Question: Chapter 2 Questions 2-2: Describe the different ways in which capital can be transferred from suppliers of capital to those who are demanding capital. 2-3:

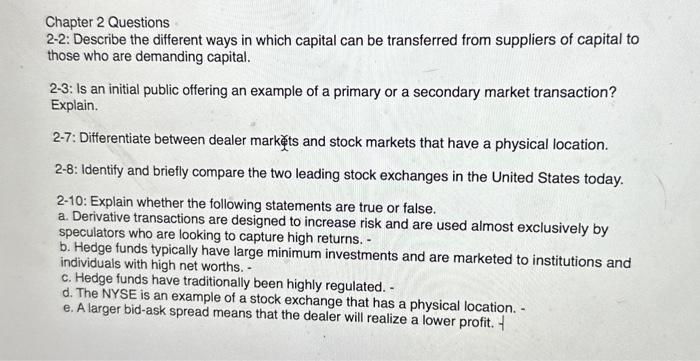

Chapter 2 Questions 2-2: Describe the different ways in which capital can be transferred from suppliers of capital to those who are demanding capital. 2-3: Is an initial public offering an example of a primary or a secondary market transaction? Explain. 2-7: Differentiate between dealer mark 2-8: Identify and briefly compare the two leading stock exchanges in the United States today. 2-10: Explain whether the following statements are true or false. a. Derivative transactions are designed to increase risk and are used almost exclusively by speculators who are looking to capture high returns. - b. Hedge funds typically have large minimum investments and are marketed to institutions and individuals with high net worths. - c. Hedge funds have traditionally been highly regulated. - d. The NYSE is an example of a stock exchange that has a physical location. e. A larger bid-ask spread means that the dealer will realize a lower profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts