Question: Chapter 23 Mini-Case Calculating and Comparing Gap, Duration, and Risk Management Alternatives CONCEPTS IN THIS CASE: interest-rate risk duration gap analysis income gap analysis minimizing

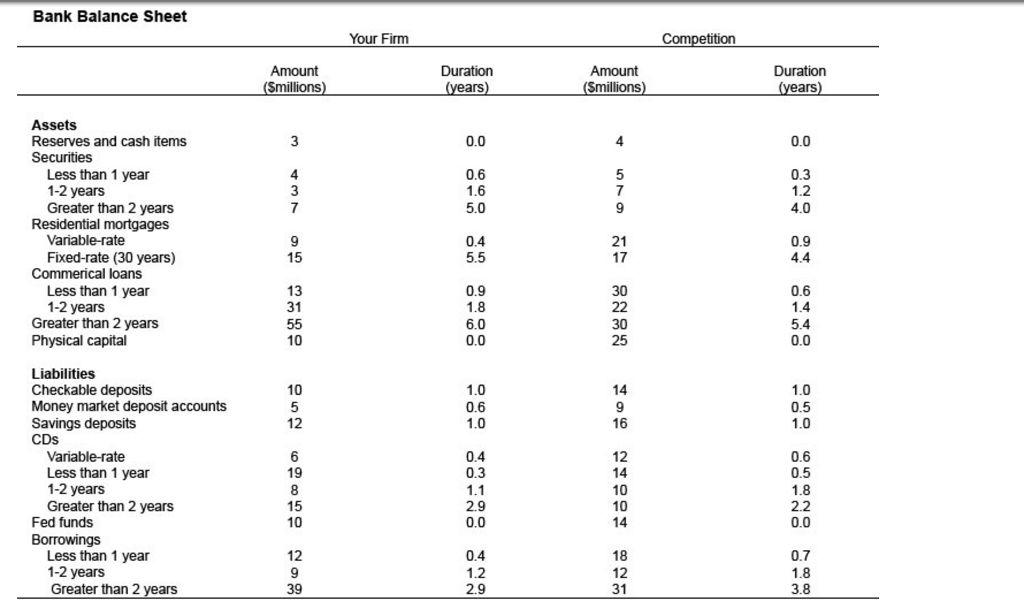

Chapter 23 Mini-Case Calculating and Comparing Gap, Duration, and Risk Management Alternatives CONCEPTS IN THIS CASE: interest-rate risk duration gap analysis income gap analysis minimizing risk of market value interest-rate sensitive assets and liabilities Your employer has asked you to examine the interest-rate risk of your bank relative to your direct competition. Management is concerned that interest rates will fall by the end of the year and wants to see what would happen to the relative profitability of the firm if the decline actually occurs. Interest-rate risk depends on each bank's relative position of interest-sensitive assets and liabilities. You begin the analysis by collecting the information and estimates

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts