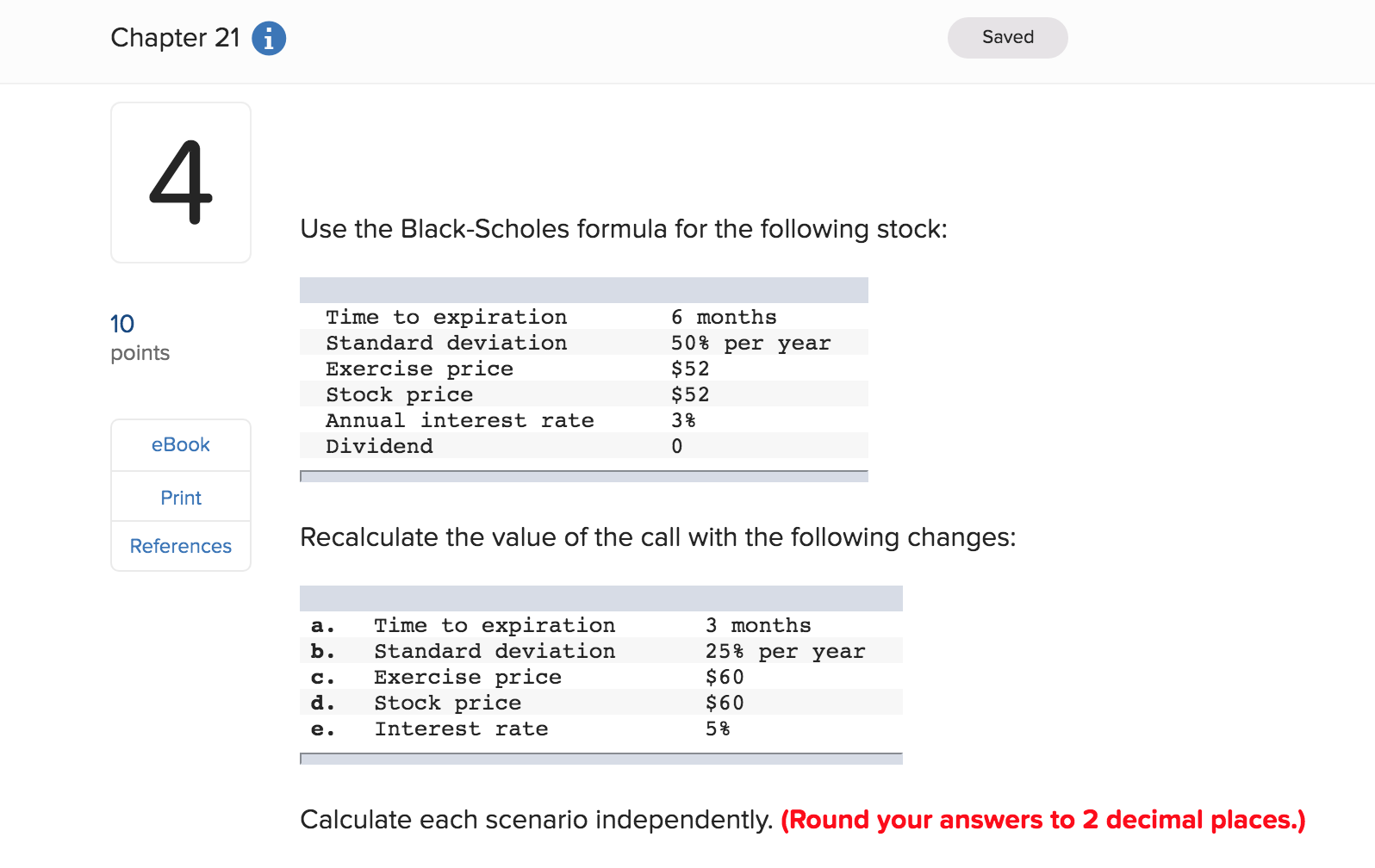

Question: Chapter 21 i Saved Use the Black-Scholes formula for the following stock: 10 points Time to expiration Standard deviation Exercise price Stock price Annual interest

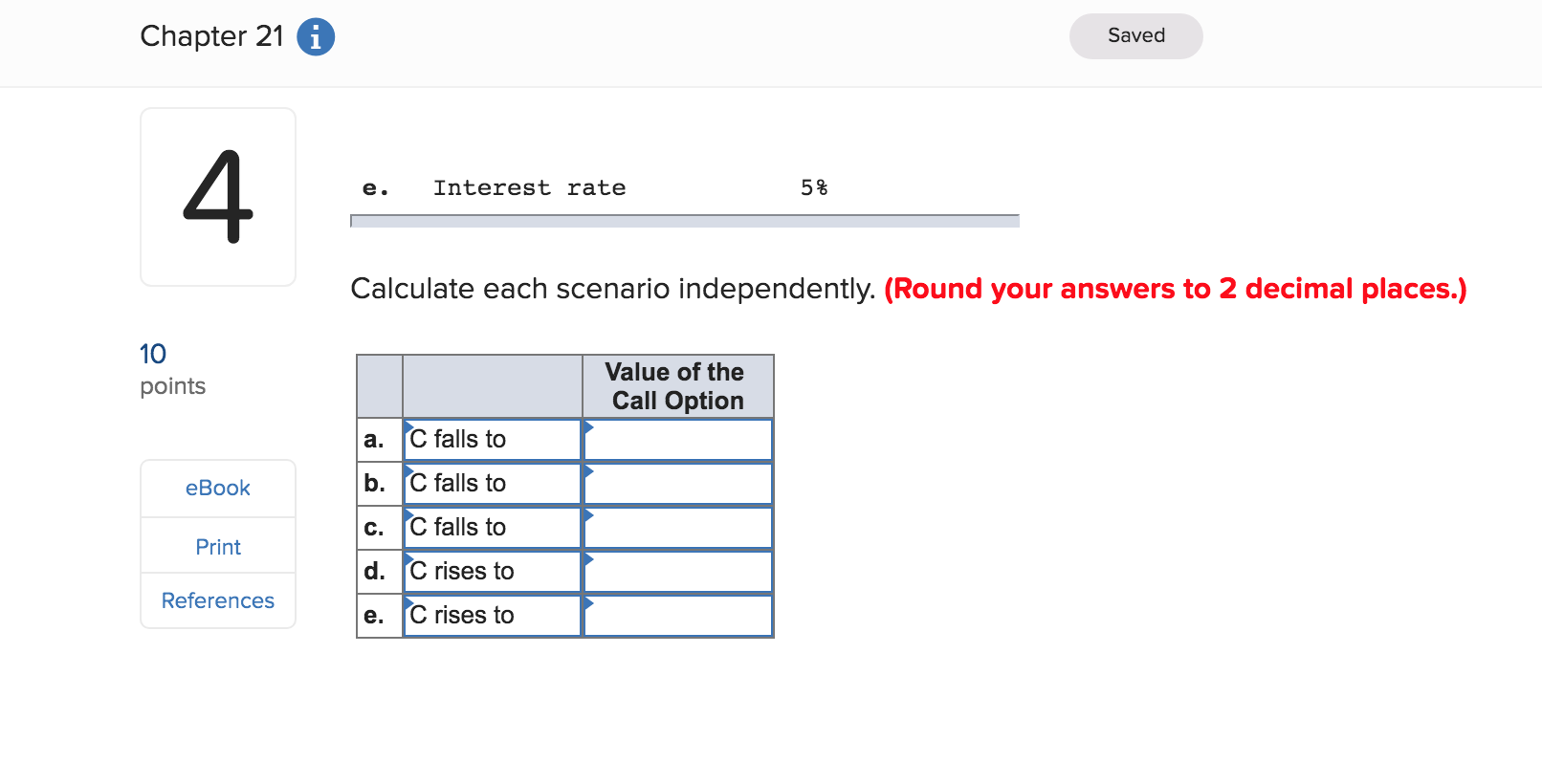

Chapter 21 i Saved Use the Black-Scholes formula for the following stock: 10 points Time to expiration Standard deviation Exercise price Stock price Annual interest rate Dividend 6 months 50% per year $52 $52 3% eBook Print References Recalculate the value of the call with the following changes: a. b. Time to expiration Standard deviation Exercise price Stock price Interest rate 3 months 25% per year $60 $60 c. d. e . 5% Calculate each scenario independently. (Round your answers to 2 decimal places.) Chapter 21 6 Saved e. Interest rate 5% Calculate each scenario independently. (Round your answers to 2 decimal places.) 10 points Value of the Call Option eBook a. C falls to b. C falls to C falls to C rises to e. fc rises to Print References

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts