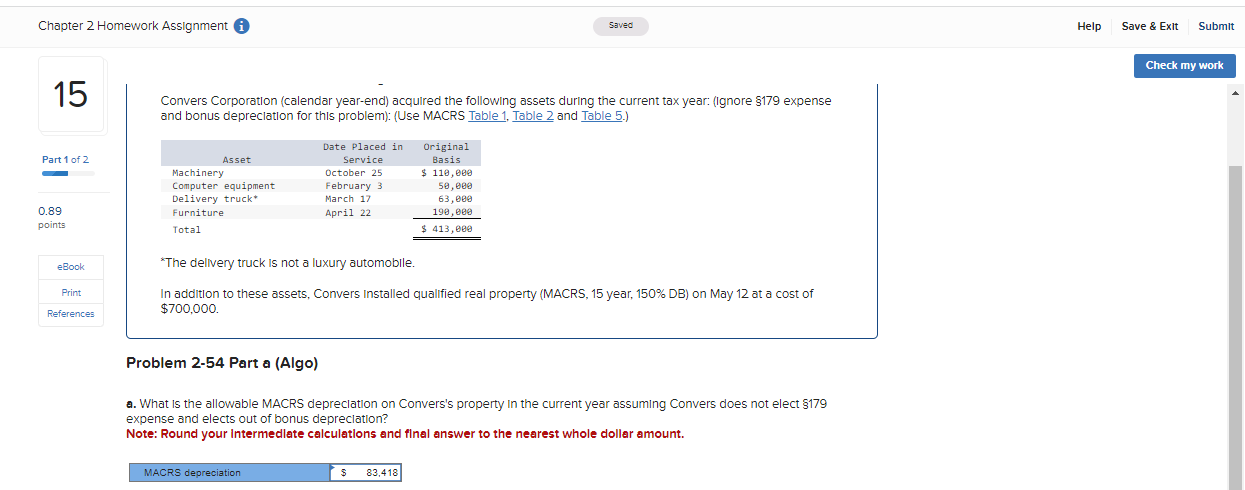

Question: Chapter 2 Homework Assignment i Saved 15 Convers Corporation (calendar year-end) acquired the following assets during the current tax year: (Ignore 179 expense and

Chapter 2 Homework Assignment i Saved 15 Convers Corporation (calendar year-end) acquired the following assets during the current tax year: (Ignore 179 expense and bonus depreciation for this problem): (Use MACRS Table 1. Table 2 and Table 5.) Asset Part 1 of 2 0.89 points Machinery Computer equipment Delivery truck* Furniture Total Date Placed in Service October 25 February 3 March 17 April 22 Original Basis $110,000 50,000 63,000 190,000 $ 413,000 eBook *The delivery truck is not a luxury automobile. Print In addition to these assets, Convers Installed qualified real property (MACRS, 15 year, 150% DB) on May 12 at a cost of $700,000. References Problem 2-54 Part a (Algo) a. What is the allowable MACRS depreciation on Convers's property in the current year assuming Convers does not elect 179 expense and elects out of bonus depreciation? Note: Round your Intermediate calculations and final answer to the nearest whole dollar amount. MACRS depreciation $ 83,418 Help Save & Exit Submit Check my work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts