Question: Chapter 2 Section 2.3 Equation of Value 1. In return for payments of $3000 at the end of four years and $6000 at the end

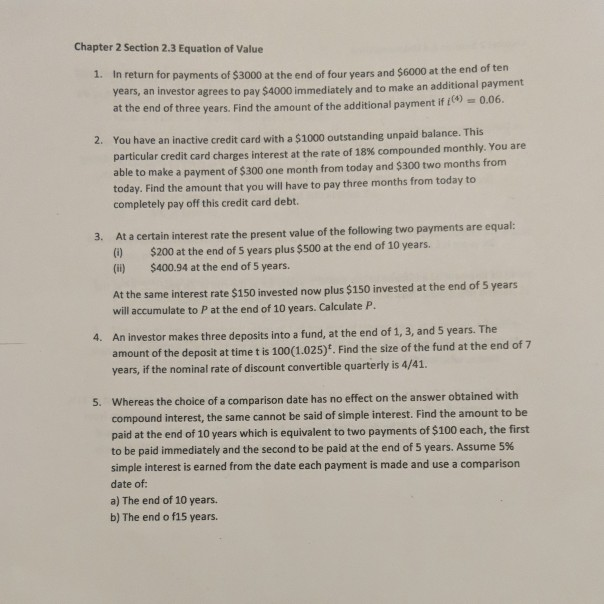

Chapter 2 Section 2.3 Equation of Value 1. In return for payments of $3000 at the end of four years and $6000 at the end often years, an investor agrees to pay $4000 immediately and to make an additional payment at the end of three years. Find the amount of the additional payment if 0 .06. 2. You have an inactive credit card with a $1000 outstanding unpaid balance. This particular credit card charges interest at the rate of 18% compounded monthly. You are able to make a payment of $300 one month from today and $300 two months from today. Find the amount that you will have to pay three months from today to completely pay off this credit card debt. 3. At a certain interest rate the present value of the following two payments are equal: (0) $200 at the end of 5 years plus $500 at the end of 10 years. (ii) $400.94 at the end of 5 years. At the same interest rate $150 invested now plus $150 invested at the end of 5 years will accumulate to P at the end of 10 years. Calculate P. 4. An investor makes three deposits into a fund, at the end of 1, 3, and 5 years. The amount of the deposit at time t is 100(1.025). Find the size of the fund at the end of 7 years, if the nominal rate of discount convertible quarterly is 4/41. 5. Whereas the choice of a comparison date has no effect on the answer obtained with compound interest, the same cannot be said of simple interest. Find the amount to be paid at the end of 10 years which is equivalent to two payments of $100 each, the first to be paid immediately and the second to be paid at the end of 5 years. Assume 5% simple interest is earned from the date each payment is made and use a comparison date of: a) The end of 10 years. b) The end o f15 years. Chapter 2 Section 2.3 Equation of Value 1. In return for payments of $3000 at the end of four years and $6000 at the end often years, an investor agrees to pay $4000 immediately and to make an additional payment at the end of three years. Find the amount of the additional payment if 0 .06. 2. You have an inactive credit card with a $1000 outstanding unpaid balance. This particular credit card charges interest at the rate of 18% compounded monthly. You are able to make a payment of $300 one month from today and $300 two months from today. Find the amount that you will have to pay three months from today to completely pay off this credit card debt. 3. At a certain interest rate the present value of the following two payments are equal: (0) $200 at the end of 5 years plus $500 at the end of 10 years. (ii) $400.94 at the end of 5 years. At the same interest rate $150 invested now plus $150 invested at the end of 5 years will accumulate to P at the end of 10 years. Calculate P. 4. An investor makes three deposits into a fund, at the end of 1, 3, and 5 years. The amount of the deposit at time t is 100(1.025). Find the size of the fund at the end of 7 years, if the nominal rate of discount convertible quarterly is 4/41. 5. Whereas the choice of a comparison date has no effect on the answer obtained with compound interest, the same cannot be said of simple interest. Find the amount to be paid at the end of 10 years which is equivalent to two payments of $100 each, the first to be paid immediately and the second to be paid at the end of 5 years. Assume 5% simple interest is earned from the date each payment is made and use a comparison date of: a) The end of 10 years. b) The end o f15 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts