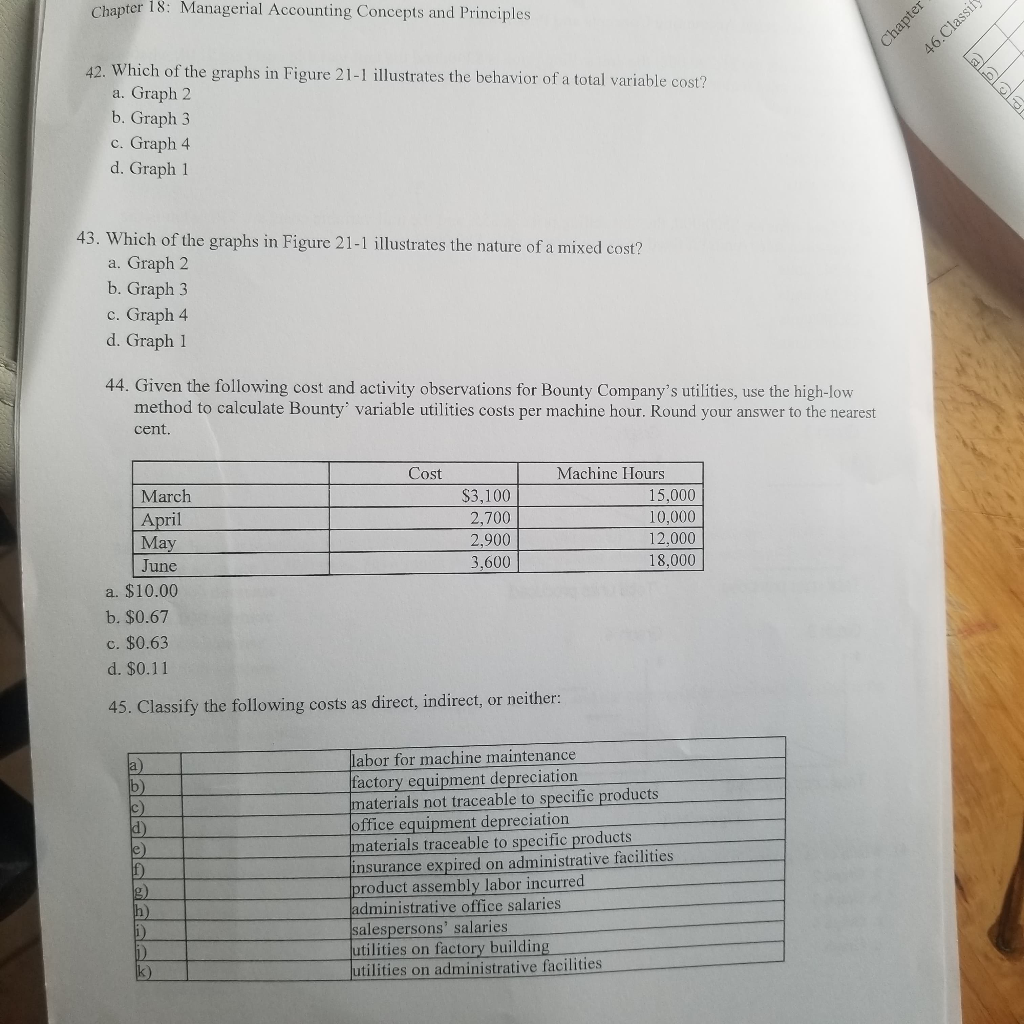

Question: Chapter 18: Managerial Accounting Concepts and Principles Chapter 46.Classif 42. Which of the graphs in Figure 21-1 illustrates the behavior of a total variable cost?

Chapter 18: Managerial Accounting Concepts and Principles Chapter 46.Classif 42. Which of the graphs in Figure 21-1 illustrates the behavior of a total variable cost? Graph 2 b.Graph 3 c. Graph 4 d. Graph 1 43. Which of the graphs in Figure 21-1 illustrates the nature of a mixed cost? a. Graph 2 b. Graph 3 c. Graph 4 d. Graph 1 44. Given the following cost and activity observations for Bounty Company's utilities, use the high-low method to calculate Bounty' variable utilities costs per machine hour. Round your answer to the nearest cent. Cost Machine Hours March $3,100 2,700 15,000 April May 10,000 2,900 12,000 June 3,600 18,000 a. $10,00 b. $0.67 c. $0.63 d. $0.11 45. Classify the following costs as direct, indirect, or neither: labor for machine maintenance factory equipment depreciation materials not traceable to specific products office equipment depreciation materials traceable to specific products insurance expired on administrative facilities product assembly labor incurred administrative office salaries salespersons' salaries utilities on factory building utilities on administrative facilities d) e) f) g) h) k) Chapter 18: Managerial Accounting Concepts and Principles Chapter 46.Classif 42. Which of the graphs in Figure 21-1 illustrates the behavior of a total variable cost? Graph 2 b.Graph 3 c. Graph 4 d. Graph 1 43. Which of the graphs in Figure 21-1 illustrates the nature of a mixed cost? a. Graph 2 b. Graph 3 c. Graph 4 d. Graph 1 44. Given the following cost and activity observations for Bounty Company's utilities, use the high-low method to calculate Bounty' variable utilities costs per machine hour. Round your answer to the nearest cent. Cost Machine Hours March $3,100 2,700 15,000 April May 10,000 2,900 12,000 June 3,600 18,000 a. $10,00 b. $0.67 c. $0.63 d. $0.11 45. Classify the following costs as direct, indirect, or neither: labor for machine maintenance factory equipment depreciation materials not traceable to specific products office equipment depreciation materials traceable to specific products insurance expired on administrative facilities product assembly labor incurred administrative office salaries salespersons' salaries utilities on factory building utilities on administrative facilities d) e) f) g) h) k)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts