Question: Chapter 2 - Financial Analysis 2) Ceramics, Inc. (CI), a company that manufactures bath tiles, is interested in measuring inventory effectiveness. Last year the cost

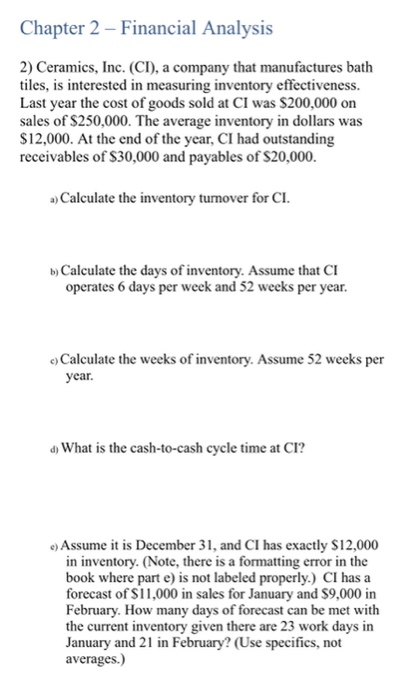

Chapter 2 - Financial Analysis 2) Ceramics, Inc. (CI), a company that manufactures bath tiles, is interested in measuring inventory effectiveness. Last year the cost of goods sold at CI was $200,000 on sales of $250,000. The average inventory in dollars was $12,000. At the end of the year, CI had outstanding receivables of $30,000 and payables of $20,000. a) Calculate the inventory tumover for CI. b) Calculate the days of inventory. Assume that CI operates 6 days per week and 52 weeks per year. ..Calculate the weeks of inventory. Assume 52 weeks per year. d) What is the cash-to-cash cycle time at CI? c) Assume it is December 31, and CI has exactly $12,000 in inventory. (Note, there is a formatting error in the book where parte) is not labeled properly.) CI has a forecast of $11,000 in sales for January and $9,000 in February. How many days of forecast can be met with the current inventory given there are 23 work days in January and 21 in February? (Use specifics, not averages.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts