Question: Chapter 21 Homework Back to Assignment Attempts: Attention: Due to a bug in Google Chrome, this page may not function correctly. Click here to learn

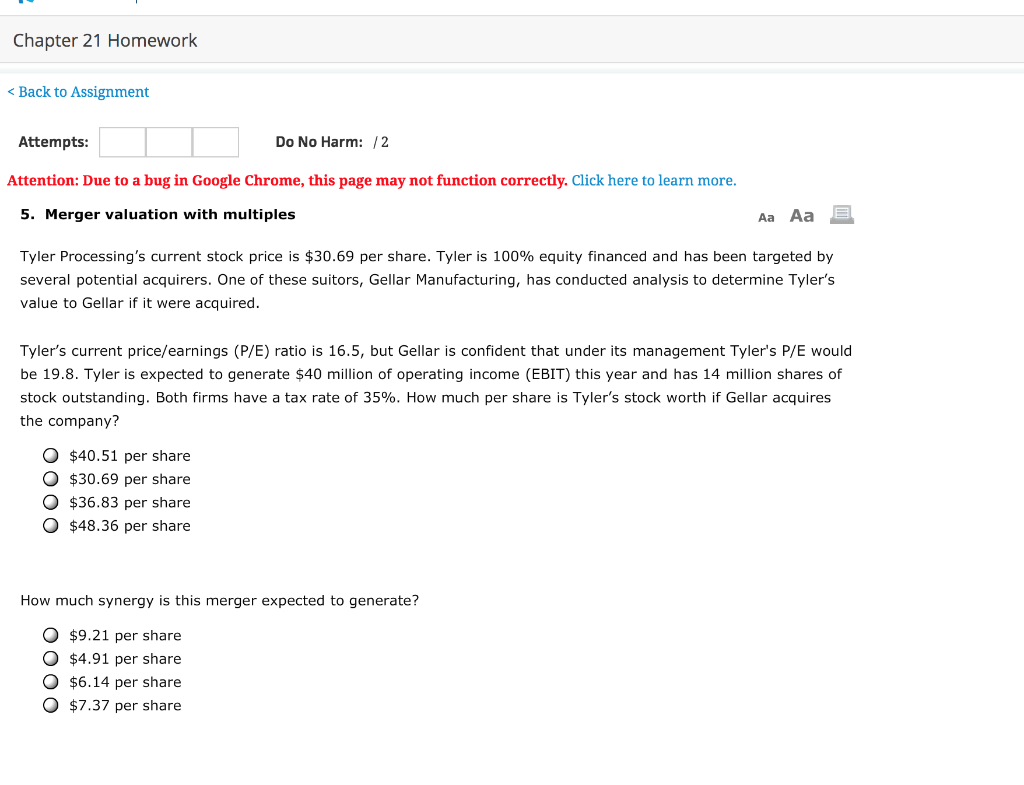

Chapter 21 Homework Back to Assignment Attempts: Attention: Due to a bug in Google Chrome, this page may not function correctly. Click here to learn more. Do No Harm: 12 Aa Aa 5. Merger valuation with multiples Tyler Processing's current stock price is $30.69 per share. Tyler is 100% equity financed and has been targeted by several potential acquirers. One of these suitors, Gellar Manufacturing, has conducted analysis to determine Tyler's value to Gellar if it were acquired. Tyler's current price/earnings (P/E) ratio is 16.5, but Gellar is confident that under its management Tyler's P/E would be 19.8. Tyler is expected to generate $40 million of operating income (EBIT) this year and has 14 million shares of stock outstanding. Both firms have a tax rate of 35%. How much per share is Tyler's stock worth if Gellar acquires the company? O $40.51 per share O $30.69 per share O $36.83 per share O $48.36 per share How much synergy is this merger expected to generate? O $9.21 per share $4.91 per share O $6.14 per share O $7.37 per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts