 0.1166 0.1072 0.0978 0.0883 0.0789 0.0694 0.0600 0.0600 11 12 Value line 13 forecasts of 1 14 annual dividends 15 16 103.57 17 Transitional period 18 with slowing dividend 19 growth Beginning of constant growth period 35.70 = PV of CF 20 E17 *(1+F17)/(B5 - F17) NPV(B5, H2:H17) 21 22 23

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts