Question: Chapter 21: In Class Group Exercise You are evaluating a proposed expansion of an existing subsidiary located in Switzerland. The cost of the expansion would

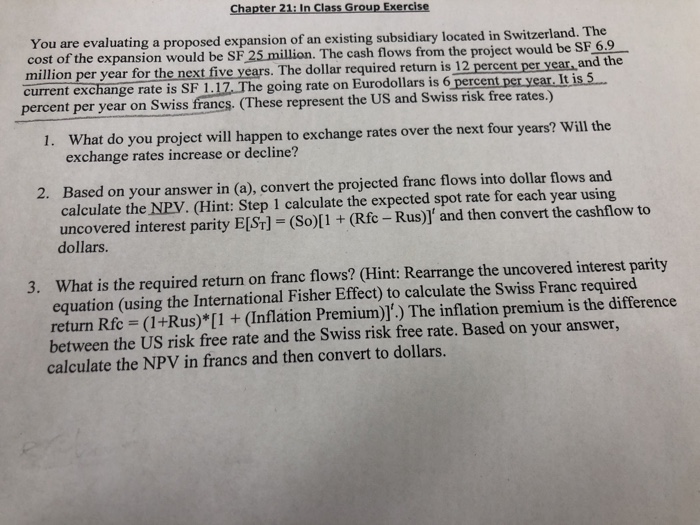

Chapter 21: In Class Group Exercise You are evaluating a proposed expansion of an existing subsidiary located in Switzerland. The cost of the expansion would be SF 25 million. The cash flows from the project would be SF 6.9 million per year for the next five years. The dollar required return is 12 percent per year, and the current exchange rate is SF 1.17. The going rate on percent per year on Swiss francs. (These represent the US and Swiss risk free rates.) Eurodollars is 6 percent per year. It is 5 1. What do you project will happen to exchange rates over the next four years? Will the exchange rates increase or decline? Based on your answer in (a), convert the projected franc flows into dollar flows and calculate the NPV. (Hint: Step 1 calculate the expected spot rate for each year using uncovered interest parity E[ST]- (So)[1 + (Rfc - Rus)l' and then convert the cashflow to dollars. 2. 3. What is the required return on franc flows? (Hint: Rearrange the uncovered interest parity equation (using the International Fisher Effect) to calculate the Swiss Franc required return Rfc (1+Rus)*[1 +(Inflation Premium)].) The inflation premium is the difference between the US risk free rate and the Swiss risk free rate. Based on your answer, calculate the NPV in francs and then convert to dollars

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts