Question: chapter 2: ANSWER THE FOLLOWING QUESTIONS QUESTIONS 1. Why is a share of Microsoft common stock an asset for its owner and a liability for

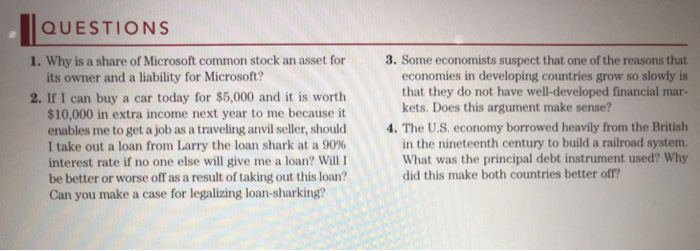

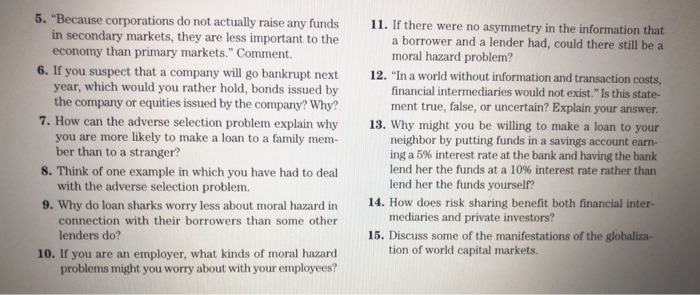

QUESTIONS 1. Why is a share of Microsoft common stock an asset for its owner and a liability for Microsoft? 2. If I can buy a car today for $5,000 and it is worth $10,000 in extra income next year to me because it enables me to get a job as a traveling anvil seller, should I take out a loan from Larry the loan shark at a 90% interest rate if no one else will give me a loan? Will I be better or worse off as a result of taking out this loan? Can you make a case for legalizing loan-sharking? 3. Some economists suspect that one of the reasons that economies in developing countries grow so slowly is that they do not have well-developed financial mar- kets. Does this argument make sense? 4. The U.S. economy borrowed heavily from the British in the nineteenth century to build a railroad system. What was the principal debt instrument used? Why did this make both countries better off? 5. "Because corporations do not actually raise any funds in secondary markets, they are less important to the economy than primary markets." Comment. 6. If you suspect that a company will go bankrupt next year, which would you rather hold, bonds issued by the company or equities issued by the company? Why? 7. How can the adverse selection problem explain why you are more likely to make a loan to a family mem- ber than to a stranger? 8. Think of one example in which you have had to deal with the adverse selection problem. 9. Why do loan sharks worry less about moral hazard in connection with their borrowers than some other lenders do? 10. If you are an employer, what kinds of moral hazard problems might you worry about with your employees? 11. If there were no asymmetry in the information that a borrower and a lender had, could there still be a moral hazard problem? 12. "In a world without information and transaction costs, financial intermediaries would not exist." Is this state- ment true, false, or uncertain? Explain your answer. 13. Why might you be willing to make a loan to your neighbor by putting funds in a savings account earn- ing a 5% interest rate at the bank and having the bank lend her the funds at a 10% interest rate rather than lend her the funds yourself? 14. How does risk sharing benefit both financial inter- mediaries and private investors? 15. Discuss some of the manifestations of the globaliza- tion of world capital markets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts