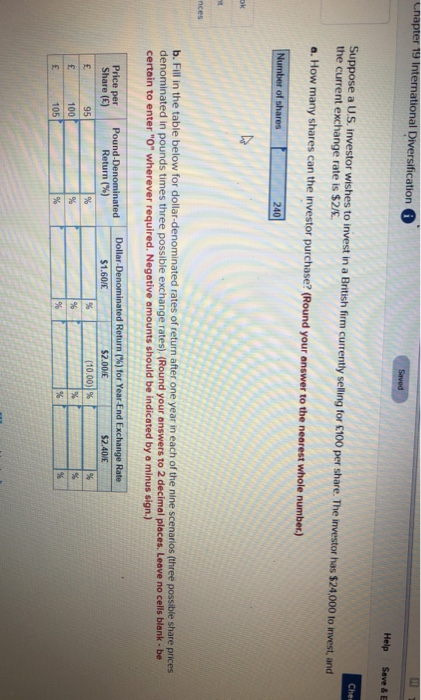

Question: Chapter 19 International Diversification 6 Seved Saved Help Save & E Suppose a U.S. Investor wishes to invest in a British firm currently selling for

Chapter 19 International Diversification 6 Seved Saved Help Save & E Suppose a U.S. Investor wishes to invest in a British firm currently selling for 100 per share. The investor has $24,000 to invest, and the current exchange rate is $2/6 Chei a. How many shares can the investor purchase? (Round your answer to the nearest whole number) Number of shares 240 b. Fill in the table below for dollar denominated rates of return after one year in each of the nine scenarios (three possible share prices denominated in pounds times three possible exchange rates), (Round your answers to 2 decimal places. Leave no cells blank.be certain to enter "0" wherever required. Negative amounts should be indicated by a minus sign.) Price per Share (E) Pound-Denominated Return (%) Dollar Denominated Return (%) for Year-End Exchange Rate $1.60/E $2.00/E (10.00) %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts