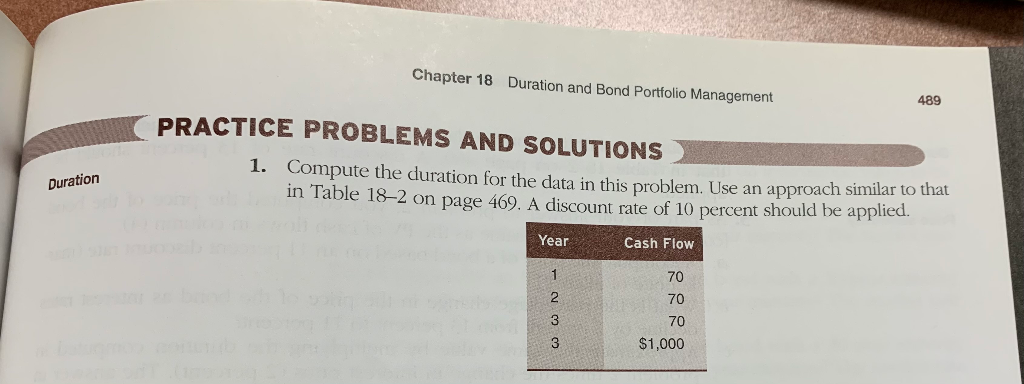

Question: Chapter 18 Duration and Bond Portfolio Management 489 PRACTICE PROBLEMS AND SOLUTIONS 1. Compute the duration for the data in this problem. Use an approach

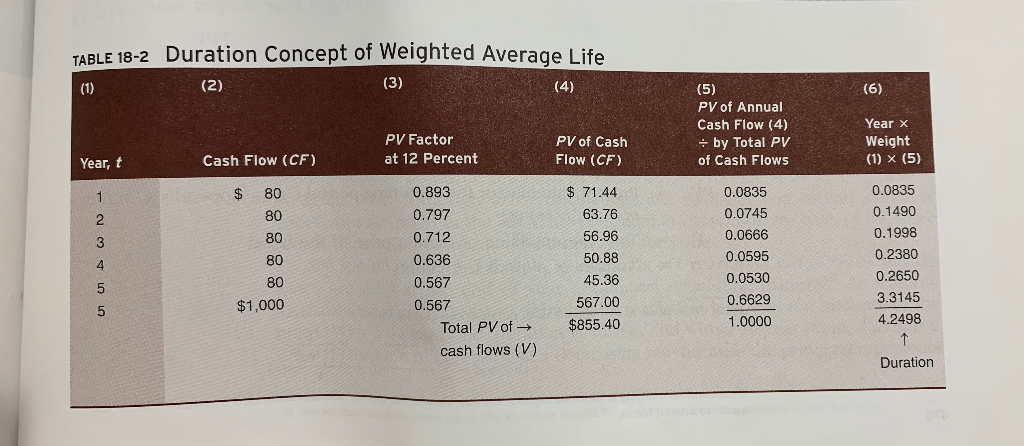

Chapter 18 Duration and Bond Portfolio Management 489 PRACTICE PROBLEMS AND SOLUTIONS 1. Compute the duration for the data in this problem. Use an approach similar to that in Table 182 on page 469. A discount rate of 10 percent should be applied. Duration Year Cash Flow 1 2 3 3 70 70 70 $1,000 TABLE 18-2 Duration Concept of Weighted Average Life (1) (2) (3) (4) (6) (5) PV of Annual Cash Flow (4) + by Total PV of Cash Flows PV Factor at 12 Percent PV of Cash Flow (CF) Year x Weight (1) X (5) Year, t Cash Flow (CF) 1 $ 80 80 80 un OWN- 80 0.893 0.797 0.712 0.636 0.567 0.567 Total PV of cash flows (V) $ 71.44 63.76 56.96 50.88 45.36 567.00 $855.40 0.0835 0.0745 0.0666 0.0595 0.0530 0.6629 1.0000 0.0835 0.1490 0.1998 0.2380 0.2650 3.3145 4.2498 80 $1,000 Duration

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts