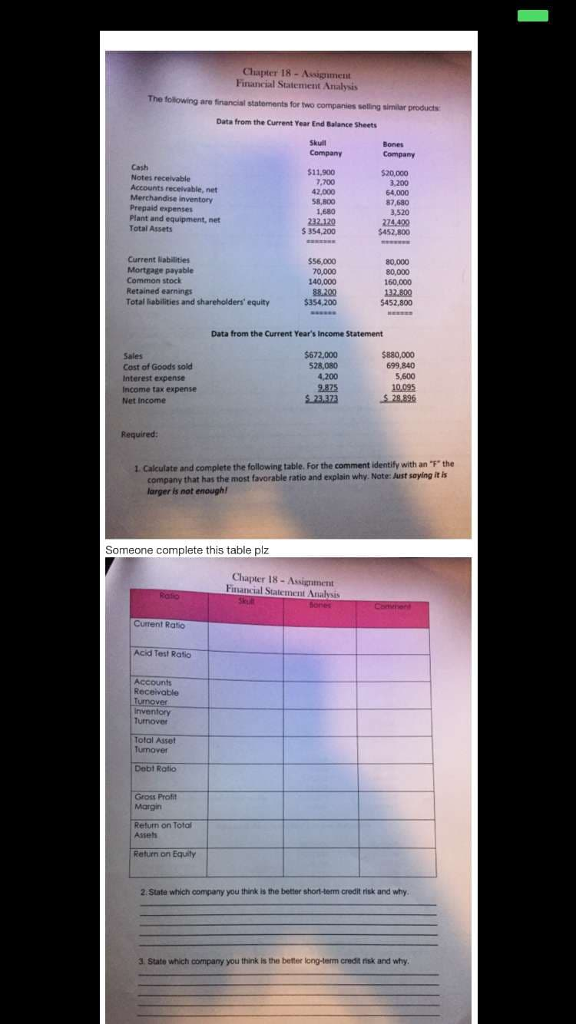

Question: Chapter 18 - Asigument Financial Statement Analysis The following are financial statements for two companies selling similar product Data from the Current Year End Balance

Chapter 18 - Asigument Financial Statement Analysis The following are financial statements for two companies selling similar product Data from the Current Year End Balance Sheets Company Bones Company $20,000 7.700 Notes receivable Accounts receivable.net Merchandise inventory Prepaid expenses Plant and equipment, net Total Assets 64.000 87,680 3,520 S8,800 1,680 232.120 S 354,200 $452,800 Current liabilities Mortgage payable Common stock Retained earnings Total liabilities and shareholders' equity $56.000 70.000 140,000 80.000 80.000 160.000 132.800 $452.800 $354,200 Data from the Current Year's income Statement Sales Cost of Goods sold Interest expense Income tax expense Net Income $672.000 528,080 4,200 S880,000 699 840 5.600 10,095 S 28.896 9.875 5.23.373 Required: 1. Cakulate and complete the following table. For the comment identify with an "F" the company that has the most favorable ratio and explain why. Note: Just saying it is larger is not enough! Someone complete this table plz Chapter 18 - Assignment Financial Statement Analysis Current Ratio Acid Test Ratio Accounts Receivable Turnover Inventory Turnover Total Asset Turnover Debt Ratio Gross Profit Margin Relum on Total Asses Return on Equity 2. State which company you think is the better short-term credit risk and why. 3. State which company you think is the better long-term credit risk and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts