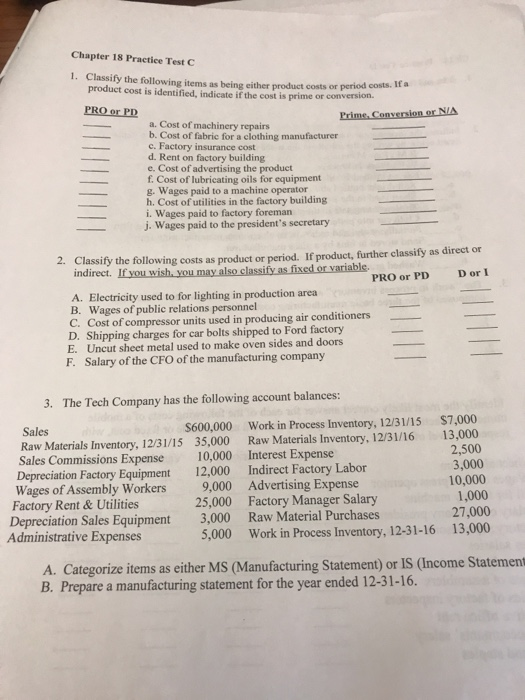

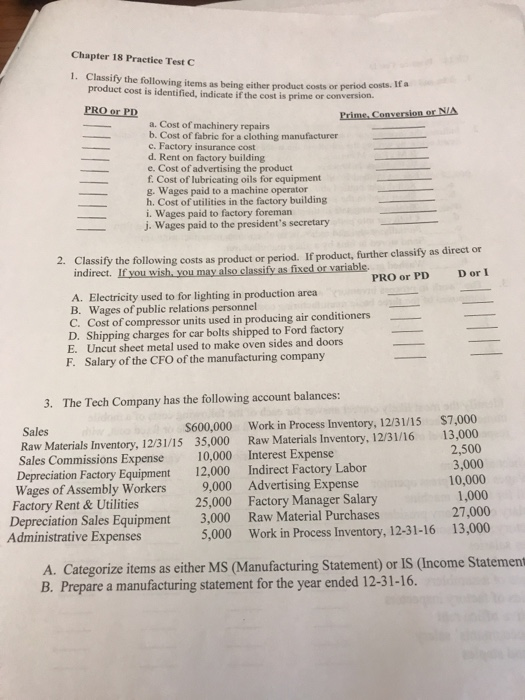

Question: Chapter 18 Practice Test C 1. Classify the following items as being either product costs or period costs. If product cost is identified, indicate if

Chapter 18 Practice Test C 1. Classify the following items as being either product costs or period costs. If product cost is identified, indicate if the cost is prime or conversion. PRO or PD a. Cost of machinery repairs b. Cost of fabric for a clothing manufacturer c. Factory insurance cost d. Rent on factory building e. Cost of advertising the product f. Cost of lubricating oils for equipment g. Wages paid to a machine operator h. Cost of utilities in the factory building i. Wages paid to factory foreman j. Wages paid to the president's secretary 2. Classify the following costs as product or period. If product, further classify as direct or indirect. If PRO or PD DorI A. Electricity used to for lighting in production area B. Wages of public relations personnel C. Cost of compressor units used in producing air conditioners D. Shipping charges for car bolts shipped to Ford factory E. Uncut sheet metal used to make oven sides and doors F. Salary of the CFO of the manufacturing company 3. The Tech Company has the following account balances: Sales $600,000 Work in Process Inventory, 12/31/15 $7,000 Raw Materials Inventory, 12/31/15 35,000 Raw Materials Inventory. 12/31/16 13,000 2,500 Sales Commissions Expense Depreciation Factory Equipment Wages of Assembly Workers Factory Rent& Utilities 10,000 12,000 9,000 25,000 3,000 5,000 Interest Expense Indirect Factory Labor Advertising Expense Factory Manager Salary Raw Material Purchases Work in Process Inventory, 12-31-16 3,000 10,000 1,000 27,000 13,000 Depreciation Sales Equipment Administrative Expenses A. Categorize items as either MS (Manufacturing Statement) or IS (Income Statement B. Prepare a manufacturing statement for the year ended 12-31-16. Chapter 18 Practice Test C 1. Classify the following items as being either product costs or period costs. If product cost is identified, indicate if the cost is prime or conversion. PRO or PD a. Cost of machinery repairs b. Cost of fabric for a clothing manufacturer c. Factory insurance cost d. Rent on factory building e. Cost of advertising the product f. Cost of lubricating oils for equipment g. Wages paid to a machine operator h. Cost of utilities in the factory building i. Wages paid to factory foreman j. Wages paid to the president's secretary 2. Classify the following costs as product or period. If product, further classify as direct or indirect. If PRO or PD DorI A. Electricity used to for lighting in production area B. Wages of public relations personnel C. Cost of compressor units used in producing air conditioners D. Shipping charges for car bolts shipped to Ford factory E. Uncut sheet metal used to make oven sides and doors F. Salary of the CFO of the manufacturing company 3. The Tech Company has the following account balances: Sales $600,000 Work in Process Inventory, 12/31/15 $7,000 Raw Materials Inventory, 12/31/15 35,000 Raw Materials Inventory. 12/31/16 13,000 2,500 Sales Commissions Expense Depreciation Factory Equipment Wages of Assembly Workers Factory Rent& Utilities 10,000 12,000 9,000 25,000 3,000 5,000 Interest Expense Indirect Factory Labor Advertising Expense Factory Manager Salary Raw Material Purchases Work in Process Inventory, 12-31-16 3,000 10,000 1,000 27,000 13,000 Depreciation Sales Equipment Administrative Expenses A. Categorize items as either MS (Manufacturing Statement) or IS (Income Statement B. Prepare a manufacturing statement for the year ended 12-31-16

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts