Question: Chapter 2 Worksheet Problems 1. During the year 2012, Yung.com had sales of $1000, costs of goods sold of $400, depreciation of $100, and interest

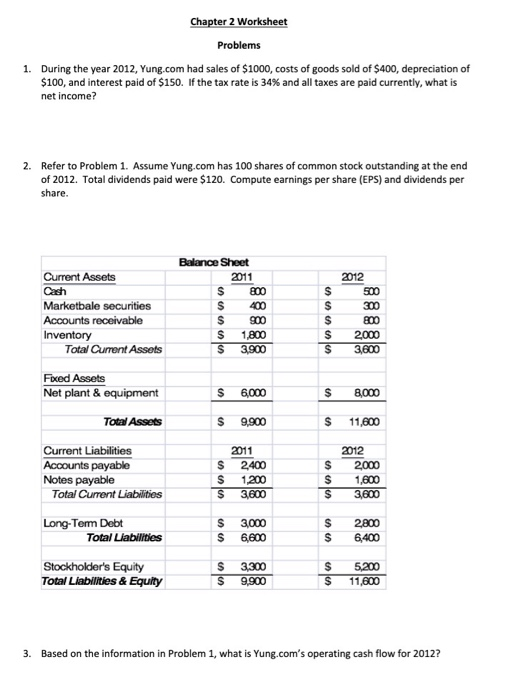

Chapter 2 Worksheet Problems 1. During the year 2012, Yung.com had sales of $1000, costs of goods sold of $400, depreciation of $100, and interest paid of $150. If the tax rate is 34% and all taxes are paid currently, what is net income? 2. Refer to Problem 1. Assume Yung.com has 100 shares of common stock outstanding at the end of 2012. Total dividends paid were $120. Compute earnings per share (EPS) and dividends per share. Balance Sheet 2011 no 2012 Current Assets Cash Marketbale securities Accounts receivable Inventory Total Current Assets S 2000 $ 380 Fixed Assets Net plant & equipment $ 6,000 $ 8,000 Total Assets $ 9,900 $ 11,600 Current Liabilities Accounts payable Notes payable Total Current Liabilities $ $ $ 2011 2,400 1.200 3,600 $ $ $ 2012 2000 1.600 3,600 $ 2A Long-Term Debt Total Liabilities $ $ 3,000 6,600 S 6400 Stockholder's Equity Total Liabilities & Equity $ $ 3,300 9.900 $ S 5200 11.600 3. Based on the information in Problem 1, what is Yung.com's operating cash flow for 2012? 4. Based on the balance sheets for Yung.com, what was net working capital for 2011? For 2012? What must changes in net working capital have been? 5. What was Yung.com's free cash flow to the firm in 2012? 6. What was Yung.com's total cash flow to long-term creditors in 2012? 7. What was Yung.com's cash flow to shareholders in 2012

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts