Question: Chapter 2 Financial Planning Exercise 6 Calculating present and future values Use future or present value techniques to solve the following problems. a. If you

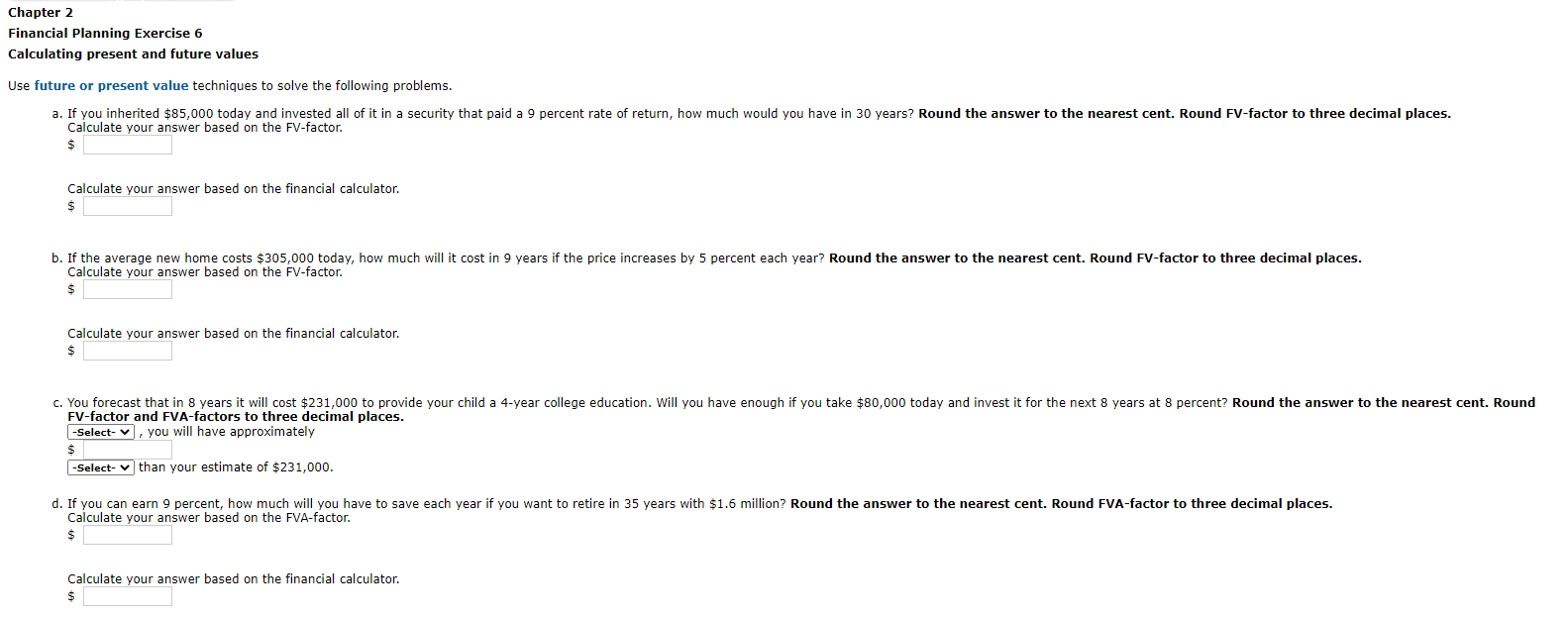

Chapter 2 Financial Planning Exercise 6 Calculating present and future values Use future or present value techniques to solve the following problems. a. If you inherited $85,000 today and invested all of it in a security that paid a 9 percent rate of return, how much would you have in 30 years? Round the answer to the nearest cent. Round FV-factor to three decimal places. Calculate your answer based on the FV-factor. $ Calculate your answer based on the financial calculator. $ b. If the average new home costs $305,000 today, how much will it cost in 9 years if the price increases by 5 percent each year? Round the answer to the nearest cent. Round FV-factor to three decimal places. Calculate your answer based on the FV-factor. Calculate your answer based on the financial calculator. C. You forecast that in 8 years it will cost $231,000 to provide your child a 4-year college education. Will you have enough if you take $80,000 today and invest it for the next 8 years at 8 percent? Round the answer to the nearest cent. Round FV-factor and FVA-factors to three decimal places. -Select you will have approximately $ -Select-than your estimate of $231,000. d. If you can earn 9 percent, how much will you have to save each year if you want to retire in 35 years with $1.6 million? Round the answer to the nearest cent. Round FVA-factor to three decimal places. Calculate your answer based on the FVA-factor. Calculate your answer based on the financial calculator. $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts