Question: Chapter 18 - Review Problems (Graded) Susmitted Problem 18-14 Beta and Leverage 0/16.7 points awarded Fitzgerald Industries has a new project available that requires an

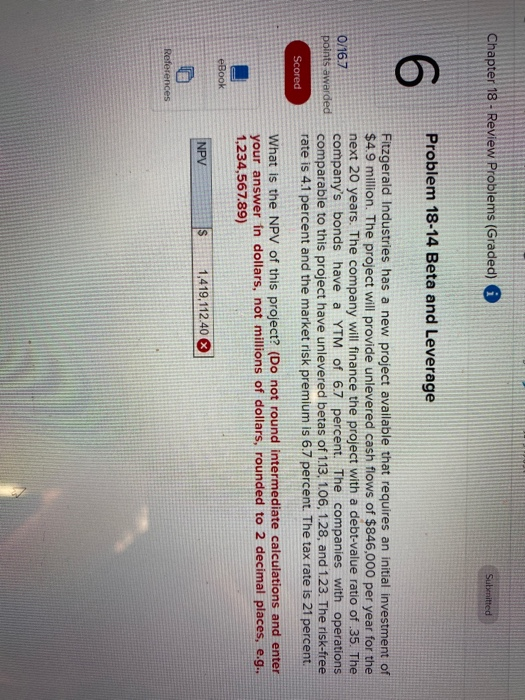

Chapter 18 - Review Problems (Graded) Susmitted Problem 18-14 Beta and Leverage 0/16.7 points awarded Fitzgerald Industries has a new project available that requires an initial investment of $4.9 million. The project will provide unlevered cash flows of $846,000 per year for the next 20 years. The company will finance the project with a debt-value ratio of .35. The company's bonds have a YTM of 6.7 percent. The companies with operations comparable to this project have unlevered betas of 1.13. 1.06, 1.28, and 1.23. The risk-free rate is 4.1 percent and the market risk premium is 6.7 percent. The tax rate is 21 percent. Scored loro What is the NPV of this project? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g.. 1,234,567.89) eBook NPV 1,419.112.40 References

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts