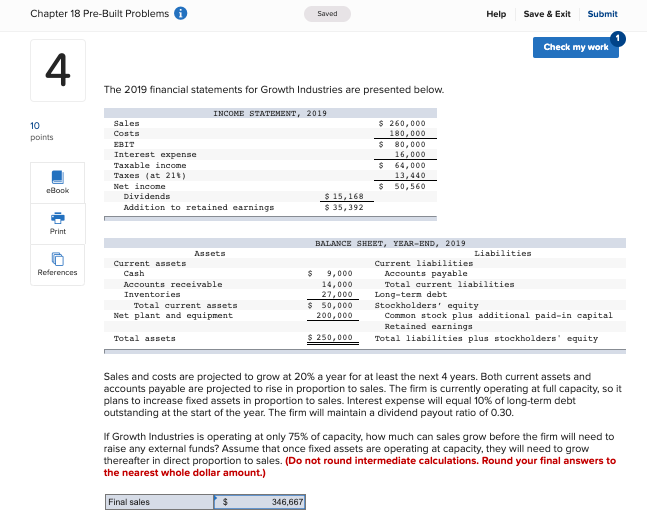

Question: Chapter 18 Pre-Built Problems Saved Help Save & Exit Submit Check my work 4 The 2019 financial statements for Growth Industries are presented below. 10

Chapter 18 Pre-Built Problems Saved Help Save & Exit Submit Check my work 4 The 2019 financial statements for Growth Industries are presented below. 10 points INCOME STATEMENT, 2019 Sales Costs EBIT Interest expense Taxable income Taxes (at 218) Net income Dividends $ 15,168 Addition to retained earnings $ 35,392 $ 260,000 180,000 $ 80,000 16,000 $ 64,000 13,440 $ 50,560 eBook Prir References Assets Current assets Cash Nccounts receivable Inventories Total current assets Net plant and equipment BALANCE SHEET, YEAR-END, 2019 Liabilities Current liabilities $ 9,000 Accounts payable 14,000 Total current liabilities 27,000 Long-tern debt $ 50,000 Stockholders' equity 200,000 Common stock plus additional paid-in capital Retained earnings $ 250,000 Total liabilities plus stockholders' equity Total assets Sales and costs are projected to grow at 20% a year for at least the next 4 years. Both current assets and accounts payable are projected to rise in proportion to sales. The firm is currently operating at full capacity, so it plans to increase fixed assets in proportion to sales. Interest expense will equal 10% of long-term debt outstanding at the start of the year. The firm will maintain a dividend payout ratio of 0.30. If Growth Industries is operating at only 75% of capacity, how much can sales grow before the firm will need to raise any external funds? Assume that once fixed assets are operating at capacity, they will need to grow thereafter in direct proportion to sales. (Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount.) Final sales $ 346,667 Chapter 18 Pre-Built Problems Saved Help Save & Exit Submit Check my work 4 The 2019 financial statements for Growth Industries are presented below. 10 points INCOME STATEMENT, 2019 Sales Costs EBIT Interest expense Taxable income Taxes (at 218) Net income Dividends $ 15,168 Addition to retained earnings $ 35,392 $ 260,000 180,000 $ 80,000 16,000 $ 64,000 13,440 $ 50,560 eBook Prir References Assets Current assets Cash Nccounts receivable Inventories Total current assets Net plant and equipment BALANCE SHEET, YEAR-END, 2019 Liabilities Current liabilities $ 9,000 Accounts payable 14,000 Total current liabilities 27,000 Long-tern debt $ 50,000 Stockholders' equity 200,000 Common stock plus additional paid-in capital Retained earnings $ 250,000 Total liabilities plus stockholders' equity Total assets Sales and costs are projected to grow at 20% a year for at least the next 4 years. Both current assets and accounts payable are projected to rise in proportion to sales. The firm is currently operating at full capacity, so it plans to increase fixed assets in proportion to sales. Interest expense will equal 10% of long-term debt outstanding at the start of the year. The firm will maintain a dividend payout ratio of 0.30. If Growth Industries is operating at only 75% of capacity, how much can sales grow before the firm will need to raise any external funds? Assume that once fixed assets are operating at capacity, they will need to grow thereafter in direct proportion to sales. (Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount.) Final sales $ 346,667

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts