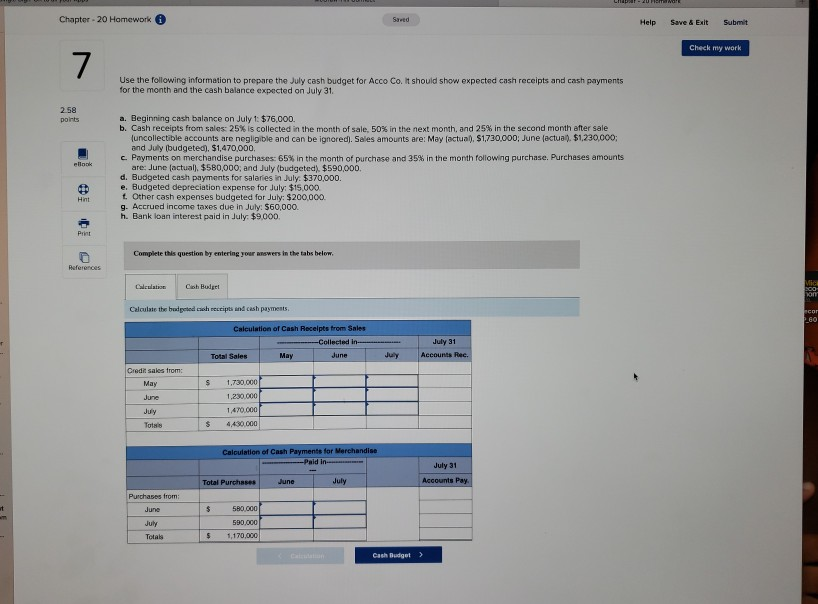

Question: Chapter 20 Homework Steed Help Save & Exit Submit Check my work 7 Use the following information to prepare the July cash budget for Acco

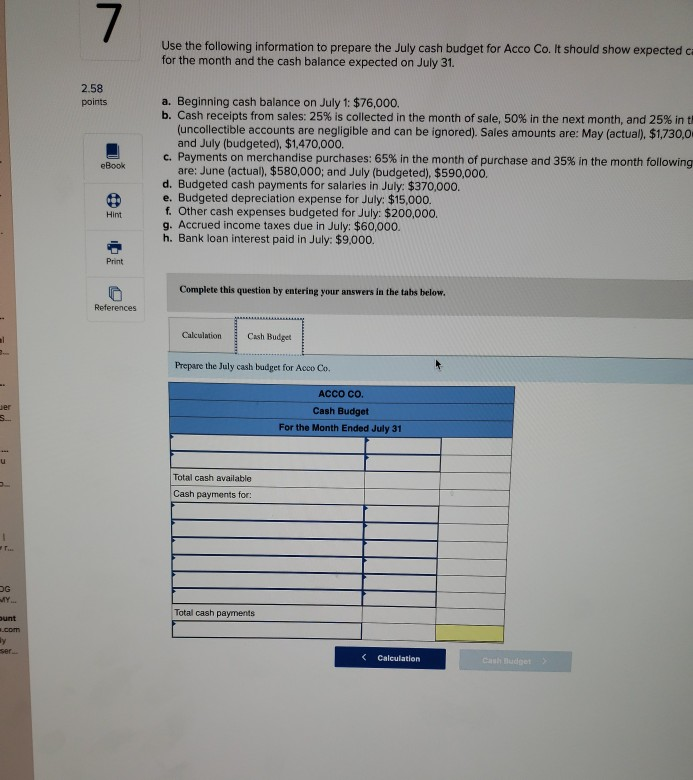

Chapter 20 Homework Steed Help Save & Exit Submit Check my work 7 Use the following information to prepare the July cash budget for Acco Co. It should show expected cash receipts and cash payments for the month and the cash balance expected on July 31 2.58 points ellon a. Beginning cash balance on July 1: $76,000. b. Cash receipts from sales: 25% is collected in the month of sale, 50% in the next month, and 25% in the second month after sale (uncollectible accounts are negligible and can be ignored). Sales amounts are: May (actual), 1,730,000, June (actualin$1.230,000; and July budgeted) $1,470,000 c Payments on merchandise purchases: 65% in the month of purchase and 35% in the month following purchase. Purchases amounts are: June (actual). $580,000, and July (budgeted) $590,000. d. Budgeted cash payments for salaries in July $370,000. e. Budgeted depreciation expense for July: $15.000 t. Other cash expenses budgeted for July: $200,000 g. Accrued income taxes due in July: $60,000. h. Bank loan interest paid in July: $9,000. Hint Print Complete this question by entering your answers in the tabs below. References Calculator Cash Bulget MICH 900 om Calculate the headpete corectits and cash payments. cor 2.60 Calculation of Cash Receipts from Sales Collected in Total Sales May June July 31 Accounts Rec. July Credit sales from May June $ 1,730,000 1,230.000 1.470.000 4,430.000 July Total $ Calculation of Cash Payments for Merchandise -Paid in July 31 Accounts Pay Total Purchases June July Purchases from t June $ 580.000 July Totals 590.000 1,170.000 $ Cash Budget 7 Use the following information to prepare the July cash budget for Acco Co. It should show expected ca for the month and the cash balance expected on July 31. 2.58 points eBook a. Beginning cash balance on July 1: $76,000. b. Cash receipts from sales: 25% is collected in the month of sale, 50% in the next month, and 25% int (uncollectible accounts are negligible and can be ignored). Sales amounts are: May (actual). $1,730,0 and July (budgeted) $1,470,000. c. Payments on merchandise purchases: 65% in the month of purchase and 35% in the month following are: June (actual). $580,000; and July (budgeted) $590,000. d. Budgeted cash payments for salaries in July: $370,000. e. Budgeted depreciation expense for July: $15,000. f. Other cash expenses budgeted for July: $200,000. g. Accrued income taxes due in July: $60,000. h. Bank loan interest paid in July: $9,000. Hint Print DO Complete this question by entering your answers in the tabs below. References Calculation Cash Budget Prepare the July cash budget for Acco Co. der S. ACCO CO. Cash Budget For the Month Ended July 31 u Total cash available Cash payments for: 1 DG Total cash payments Sunt .com -Y ser.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts