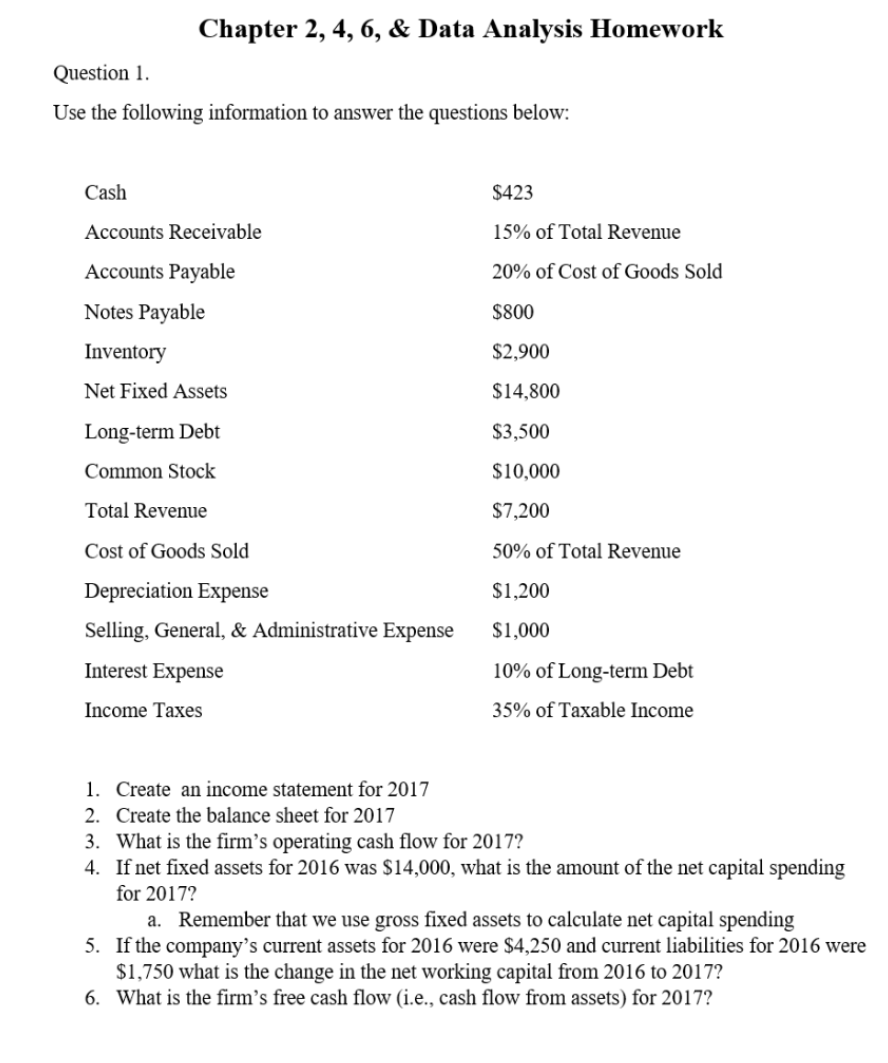

Question: Chapter 2, 4, 6, & Data Analysis Homework Question 1. Use the following information to answer the questions below: Cash $423 Accounts Receivable 15% of

Chapter 2, 4, 6, & Data Analysis Homework Question 1. Use the following information to answer the questions below: Cash $423 Accounts Receivable 15% of Total Revenue Accounts Payable 20% of Cost of Goods Sold Notes Payable $800 $2,900 $14,800 Inventory Net Fixed Assets Long-term Debt Common Stock $3,500 $10,000 Total Revenue $7,200 50% of Total Revenue Cost of Goods Sold Depreciation Expense $1,200 Selling, General, & Administrative Expense $1,000 10% of Long-term Debt Interest Expense Income Taxes 35% of Taxable Income 1. Create an income statement for 2017 2. Create the balance sheet for 2017 3. What is the firm's operating cash flow for 2017? 4. If net fixed assets for 2016 was $14,000, what is the amount of the net capital spending for 2017? a. Remember that we use gross fixed assets to calculate net capital spending 5. If the company's current assets for 2016 were $4,250 and current liabilities for 2016 were $1,750 what is the change in the net working capital from 2016 to 2017? 6. What is the firm's free cash flow (i.e., cash flow from assets) for 2017? Chapter 2, 4, 6, & Data Analysis Homework Question 1. Use the following information to answer the questions below: Cash $423 Accounts Receivable 15% of Total Revenue Accounts Payable 20% of Cost of Goods Sold Notes Payable $800 $2,900 $14,800 Inventory Net Fixed Assets Long-term Debt Common Stock $3,500 $10,000 Total Revenue $7,200 50% of Total Revenue Cost of Goods Sold Depreciation Expense $1,200 Selling, General, & Administrative Expense $1,000 10% of Long-term Debt Interest Expense Income Taxes 35% of Taxable Income 1. Create an income statement for 2017 2. Create the balance sheet for 2017 3. What is the firm's operating cash flow for 2017? 4. If net fixed assets for 2016 was $14,000, what is the amount of the net capital spending for 2017? a. Remember that we use gross fixed assets to calculate net capital spending 5. If the company's current assets for 2016 were $4,250 and current liabilities for 2016 were $1,750 what is the change in the net working capital from 2016 to 2017? 6. What is the firm's free cash flow (i.e., cash flow from assets) for 2017

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts